August 26th, 2024 | 07:15 CEST

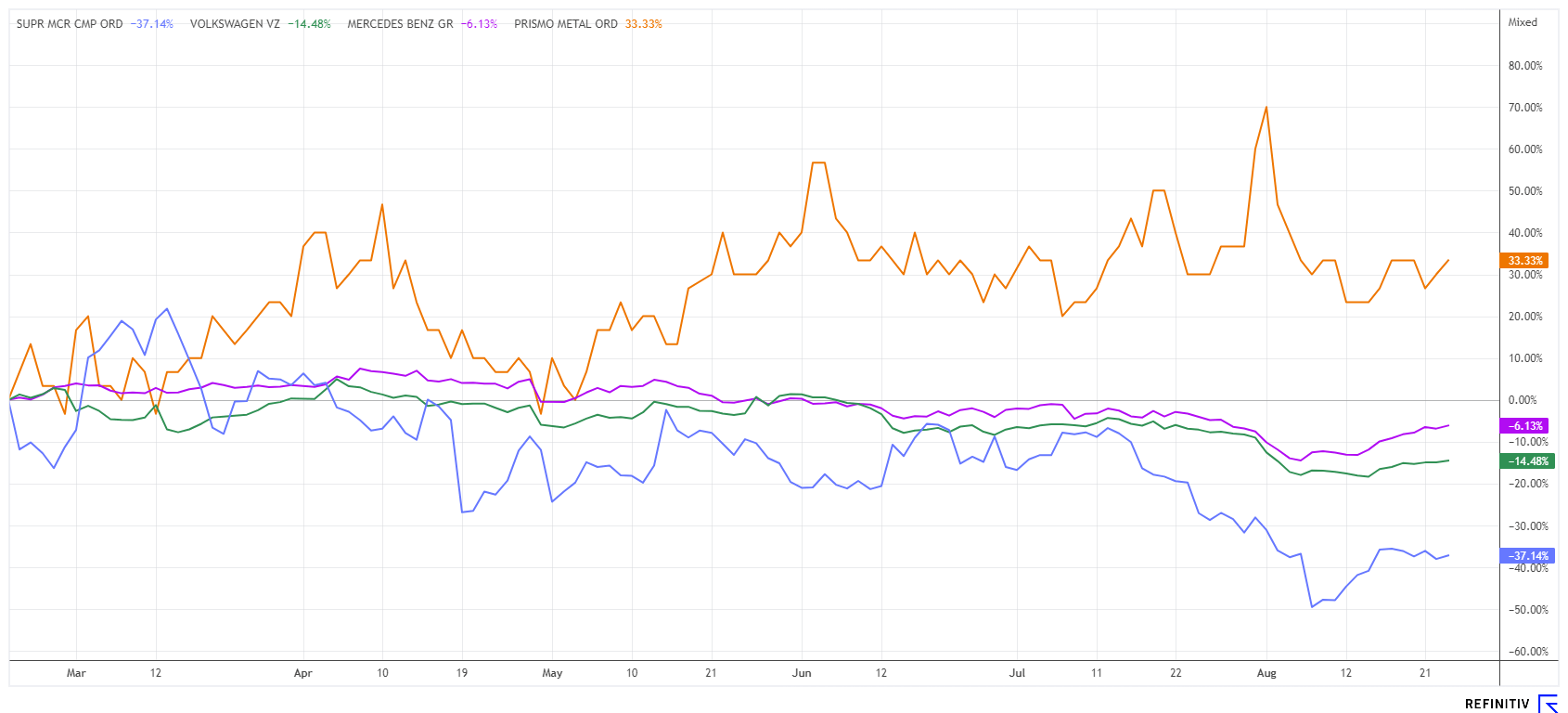

E-mobility stutters, 200% possible with AI! VW, Mercedes, Prismo Metals, and Super Micro Computer in focus!

E-mobility has become a political issue in Europe. This is because the EU is smilingly having to approve imports from China, which are around 25% cheaper. Although punitive tariffs came into force last week, they also affected German models produced in Asia that are intended for the European market. In the long term, trade wars will always have a negative impact on the economy because consumers remain uncertain, delaying new car purchases. Local dealers are overwhelmed with showroom stock delivered directly from factories. Overall, this puts additional pressure on an already struggling economy, and after Varta, there will likely be more cases of restructuring in the sector. We take a closer look at this challenging sector and uncover interesting opportunities!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

VOLKSWAGEN AG VZO O.N. | DE0007664039 , MERCEDES-BENZ GROUP AG | DE0007100000 , PRISMO METALS INC | CA74275P1071 , SUPER MICRO COMPUT.DL-_01 | US86800U1043

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Super Micro Computer - After the correction is before the rally?

Tech and chip giants have seen the biggest upswing since 2023 in more than a decade. By the end of July, the Nasdaq 100 index had corrected a full 15% from its 40% gain in 2024 before a surprising rebound began. Now, the stock market favorites of 2024 are back at the top of investors' hit lists. The old high-tech favorites from the artificial intelligence and high-performance chip sectors have, therefore, been back on the buy list of long speculators for a few days now. There has been no stopping Nvidia since the correction. The manufacturer of specialized chips and data centers is expected to double its turnover this year to around USD 120 billion, while earnings per share are expected to increase by 120% to around USD 2.60. However, the Company is already valued at a good USD 3 trillion.

The mainframe cooling system specialist Super Micro Computer operates in the same sector. The SMCI share has gained 25% in the last two weeks. From a low of EUR 440, it rose to over EUR 580; on Friday, the share price was EUR 548. The driving force behind the share price performance is likely to have been the extremely high short-selling ratio, which ultimately forced the short sellers to cover their positions following the rapid turnaround. However, tech stocks were also boosted by the indirect confirmation of a US interest rate cut by Jerome Powell.

Prismo Metals - Copper from Arizona, precious metals in Mexico

Our new discovery from July of this year is off to a good start. We are talking about the Canadian exploration company Prismo Metals. The share price has risen by 54% over the last six months. In addition to gold and silver projects in Mexico, the junior also owns a copper property called "Hot Breccia" in resource-rich Arizona. The property consists of 1,420 hectares with a total of 227 contiguous mining claims located in the world-class copper belt between the well-known Morenci, Pinto Valley, Ray, and Resolution copper mines.

There is currently good news on Palo Verdes in Mexico. The drill program is now scheduled and commenced in August. Together with anchor shareholder Vizsla Silver Corp., targets on the property are now being tested using additional drill pads on Vizsla's properties adjacent to Palos Verdes to increase drilling efficiency. This is the Company's fourth drill campaign at Palos Verdes and is designed to test the vein up to 100 metres below the high-grade mineralization intersected by several previous drill holes. Reported results from last year's drilling include hole PV-23-25 with 102 g/t gold, 3,100 g/t silver, and 0.26% zinc over 0.5 meters, or 11,520 g/t silver equivalent - the highest grade intercept to date on the project. A dream come true!

"We are very excited to continue drilling this vein system, which has already returned excellent results. Combined with our fully permitted Hot Breccia copper project in the heart of the Arizona Copper Belt, Prismo expects a very active second half of 2024 with numerous drill program results from these two world-class exploration projects," said CEO Alain Lambert. The Company currently has 53.39 million shares outstanding. At a share price of CAD 0.21, this results in a market capitalization of CAD 11.2 million. In the next commodity rebound, such opportunities may no longer be available. Collect!

VW and Mercedes - E-mobility in reverse gear

Volkswagen and Mercedes-Benz continue to face pressure as their combustion engine vehicles falter in China, and their electric models for the European market remain too expensive. Embarking on a dual strategy with combustion engines until 2035 and a half-baked e-implementation is a ride on the razor's edge. For months, Chinese manufacturers such as BYD have been conquering the European continent, with a ship arriving in Rotterdam every week to unload its cargo. The cargo is 3,000 new top models, on average 25% cheaper than the German competition. The manufacturer BYD is currently having around 100 new ships built, so the EU market is likely to be flooded with affordable products from the Far East within 1 to 3 years. This could potentially trigger the second wave of e-mobility. Until then, German buyers will shine with absenteeism. While 94% of all new vehicles in China were still powered by petrol or diesel in 2020, this figure was only 59% in the first half of 2024. At the same time, sales of electric and hybrid vehicles rose by a solid 38%, which is a considerable burden on the core business of Western car manufacturers. VW, once the market leader, has reported only declines for several quarters, with its market share in China falling from 19% to 14% over the past four years.

The figures for Mercedes-Benz paint a similar picture. New registrations shrank by more than 10% in the first half of 2024. One of the main problems for German car brands is the lack of competitiveness of their electric vehicles and digital technologies, while Chinese car manufacturers also benefit from government subsidies. Although share prices have stabilized slightly at EUR 96 and EUR 62, there is currently no reason to hope for a major rally. For those looking to secure long-term P/E ratios of 3.5 to 5.5 and dividend yields of over 7%, now is the time to start building up positions at this level. After all, sentiment will likely turn here at some point.

Things are not looking very good for e-mobility. Pressure from Asia is increasing, with Japan now also introducing new models. In addition to China, Korea is also very strong. Artificial intelligence was the top topic in 2024, but now, after the correction, it is going up again! Prismo Metals is now entering the exploration phase, and the share price has been rising for six months. A diversified investment strategy significantly reduces risk.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.