March 6th, 2025 | 07:10 CET

dynaCERT – In the fast lane with hydrogen technology and CO2 certificates

The world is at a critical crossroads in terms of decarbonization. Developed countries are increasingly relying on regulatory levers to force change. For example, from 2025, EU fleet operators will have to drastically reduce their CO₂ emissions per km, while in the US, stricter limits for heavy-duty commercial vehicles will apply from 2027. However, the road to compliance is rocky: half of European companies are not yet aware of the new reporting requirements, and over 20% of fleets lack emissions data altogether. As a result, the market for climate technology is booming. But what solutions can bridge the gap between regulatory pressure and operational implementation? The focus is on companies that build bridges between ambitious goals and practical applicability. In this context, it is worth taking a look at players like dynaCERT, whose technology comes into play precisely where politics, climate science, and operational reality collide.

time to read: 4 minutes

|

Author:

Armin Schulz

ISIN:

DYNACERT INC. | CA26780A1084

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

dynaCERT is now ideally positioned

The Canadian company dynaCERT (TSX: DYA | OTC: DYFSF | FRA: DMJ) is increasingly positioning itself as a key player in the field of emission-reducing technologies. With its patented HydraGEN™ solution, strategic partnerships, and recent certifications, the Company could be taking a decisive step towards profitability and market penetration at just the right time. This scenario is highly interesting for equity investors.

Dakar Rally: Ultimate test for HydraGEN™ technology

For the second consecutive year, dynaCERT made a clear statement at the Dakar 2025 Truck Rally. The HydraGEN™ units, which use electrolysis to generate hydrogen and oxygen from distilled water, were again used under extreme conditions. After a vehicle equipped with HydraGEN™ technology successfully entered the race for the first time in 2024, coming in 3rd, dynaCERT supported the French team Normandy Racing Solutions (NRS) in 2025. The team's trucks, including a 950 hp DAF prototype and a MAN racing truck in the "Dakar Classic", were equipped with HG1 units.

The focus here is not on speed but verifiability: The desert's heat, vibrations, and dust serve as a test field for the technology's suitability for everyday use. This is an ideal stage for dynaCERT to convince potential customers from the transportation, mining, and logistics industries of the robustness of the solution.

Carbon credits and strategic positioning

dynaCERT reached a milestone in October 2024 with certification by VERRA, one of the world's leading organizations for carbon credits. This certification enables customers to generate tradable carbon credits (CO2 credits) through the use of HydraGEN™ technology. A smart move: dynaCERT shares the proceeds from the sale of the credits with the users – an additional incentive for fleet operators to invest in the technology.

This is supported by the appointment of Seth Baruch, CEO of Carbonomics LLC, to the dynaCERT advisory board. Carbonomics LLC is a consultant for the implementation of dynaCERT's Verra carbon credit projects. Baruch brings with him years of experience in the carbon market and is expected to accelerate the implementation of Verra projects. "With decarbonizing the transportation sector being such a challenge, I look forward to working with the dynaCERT team on their carbon credit projects and as a member of the advisory board," said Baruch. The combination of technology and financing model could give dynaCERT a significant competitive advantage.

Financing and Expansion: Targeting the European Market

The Company strengthened its balance sheet in February 2025 with a successfully placed capital increase of CAD 5 million at CAD 0.15 per share, as well as a warrant at CAD 0.20. The funds are being used for a global sales offensive, particularly in the target sectors of mining, oil & gas, and transportation. At the same time, the European presence was expanded. The German subsidiary dynaCERT GmbH relocated to Munich Airport to be closer to customers such as manufacturers of commercial vehicles and construction equipment.

This a strategic step at the right time because in April 2025, the world's largest trade fair for construction machinery, bauma, is scheduled to take place in Munich – an ideal platform to present the HydraGEN™ technology to decision-makers from industry and politics. Kevin Unrath, dynaCERT's COO, emphasizes: "Munich is an important hub for many of our key German and European customers in the engine, commercial vehicle, construction, and industrial solutions sectors."

Market potential: Why dynaCERT could be on your watchlist

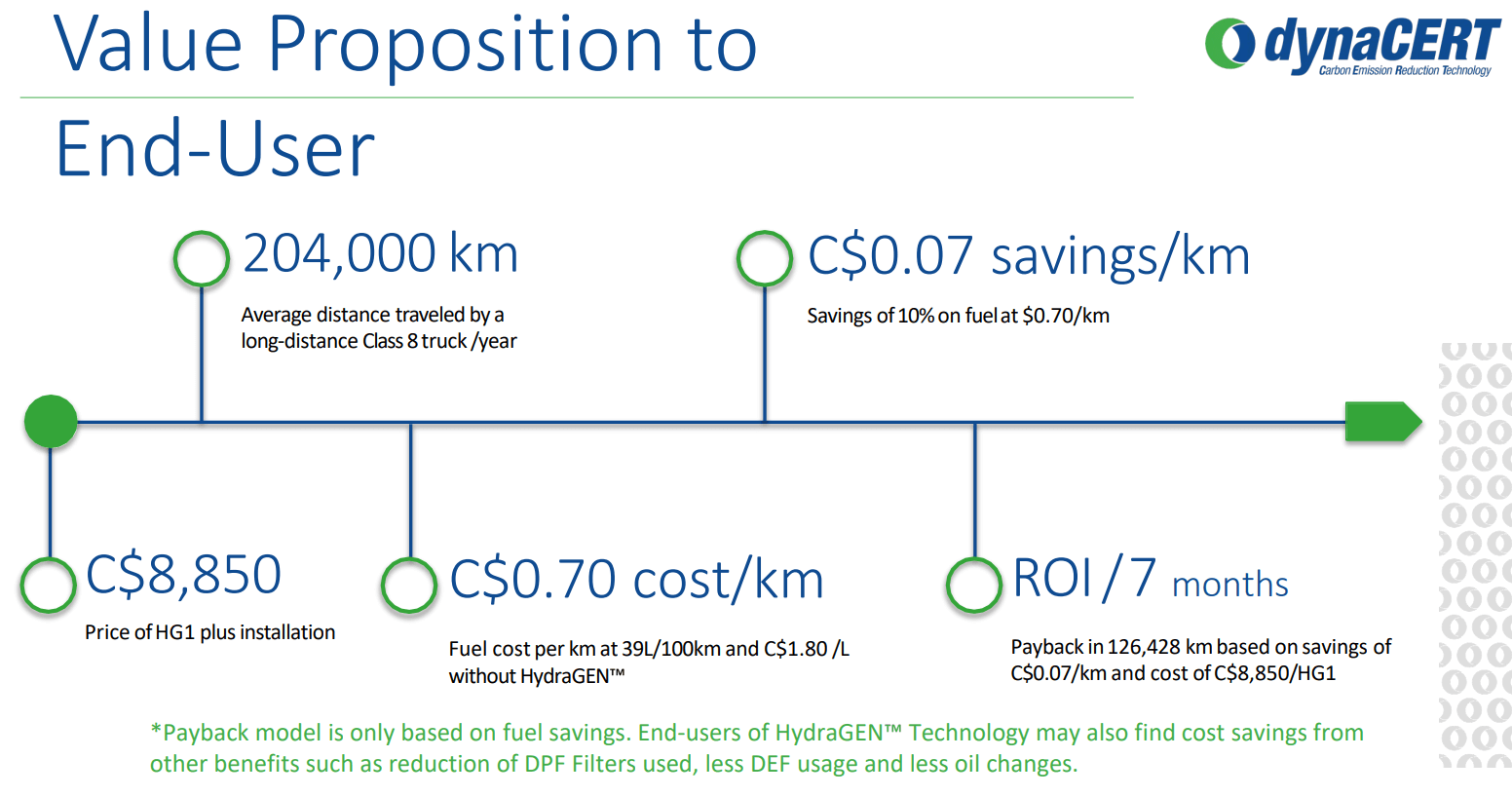

There are over 13.5 million trucks on the road in the US alone and 6 million in the EU. dynaCERT aims to provide customers with a quick return on investment. With a unit price of approximately CAD 8,850 and savings of 6 to 19% on fuel costs and maintenance, the investment pays for itself in just 7 months, according to the Company, based on a mileage of 204,000 km, which corresponds to the annual average for Class 8 trucks. Added to this are revenues from carbon credits, which dynaCERT quantifies precisely via its HydraLytica telematics software.

Another lever is the partnership with Cipher Neutron, a specialist in green hydrogen. Joint projects, such as the development of anion exchange membrane electrolyzers for the steel industry, are opening up new markets for dynaCERT beyond the transportation sector.

Conclusion: More than just a "green tech" play

dynaCERT impresses with a unique combination of proven hydrogen technology, strategic partnerships, and a scalable business model with carbon credits. VERRA certification makes carbon credits a recurring source of income, participation in the Dakar highlights the reliability of the hardware, and the expansion in Europe lays the foundation for scalable revenues. With a market capitalization of around CAD 64 million, the Company appears undervalued – especially considering that it is aiming for medium-term self-financing. For investors focused on practical climate technologies, dynaCERT could be a meaningful strategic addition to their portfolio.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.