October 8th, 2025 | 06:55 CEST

Drone warfare and armament – Caution with Rheinmetall, Hensoldt, and thyssenkrupp, but 150% upside with Antimony Resources

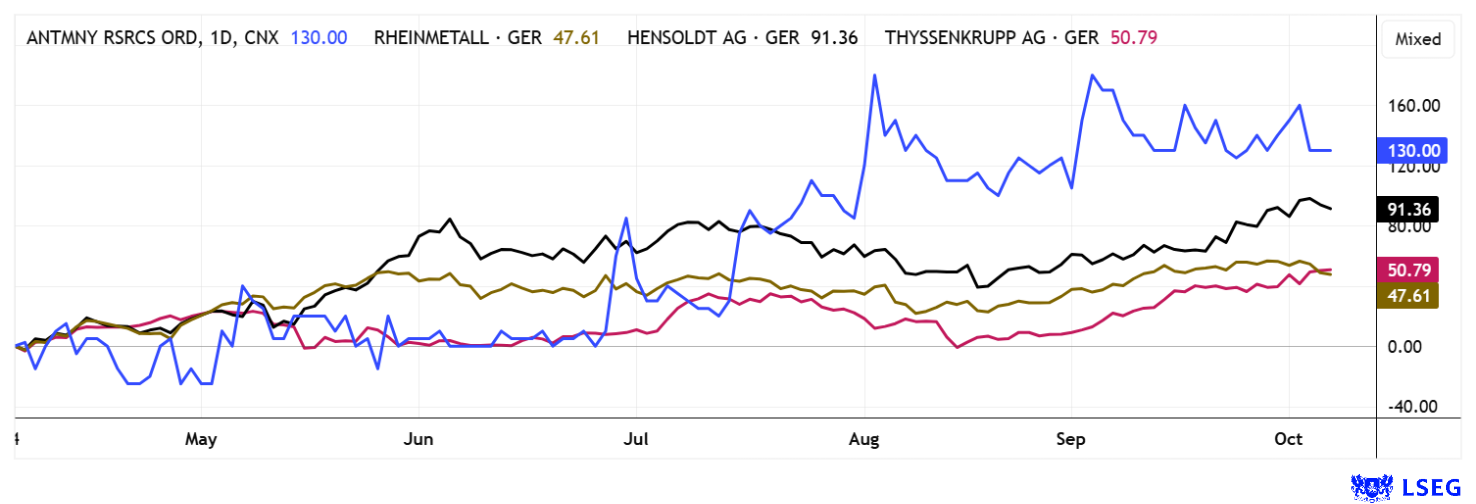

Recent geopolitical events impressively highlight the critical need for strategic metals. While tungsten producer Almonty has surged by over 1,000%, risk-aware investors are now turning their attention to Antimony Resources. With properties that are indispensable for ammunition, electronics, and protection systems, antimony is emerging as a key strategic metal for modern defense and high-tech industries. The heavy reliance of Western nations on a few producing countries, such as China, is increasingly bringing security of supply into the focus of geopolitical debates. Without a stable supply chain, there is a risk of bottlenecks that threaten not only defense capabilities but also technological sovereignty. Investors and industry players are therefore increasingly seeking alternative sources and recycling solutions to meet rising demand in a sustainable manner. Meanwhile, defense stocks are currently consolidating at a high level. Is the rally now entering its final phase?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , HENSOLDT AG INH O.N. | DE000HAG0005 , THYSSENKRUPP AG O.N. | DE0007500001 , ANTIMONY RESOURCES CORP | CA0369271014

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Geopolitical pressure on raw materials - Antimony Resources pushes ahead with exploration in Canada

In view of the export restrictions on strategic metals introduced by China, Western industries are under increasing pressure to tap into secure sources of supply. Antimony, an element that is indispensable for flame retardants, electronic components, and as a catalyst in PET production, is particularly affected. China, Russia, and Tajikistan control almost 90% of the global market, which means that the latest export restrictions since spring 2025 are also having a significant impact on European imports. Rising demand from the defense sector is further increasing demand, as antimony is essential for protective clothing, night vision devices, and electronic systems.

This is where Antimony Resources from Canada opens up a strategic perspective after securing the option on the high-grade Bald Hill deposit. Initial drill results over 3,150 meters confirmed stibnite mineralization in 70% of cases, including over 20 meters of massive ore sections. In September 2025, the Company successfully completed a CAD 700,000 flow-through financing through the issuance of 2.8 million shares. The funds will be used entirely for the further development of the Bald Hill project, which has already proven over 700 meters of strike length with average grades of 3% to 4% Sb. Of particular note are drill intersections such as 14.91% Sb over three meters or 9.85% Sb over 4.3 meters, which indicate significant potential. According to a technical report, the estimated resource is 725,000 to one million tons with up to 5.32% Sb.

Just a few days later, the second drilling phase began, with at least 6,000 meters planned to extend the known deposits to the north, south, and at greater depths. A key objective is to confirm the continuity of mineralization and lay the foundation for an initial resource estimate by early 2026. Of particular interest is a newly discovered zone approximately 450 meters southeast of the main deposit, which has seen little exploration so far. Previous drilling has already yielded high-grade results such as 4.17% Sb over 7.4 meters and 14.91% Sb over three meters, suggesting significant exploration potential. CEO Jim Atkinson emphasizes that this second phase marks a decisive step toward resource definition and potential future production. With this consistent development strategy, Antimony Resources could soon play a key role in supplying critical antimony to Western markets. Following huge price gains in the critical metals peer group, Antimony has also risen by roughly 150% since July - and that is far from the end of the story!

Register for today's 16th International Investment Forum to discover interesting stocks. Click here to join the online conference.

thyssenkrupp – What is next for the marine division?

The defense industry will soon have a new publicly traded company called thyssenkrupp Marine Systems (TKMS). The current line in press releases regarding the planned IPO of the Thyssenkrupp subsidiary points to an IPO in 2025. It was recently decided to distribute 49% of the shares in TKMS to existing thyssenkrupp shareholders, while thyssenkrupp will retain control with 51%. The spin-off into the new company "TKMS AG & Co. KGaA" is to be completed by mid-October. At the same time, TKMS is reporting strong growth with a record order backlog of EUR 16 billion and a significant increase in EBIT in the first half of the year. At the Capital Markets Day, the goal was announced to raise operating margins to over 7% in the medium term (currently around 4.3%). At the same time, investment opportunities for external partners such as Fincantieri are being discussed in order to enable strategic cooperation without giving up the majority stake. However, there is still criticism and uncertainty regarding the role of the federal government: media reports suggest that Berlin is considering acquiring a stake, but the Ministry of Economics denies this and refers to ongoing discussions. For thyssenkrupp shares, the current discussion is grist to the mill. The stock reached a new 5-year high of EUR 12.94 this week!

Rheinmetall and Hensoldt – Momentum slows significantly

After weeks of sideways movement, the defense stocks Rheinmetall and Hensoldt recently reached new highs once again. From an outsider's perspective, it has become apparent how difficult it is for these stocks to continuously attract new investor groups. At the same time, many investors are selling their positions to lock in the substantial gains of recent months. After Rheinmetall finally broke through the EUR 2,000 mark with a new high of EUR 2,005, heavy profit-taking set in, and the stock closed yesterday at EUR 1,870 on high trading volumes. The sell-off temporarily extended to EUR 1,837 before the stock stabilized again. The same story played out at Hensoldt: high momentum and a vertical rise from EUR 105 to EUR 117.60, then back down to EUR 109. The defense buying frenzy may not be over yet. Investors should now adjust their stop-loss levels upward. For Rheinmetall, a level of EUR 1,775 is suggested, while Hensoldt should be stopped out if it falls below EUR 105. Analysts on the LSEG platform estimate 12-month price targets of EUR 2,150 and EUR 91, respectively. While Rheinmetall may still have about 15% upside potential, experts believe that the potential for Hensoldt lies more on the sell side. Caution: volatility can reach almost any price level! Trading machines with perfect AI algorithms dominate the markets. If this rally turns, price movements can happen incredibly fast.

Global crises and disrupted supply chains are putting strategic metals and security technologies in the winner's circle. Antimony Resources is poised to fill a critical supply gap for antimony with a rapid mine start-up in North America. Rheinmetall and Hensoldt are receiving record orders thanks to massive defense spending in Europe and the US, while thyssenkrupp is gaining new strength with a clear corporate restructuring. As always, diversification is key to success!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.