June 23rd, 2025 | 07:10 CEST

DRONE STOCK: Volatus Aerospace benefits from NATO billions - and much more! BUY RECOMMENDATION!

The drone revolution has only just begun. In Ukraine, remote-controlled aircraft have become a game changer in modern warfare. Defense is just one of many industries being disrupted by drones equipped with the latest camera technology and AI. These all-rounders can transport goods to remote areas, inspect buildings and bridges for structural damage, and even act as aerial fire extinguishers during high-rise fires. One insider tip in this billion-dollar market is Volatus Aerospace. The Canadian company offers numerous services - from drone pilot training to surveillance - and generates recurring revenue streams. The latest capital increase was oversubscribed and should give the stock fresh momentum. Analysts forecast that revenues will soon exceed CAD 80 million and are issuing a "Buy" recommendation for the stock.

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

VOLATUS AEROSPACE INC | CA92865M1023

Table of contents:

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Volatus Aerospace: Winner of the drone revolution

Volatus Aerospace was founded in 2018 and offers a wide range of services related to training, reconnaissance, and cargo transport with its fleet of drones, aircraft, and helicopters. The Canadian company's customers come from the government security sector and civilian industries such as oil and gas, energy supply, healthcare, and infrastructure. In 2024, more than 3,000 drone pilots were trained and over 4,000 surveillance flights and 700 transport flights were carried out. After generating revenue of around CAD 27 million in 2024, the figure is expected to reach around CAD 45 million in the current year – and the trend is rising sharply.

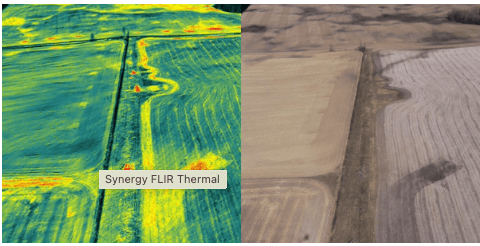

The clear focus is now on drones. These are state-of-the-art aircraft with ultra-HD optics, LiDAR technology, and AI-controlled pattern recognition. They are an efficient alternative to conventional methods, especially for monitoring critical infrastructure – 24/7 and in virtually any weather. Volatus, for example, inspects bridges and pipelines and monitors borders. The aircraft can be equipped with a wide variety of cameras, such as UltraHD and thermal imaging technology.

AI opens up new possibilities

Volatus' growth drivers are software and services – more and more of which incorporate artificial intelligence (AI). For example, AI will automate the evaluation of video footage and thermal imaging. Recurring patterns, anomalies, and temperature differences can be detected in real time. This enables the identification of potential danger zones or incidents, allowing for immediate response. As mentioned, the range of applications is vast: borders, military areas, war zones, industrial facilities, buildings, bridges, and pipelines.

Realignment for geopolitics and NATO billions

Current geopolitical developments offer Volatus significant growth opportunities in the areas of defense, armaments, and public safety. For example, Volatus can train drone pilots and monitor borders - such as between Canada and the US - and military installations. In order to be a reliable partner in the US and Europe, the Company is currently repositioning itself. Chinese hardware and software are being supplemented by Western suppliers and partnerships are being formed.

The Company plans to establish a cross-border delivery network with the US drone delivery service DroneUp. The partners complement each other perfectly: DroneUp brings a certified delivery drone system for the US to the table, while Volatus has a Canadian operating license and extensive operational expertise.

Ondas Holdings is being brought on board to support border and security area surveillance. As part of the partnership, Volatus will market and provide support for Ondas' Optimus system - a fully automated aerial surveillance platform. Manned and remote-controlled aircraft can be combined with ground-based sensors.

Volatus also sees growth opportunities in Africa, where infrastructure and logistics channels are often lacking. For example, in the areas of long-range, heavy-lift, and medical transport. To this end, the Company is working with hardware manufacturers RigiTech and Dufour Aerospace, among others.

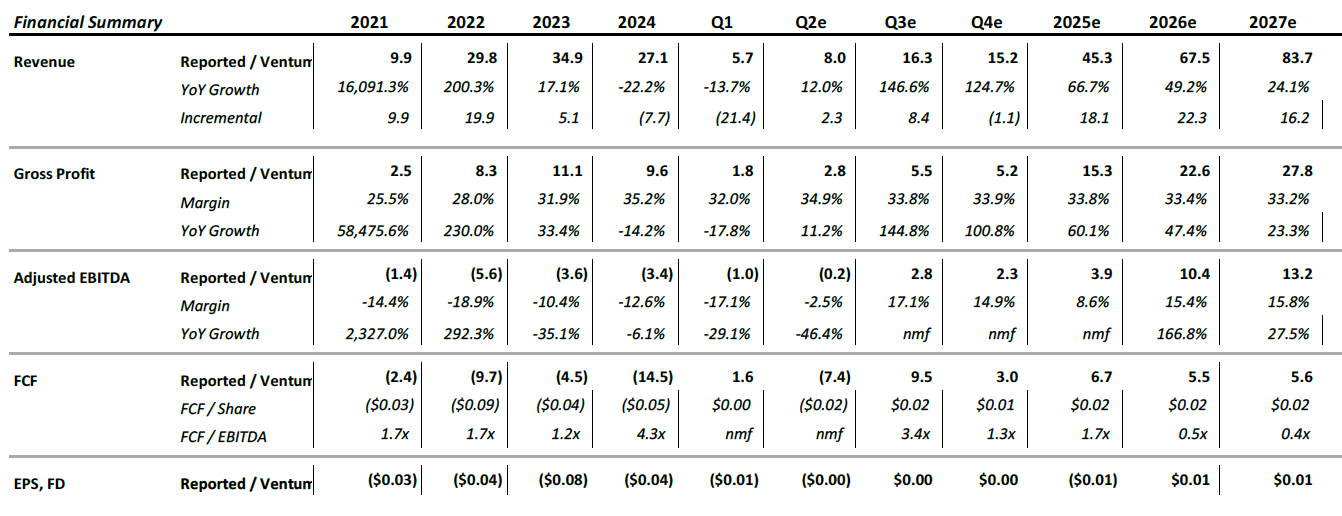

Analysts recommend buying: Target price CAD 0.32

Analysts at Ventum Capital Marktes recommend buying Volatus Aerospace shares. The target price is CAD 0.32. The share is currently trading at CAD 0.24 and is now also increasingly traded on German stock exchanges such as Tradegate. Looking at growth expectations, analysts emphasize that their forecasts are conservative. And these conservative estimates are already dynamic. Volatus is expected to generate revenues of around CAD 45 million in the current year, which would be 67% more than in the previous year. After CAD 72.5 million in the coming year, revenues are expected to reach CAD 83.7 million in 2027. Analysts believe Volatus will already achieve a positive operating result (EBITDA) in the current second quarter, with an upward trend. In 2027, adjusted EBITDA is expected to be CAD 10.4 million, free cash flow CAD 5.6 million, and earnings per share CAD 0.01. This results in a P/E ratio of 24 for 2027. This appears to be anything but expensive for a growth company in a billion-dollar market.

Analysts see upside potential driven by significant contract wins and the opportunity to generate higher-quality recurring revenue from the Company's extensive contract pipeline. The favorable market conditions resulting from rising defense spending are expected to further increase the prospects of a significant outperformance.

Conclusion: Purchase could pay off soon

The chances of rising prices for Volatus shares are good. The Company has realigned itself, is growing profitably, and has strengthened its financial base through the recent capital measure. The fact that analysts emphasize that their estimates are conservative shows the upside potential. The stock has jumped in recent weeks but remains a hidden gem. Buying the stock at its current level could pay off soon.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.