December 20th, 2024 | 07:50 CET

Christmas is fast approaching: Tesla is breaking all records – 100% with BYD, NIO, 123fahrschule or VW?

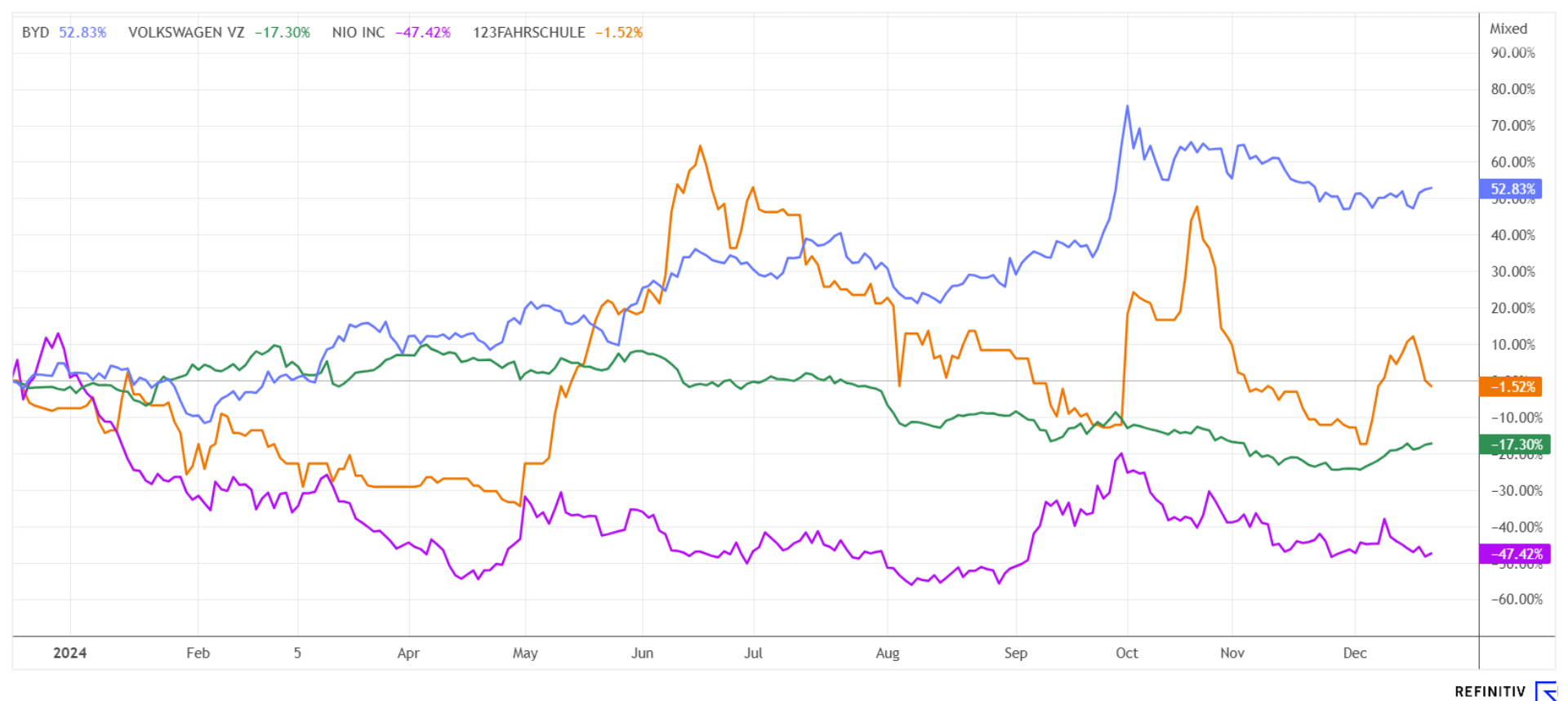

What an investment year 2024 has been! Just three days ago, the NASDAQ 100 index was up over 30%. Now, in the middle of the week, there was a strong 'one-day reversal' – the first significant weakness in months. Those who boldly invested in high-tech stocks enjoyed even larger gains, such as Nvidia soaring by 180% or Palantir Technologies surging 340%. In some sectors, however, performance was dismal. European automotive stocks, for instance, dropped an average of nearly 20%, grappling with fundamental adjustment pressures and a dramatic decline in margins. Tesla and BYD, on the other hand, demonstrated how effective stock marketing works in the automotive sector, posting gains of 82% and 39%, respectively, this year. The big question now is: what is next for 2025?

time to read: 6 minutes

|

Author:

André Will-Laudien

ISIN:

123FAHRSCHULE SE | DE000A2P4HL9 , TESLA INC. DL -_001 | US88160R1014 , BYD CO. LTD H YC 1 | CNE100000296 , NIO INC.A S.ADR DL-_00025 | US62914V1061 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] We know exactly what we are doing and are implementing what we consider to be a proven technology in an industrially applicable and scalable way. [...]" Uwe Ahrens, Director, Altech Advanced Materials AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

VW – The Lithium Deal in Canada

VW was one of the biggest losers in the DAX 40 index, down a good 20% at the beginning of the year. In addition to high location costs, the mass-market manufacturer suffered a sharp drop in sales in China, the Wolfsburg-based company's most important foreign market. As part of its cost-cutting program, the core VW brand is no longer ruling out plant closures and redundancies; the agreement with the works council to safeguard jobs has been terminated. According to insiders, the aim is to reduce costs by around EUR 4 billion from 2026. The measures affect not only the VW brand but the entire Volkswagen Group. Audi, in particular, has had a horror year. The operating result fell by 91% compared to the previous year, while profit after taxes declined by 47%, largely due to provisions for the upcoming plant closure in Brussels.

VW wants to get a grip on its failures in the field of e-mobility by cooperating with the US automotive software start-up Rivian. The Wolfsburg-based company had recently fallen behind its Asian competitors due to significant problems in battery control. A 9.9% deal worth USD 48 million to secure lithium for the future was announced midweek. The partner company is the Canadian Patriot Battery Metals. A binding offtake agreement for the delivery of 100,000 tonnes of spodumene concentrate per year over a period of 10 years is to be entered into with PowerCo SE, a battery manufacturer wholly owned by Volkswagen. The purchase is intended to supply PowerCo's cell production activities in Europe and North America. While Patriot is up over 30%, VW has at least charted a bottom at EUR 79. With a 2025 P/E ratio of 3.4, Europe's largest automotive group has never been so cheap.

123fahrschule – Reaching the goal faster with innovation and drive

While Germany is still lagging when it comes to digitization, the new candidates for the chancellorship, following the resignation of Olaf Scholz, are promising rapid improvement if they are elected. This topic is at the top of the agenda, along with tax cuts and a quick fix for infrastructure deficiencies. These are all good approaches that will hopefully gradually change the manifest locational disadvantages for the better.

Digitization is part of the DNA at the listed driving school provider 123fahrschule SE. CEO Polenske founded KlickTel at the turn of the millennium and took it public. 123fahrschule was founded in 2016. The Company specializes in the digitization and modernization of the driving school industry, combining innovative technologies such as online registration, app-supported appointment management, and driving simulators with traditional driving school services. It is now one of Germany's largest driving school chains and focuses on further growth through new openings and takeovers. With approaches such as a learning app, a driving simulator, blocked theory training and targeted exam preparation, 123's offering stands out from the market. The goal is to make a Class B driver's licence attainable today for EUR 2,000 to 2,500.

In the third quarter, there was a record turnover of EUR 5.7 million, around 8% more than in the previous year. The increase in revenue was largely generated organically, as no location expansion has taken place in the last 12 months due to the focus on EBITDA and cash flow. The German driving school market is highly fragmented and produces a volume of around EUR 3 billion, while the expected annual revenue at 123fahrschule is a good EUR 24 million. This means that there is still plenty of scope for market consolidation. Despite the planned reduction in driving licence costs for students due to digitization, the Company expects to see a significant improvement in margins as a result of the increasing proportion of high-margin digital products in driving licence costs.

CEO Polenske explains why: "The amendment to driving school training is a milestone for us. We expect that the topic of simulators will be approved for the entire scope of gear-shifting competence. This means that we will eventually be able to do without all manual transmission vehicles, which will save us at least 20 to 25% of the current fleet. The significant impact will be felt starting in 2025/26, but by accelerating online theory courses, we will also save a significant portion of personnel costs. We now also have an effective lever against the shortage of driving instructors".

After a successful capital increase in autumn, there are now 5.558 million shares outstanding, with a market capitalization of EUR 14.7 million. The CEO regularly buys back shares on the market, most recently in November. mwb research confirmed its "Buy" rating with a target price of EUR 6.20 after the good Q3 figures. With the "Strategy 2027" presented at the German Equity Forum, the digital transformation is entering the next round. The share is currently fluctuating between EUR 2.55 and EUR 2.85, a good entry point for attractive gains in 2025.

BYD and NIO – Strategy 2025 is in place

Back to the Chinese e-competition. BYD shares have picked up again in recent days, mainly due to the wide range of reports on related projects in the coming year. The Asian electric vehicle market leader is underpinning its European market offensive with a further sponsorship deal for the UEFA U21 European Championship. There will be a veritable flood of new SUVs in the course of the year because in addition to the Sealion 07, BYD is also planning the Sealion 05 and probably a Sealion 06. Both new models have already been spotted as test vehicles and are targeting the mid-size SUV market as well as the Tesla Y. With its sports car brand Denza, BYD will soon launch an electric copy of the 911. There is much to suggest that BYD will continue to grow aggressively, and from 2026, the Chinese company will also be circumventing EU import tariffs with a plant in Hungary. With revenue growth of a good 10% per annum and a P/E ratio of 14.5 in 2025, the share is not too expensive at EUR 33.50; the annual high was EUR 37.85.

The Chinese start-up NIO also has an announcement to make. With its new 'Firefly' brand, it is targeting the premium small car segment. Its positioning in the high-end small car market focuses on intelligence, quality and safety. The official announcement is expected next Saturday at NIO Day 2024, while deliveries are scheduled to start in the first half of 2025. The recently introduced Renault 5 and the new VW ID.2 could be the main competitors of the Firefly. Due to the substantial subsidies from the Chinese side, imports are subject to an additional 20.7% tariff. Work is also being done on a battery-changing infrastructure. NIO is highly innovative but is expected to remain in the red until at least 2027, according to estimates on the Refinitiv Eikon platform. Promising, but with a valuation of almost EUR 9 billion, it is also highly speculative!

2025 could still bring stormy weather for the European automotive sector. While Chinese suppliers are increasingly stepping on the gas, local manufacturers are struggling with high location costs and a sleepy e-mobility strategy. Making up for the lost time, along with a restructuring, will require significant resources. 123fahrschule has set the course for further growth, and the share looks very promising.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.