October 29th, 2025 | 07:45 CET

Caution! Moment of truth for TeamViewer, TKMS, thyssenkrupp, Beyond Meat, and Kobo Resources

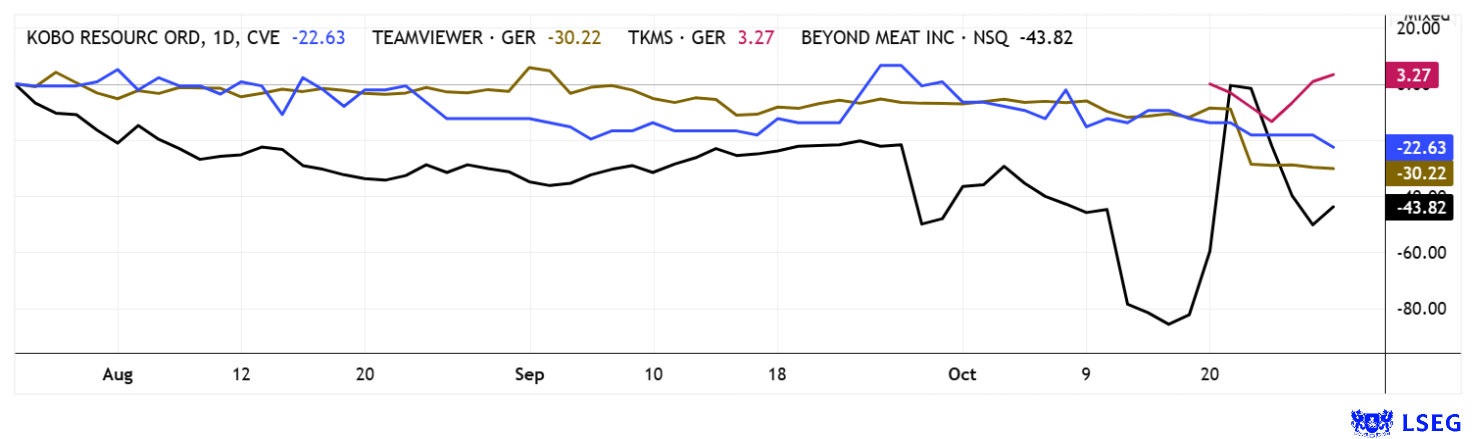

The stock market has been very volatile in October. Many market participants had expected a "crash" after the initial downward swings. The definition of such an abrupt downward movement is a minimum decline of at least 25% within just a few trading days. This already happened back in April, when Donald Trump projected his feverish dreams of tariff policy onto the board. Little remains of these announcements, which is why stocks quickly rebounded. Yesterday, Tuesday, the NASDAQ 100 reached a new all-time high of over 26,000 points on massive trading volumes. Fund managers and desperate private investors are pushing more and more money into stocks that have long since ceased to be cheap. What to do now? Good advice remains hard to come by!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

TEAMVIEWER AG INH O.N. | DE000A2YN900 , TKMS AG & CO KGAA | DE000TKMS001 , KOBO RESOURCES INC | CA49990B1040 , THYSSENKRUPP AG O.N. | DE0007500001 , BEYOND MEAT INC. | US08862E1091

Table of contents:

"[...] We have a clear strategy for neutralizing sovereign risk in Papua New Guinea. [...]" Matthew Salthouse, CEO, Kainantu Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

TeamViewer – Minor notes from headquarters

Supervisory board member Ralf W. Dieter reports share purchases at TeamViewer. Meanwhile, disappointing figures came out of Göppingen on October 21. The Company now expects annual recurring revenue (ARR) of EUR 780 to 800 million instead of the previous EUR 815 to 840 million, while revenue is expected to be at the lower end of the range at EUR 778 to 797 million. Despite the weaker growth momentum, the adjusted EBITDA margin will be raised slightly to around 44%. So far, so good. The main reasons for the revision are integration problems at the US subsidiary 1E and subdued IT demand, particularly in the American market. This puts pressure on the growth strategy with which TeamViewer wanted to position itself more strongly as an enterprise software provider. For 2026, management now expects revenue growth of only 2 to 6%, signaling the transition from a growth company to a mature company. Deutsche Bank analysts reacted sharply, cutting their price target from EUR 12 to EUR 7.50 and downgrading the stock to "Hold." There is little imagination left for the former growth icon from the TecDAX. The average price target on the LSEG platform remains EUR 11.69, based on 9 out of 18 analyst ratings. However, it remains questionable whether the 5-year low of EUR 6.45 already marks the bottom!

TKMS – Successful IPO by thyssenkrupp provides a boost

The situation is quite different for thyssenkrupp's marine subsidiary TKMS. The IPO price of EUR 60 was quickly surpassed, rising to EUR 105. However, this was followed by profit-taking down to around EUR 70. But now the good news continues. The German naval shipbuilder and the German Armed Forces Procurement Office have signed a contract for the delivery of HMS-12M mine hunting sonars for the MJ332 class mine hunting boats. According to TKMS, the HMS-12M sonar is a powerful, hull-mounted, three-frequency sonar that is already being used successfully by navies in Northern Europe, the Mediterranean, and the Arab world. It is used for comprehensive searches for sea mines in the water column and on the seabed. Singapore also ordered two more submarines, and the first analyst opinions have arrived. mwb research rates the stock as a "Buy" with a 12-month price target of EUR 100. Bernstein is somewhat more cautious, giving the stock an "Underperform" rating with a price target of EUR 74. Flip a coin!

Kobo Resources – Drilling successes strengthen West Africa's exploration boom

West Africa continues to gain strategic importance as a resource hub, with rapidly developing mining infrastructure and, in some countries, strong government support attracting significant investor interest. Côte d'Ivoire stands out as one of the most stable and dynamic countries in this regard - and one of the most resource-rich. In addition to its status as Africa's largest cocoa producer, the country's gold sector is taking on growing strategic significance.

Despite a slight correction in the price of gold, investors are focusing their attention on promising exploration projects delivering strong drilling results.

This is benefiting Canadian exploration company Kobo Resources, which is systematically advancing its 100%-owned Kossou Gold Project in the Birimian Belt, roughly 40 km from the capital, Yamoussoukro. To date, over 24,000 meters of drilling have confirmed continuous mineralization within the Road Cut and Jagger zones. Notably, recent intercepts of 17 meters at 3.87 g/t Au and 9 meters at 6.84 g/t Au highlight the potential for high-grade and continuous mineralization. At the same time, new drilling to depths of 240 meters reinforces the prospect of a scalable deposit system that may extend over a strike length of more than 3.5 km.

To quickly convert this potential into a maiden mineral resource estimate (MRE), Kobo is currently conducting an expanded drilling program covering 12,000 to 15,000 meters. The CAD 3.9 million financing successfully placed in August will be used to expand these activities and conduct further metallurgical studies at both Kossou and the nearby Kotobi project. With a low market capitalization of around CAD 30 million, Kobo could eventually attract attention from established regional producers such as Barrick, Perseus, or Endeavour, but of course, this will require further hits!

Beyond Meat – MEME plaything at its finest

Ten times more volatile than the price of gold, the meme stock Beyond Meat fluctuates through the trading systems. The stock regularly trades more shares than have ever been issued. This means that traders buy and sell the stock several times a day. In recent months, short sellers in particular had targeted the stock. However, last week they had to watch as the price rose ad hoc from USD 0.50 to USD 7.50, a factor of 15 in just five trading days. This week has been much quieter, with the technical range so far between USD 1.60 and USD 2.40. Even the German newspaper Bild ran the headline "Stock market thriller surrounding veggie pioneer Beyond Meat" and described the new speculative trend. It is doubtful that the operational decline will turn into a success story. Nevertheless, according to reports, the vegan burger and chicken imitations can now also be purchased at Walmart. If you are quick with the mouse, you might still be able to pocket a few euros. Casino Royale!

The stock market casts light and shadow. There is positive news to report about TKMS, where there is movement in order intake. TeamViewer had to revise its targets downward again, and investors are selling off the stock en masse. Trading algorithms reign supreme at meme stock Beyond Meat. Meanwhile, Kobo Resources reports good drill results. Investors could use the current gold correction here as a smart entry point.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.