October 23rd, 2023 | 07:00 CEST

Attention, take advantage of the sell-off now! Bombed-out prices at JinkoSolar, SolarEdge, Manuka Resources and BYD!

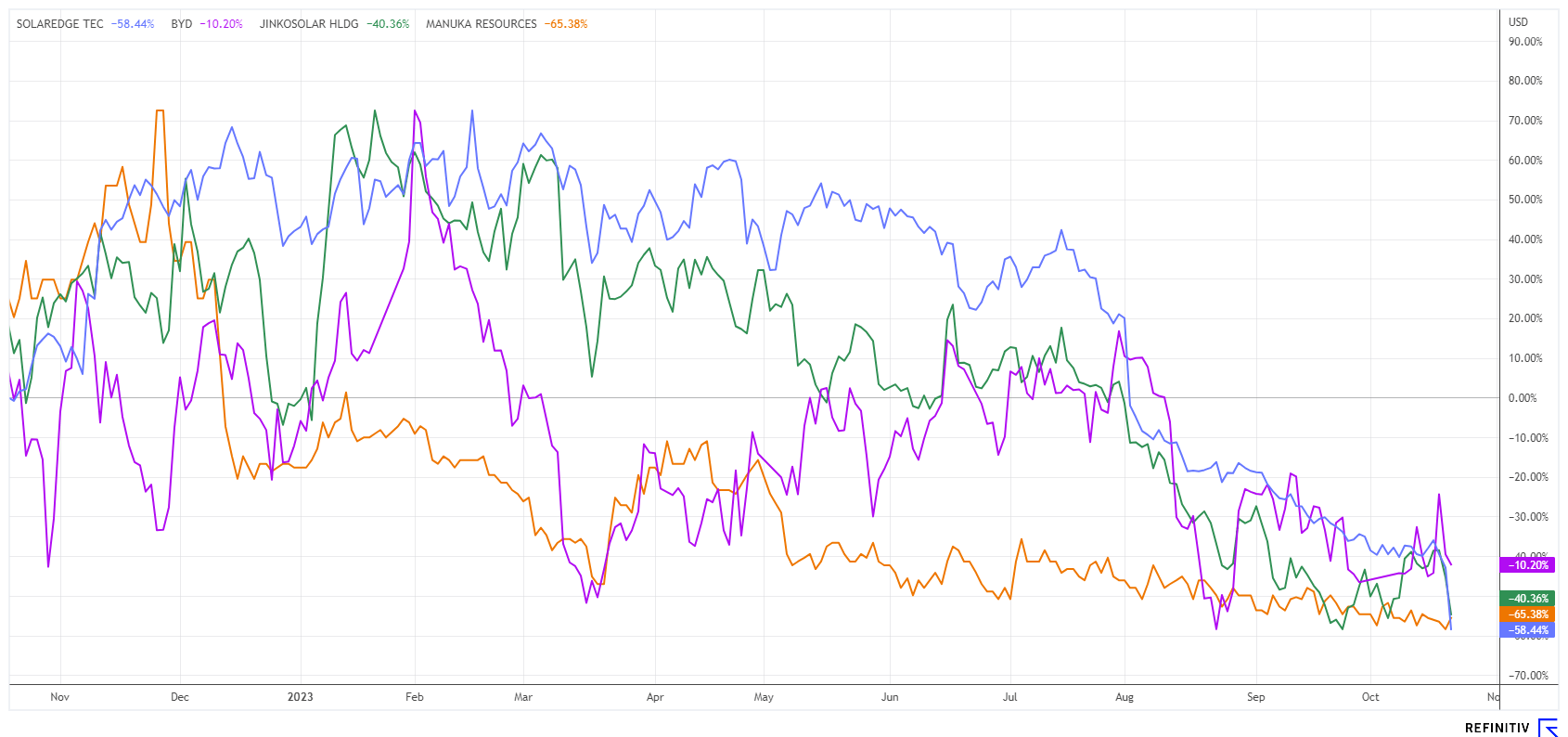

This has not happened for a long time: Lower prices among the "Who's Who" of international technology stocks. Investors who had bet on the endless upswing of well-known growth stocks have taken a beating in the last 6 weeks. But not every fallen angel is excessively overvalued! In times of high volatility and rising interest rates, it pays to take a clear look at robust business models. And as we all know, these are to be found among the market leaders. We welcome the necessary price corrections because they present better opportunities for prudent investors. However, the stock market must now compete with a safe EU bond yield of just under 4%. The risk capital for equities is, therefore, no longer as abundant due to attractive fixed-income alternatives. We assess the opportunities for a few selected stocks.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

JINKOSOLAR ADR/4 DL-00002 | US47759T1007 , SOLAREDGE TECHN. DL-_0001 | US83417M1045 , Manuka Resources Limited | AU0000090292 , BYD CO. LTD H YC 1 | CNE100000296

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

JinkoSolar and SolarEdge - The moment of truth

Solar power generation fits 100% into the concept of a future free of fossil energy. However, high-margin production facilities have long since shifted to China due to high costs in Europe; the Middle Kingdom supplies 75% of all solar projects worldwide. But manufacturing costs are also rising in the Far East, causing producers' margins to collapse.

For the inverter expert SolarEdge, the last quarterly report ended with a disaster. The Israeli company had to issue a profit warning due to a lack of new orders. As part of preliminary key data for the third quarter, SolarEdge announced that revenues are now only seen in a range of USD 720 to USD 730 million, compared to guidance of USD 880 to USD 920 million. Experts on the Refinitiv Eikon platform had expected an average revenue of USD 909 million, a full 25% above the announcement. The operating margin falls analogously from an expected 28% to 30% to just over 20%. CEO Zvi Lando places the blame on European distribution partners, who have incurred high cancellation rates. Due to the ongoing destocking, management also expects "significantly lower revenues" in the fourth quarter. SolarEdge shares lost more than 28% to EUR 77.40 in Friday's close, with the year's high at an impressive EUR 322.75. It is going lower and lower, hard to believe.

Out of sympathy and industry affiliation, the shares of the Chinese module manufacturer JinkoSolar also fell. The share price has already experienced a 35% slide in 2023. On Friday, the value fell a further 7.5%, and well-known solar ETFs collapsed between 8% and 10%. It will now be exciting on October 26, when there will be financial results from China. Caution is still advised. The industry trend remains uncertain.

Manuka Resources - Well positioned for a leap in growth

A future supplier of battery materials could be Australia-based Manuka Resources Ltd (ASX symbol: MKR). Manuka is a mining and exploration company that, in addition to its gold and silver deposits in the Cobar Basin (New South Wales), also sits on significant quantities of vanadium through a 2022 M&A transaction. Following the acquisition of Trans-Tasman Resources Limited (TTR), the Australians became the owners of the Taranaki vanadium-titanium-magnetite (VTM) project. This puts the Company in a very promising position for the future. While gold and silver are subject to relatively constant global demand, the signs point to a storm in the battery metals sector. In the future, the replacement of lithium-ion batteries may draw the attention of technology producers to the particularly rare metal vanadium. It has long been on the list of strategic metals of US and EU governments because of its exceptional importance. For resource-poor Europe, geopolitically secured access in Australia is particularly important.

To provide a constant cash flow, drilling continues at the active Mt Boppy gold mine and advances into deeper regions. Silver production is also an option at higher market prices; so far, the Company does not want to offer the precious ore at these low prices. The 1,150 sq km area also hosts base metals that can be further explored. In the medium term, management's expectations are clearly based on addressing the battery, energy and e-mobility markets with vanadium. CEO Dennis Karp provided deeper insights into his forward-looking strategy at the recent International Investment Forum (IIF).

Manuka Resources Ltd. has issued 562 million shares and is holding its AGM in Sydney on November 16. There will undoubtedly be exciting information here again. The shares are currently trading at around AUD 0.045, so the corresponding market value is AUD 23 million. Once the vanadium project makes progress, these were definitely still affordable entry prices.

BYD - Things are getting better

The car manufacturer "Build Your Dreams" (BYD), co-financed by Warren Buffett, is currently rehearsing its European entry. In China, it has already outstripped VW and Tesla, and now it wants to gain a foothold in Europe with 5 new models. That the Chinese are serious was shown in September at the IAA Mobility Show in Munich, where they had the largest, most dazzling exhibition space. German manufacturers currently can't demonstrate this kind of progress in the market, as they have already fallen far behind in the development of modern mobility concepts.

**Within its corporate structure, BYD has clear strategic advantages. On the one hand, it is already located in a highly technical country with the best infrastructure. On the other hand, the Group has already integrated all vertical process steps into its value chain for some time. BYD has its own software, processors, batteries and vehicle expertise that has grown over the years. In geopolitically challenging times, this structure is robust against the unstable supply chains of European manufacturers, which have 70% of their preliminary products produced abroad. Time and again, there are drastic production stoppages when there is a crisis somewhere.

The BYD share has already overtaken VW in terms of valuation but is currently also suffering from the global sell-off in technology shares. After a long sideways trend between EUR 26 and EUR 32, it must technically go through resistance with large turnovers before investors can hope for more significant gains again. In the long term, however, BYD is a top pick for the portfolio in the high-tech segment.

For a long time, newcomers had to wait for more favorable prices. Due to the crisis, opportunities are now lighting up on the screen. Therefore, It is worth taking a closer look at yesterday's best performers, as they will be at the forefront again in the next upswing. The solar sector should still consolidate a bit. BYD continues to grow operationally, even without price movements. Manuka Resources can be added as an opportunity stock because a lot should happen here in 2024.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.