October 14th, 2025 | 07:30 CEST

Alternative to BioNTech, Evotec, and Co.: BioNxt Solutions impresses at investor conference and sparks takeover speculation

While the shares of BioNTech and Evotec are treading water, BioNxt Solutions is on an upward trajectory. The Company is currently shaking up Big Pharma. The announcement to replace the weight-loss injection Ozempic with an oral dissolvable film has sparked takeover speculation. BioNxt also aims to make waves in multiple sclerosis, another multi-billion-dollar market, by significantly simplifying the administration of a blockbuster drug for patients. At last week's IIF investor conference, the management board delivered a convincing presentation. Partnerships and licensing opportunities were outlined - assuming no acquisition occurs beforehand. This could prove highly rewarding for both a pharmaceutical company and shareholders.

time to read: 2 minutes

|

Author:

Fabian Lorenz

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , EVOTEC SE INH O.N. | DE0005664809 , Bionxt Solutions Inc. | CA0909741062

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Scalable business model

BioNxt Solutions' presentation at the IIF investor conference on October 8, 2025, was convincing. The business model was clearly presented: rather than inventing new active ingredients, the Company focuses on the intelligent reformulation of already approved drugs. The focus is on neurological and autoimmune diseases as well as oncology. CEO Hugh Rogers and Dr. Wolfgang Wagner (Head of R&D) highlighted oral dissolvable films (ODF) at the centre of the strategy: thin films that dissolve under the tongue, allowing precise dosing, bypassing first-pass metabolism and thus improving bioavailability, tolerability, and adherence. This approach promises faster research, lower development costs, and reduced regulatory risk, and represents a scalable model that is also realistic even for a small-cap company.

https://youtu.be/vbmx2gVmYoc?si=u1m_hhM-vxjudpbW

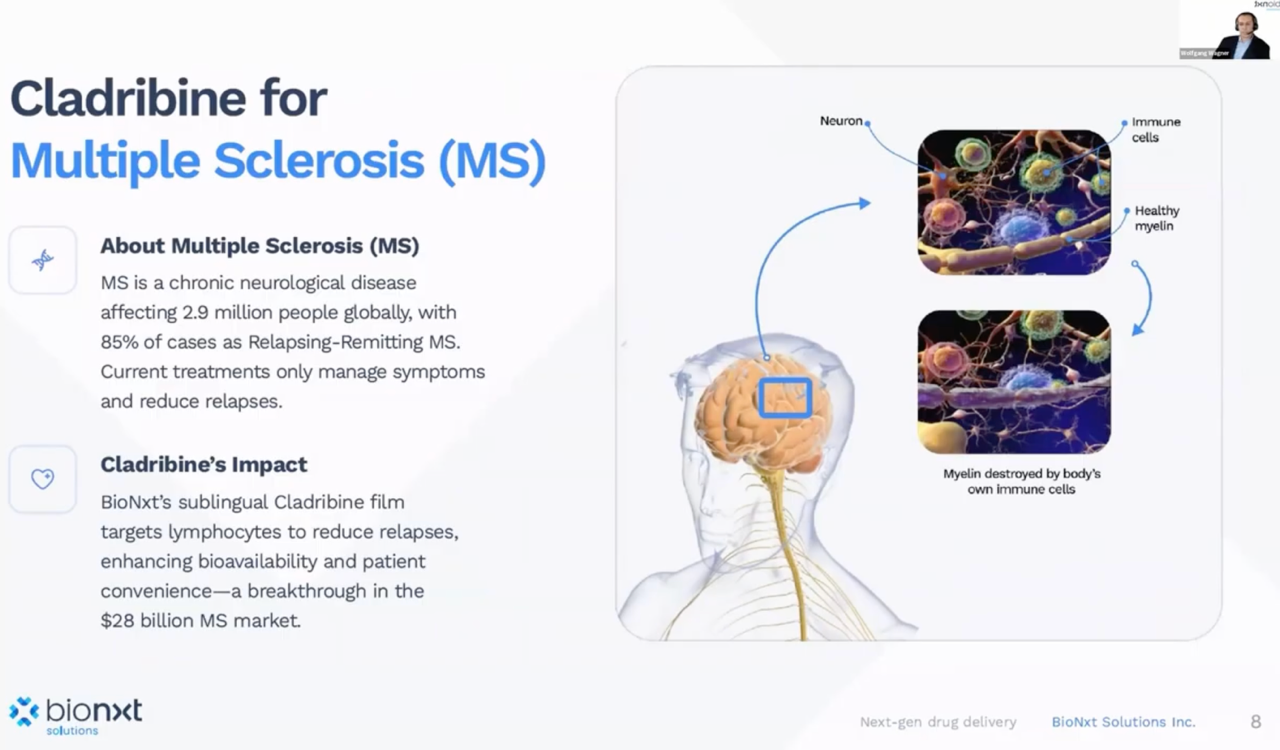

Flagship project addresses billion-dollar market

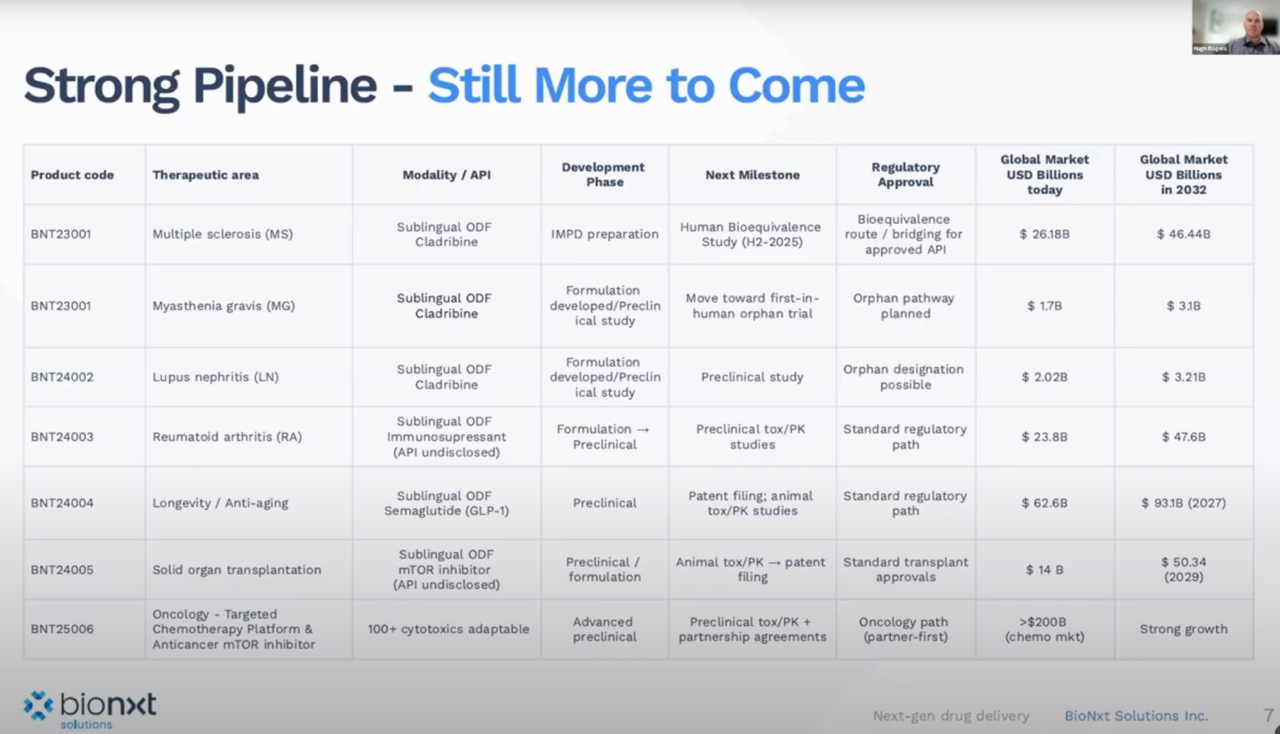

The team presented BNT23001, a cladribine ODF for multiple sclerosis, as its flagship project. This addresses a market that is already worth over USD 1 billion with the tablet reference product. BioNxt is pursuing a "generic-plus" approach: a known active ingredient, but with an advantageous dosage form (sublingual), potentially lower API usage for the same effect, and more convenient administration without water. Because dosages on the film can be very finely adjusted, the concept is intended to be transferable to related indications such as myasthenia gravis and other immunological applications. BioNxt reported positive preclinical data in small animals; as a risk reduction measure, a larger study in pigs is now being initiated to refine the bioequivalent dose for humans before entering clinical trials.

The IP strategy is a key pillar: in addition to platform patents for ODFs and other dosage forms (including transdermal patches), BioNxt is focusing on product-specific property rights. For the cladribine ODF, the Company is on the verge of patent grant in Europe and is utilizing fast-track procedures; applications are pending in Canada, Australia, and Eurasia, among other places. IP protection is intended to deter imitators and increase licensability - an important element, as BioNxt plans to leave manufacturing and commercialization largely to partners.

At the same time, the Company is broadening its pipeline: early sublingual formulations of additional active ingredients, including a longevity/anti-aging API, as well as an oncology project in North America (LOI signed). The concept: to "trap" cytostatic drugs locally in the tumor microenvironment and deactivate them outside it – an elegant drug-delivery mechanism that complements the ODF expertise. Scientifically, BioNxt benefits from a German-Canadian network.

Partnerships and licenses in the next 12 to 24 months

Strategically, BioNxt is focusing on partnerships and licensing over the next 12 to 24 months. The core investment case remains the asymmetric risk profile. Because BioNxt does not have to prove the efficacy of new molecules, but instead converts approved APIs into improved delivery forms, the binary biotech bet is mitigated. If a candidate does not fit the ODF profile, a broad selection of alternative active ingredients is available – the scalability comes from the platform.

Conclusion: Opportunity for value-creating licensing deals and acquisition

The IIF presentation outlined the opportunity for partnerships and licensing. If bioequivalence is proven and patents are secured, the chance of value-creating licensing deals increases – unless an acquisition occurs first.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.