June 9th, 2025 | 10:15 CEST

Almonty Industries: The new Pillar of Western Raw Material Security

The Western world is facing a raw material crisis with explosive geopolitical implications. In recent months, China has drastically tightened its export controls on critical minerals, affecting primarily strategically important metals such as gallium, germanium, antimony, and, most recently, tungsten. These raw materials are indispensable for the defense industry, semiconductor production, and high-tech manufacturing. Amid this tense situation, one company that is positioning itself as an important part of the solution is stepping into the spotlight: Almonty Industries (TSX: AII). The tungsten specialist operates strategically located tungsten projects in South Korea, Portugal, and Spain and will soon play a key role in supplying Western industries, as global tungsten supplies are expected to run critically low in the near future.

time to read: 2 minutes

|

Author:

Mario Hose

ISIN:

ALMONTY INDUSTRIES INC. | CA0203981034

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Mario Hose

Born and raised in Hannover, Lower Saxony follows social and economic developments around the globe. As a passionate entrepreneur and columnist he explains and compares the most diverse business models as well as markets for interested stock traders.

Tag cloud

Shares cloud

Almonty as a countermodel to Chinese dependency

Since mid-2023, China has gradually tightened its control over the export of critical raw materials. Gallium and germanium, essential for the semiconductor and solar industries, have been subject to strict export restrictions since August 2023. Antimony, a metal used in ammunition, batteries, and military equipment, followed in 2024. Particularly controversial is the increasingly restrictive handling of exports of so-called dual-use materials - substances with both civilian and military applications. Tungsten, an extremely hard and dense metal used in missile tips, armor plating, microchips, and cutting tools, also falls under these regulations.

The consequences are already becoming apparent: According to Martin Hotwagner of Steel & Metals Market Research in Austria, every vehicle contains an average of around 300 grams of tungsten – most of which is lost during recycling. The result: declining reserves, rising prices, and increasing pressure to act in the US, Europe, and Japan. As supplies dwindle, he expects Western companies will run out of tungsten by the end of the summer. Western governments are urgently looking for alternatives – and in doing so, they are turning their attention to Almonty Industries.

The strategic rise of Almonty Industries

In recent years, Almonty has systematically positioned itself as a non-Chinese supplier of tungsten and, in the future, molybdenum. With the Sangdong mine in South Korea set to start production soon, the Company is in a unique position: once operational, Sangdong will be one of the largest sources of tungsten outside China and will be able to cover up to 40% of non-Chinese global production. The mine has a life span of over 90 years, and the rock has an exceptionally high tungsten content.

The geopolitical relevance has not gone unnoticed: the US, which classifies tungsten as critical to national security, has already recognized Almonty as a strategic partner. The Company has signed exclusive purchase agreements with US defense contractors, including price floors guaranteeing a long-term economic basis. At the same time, Almonty is planning a NASDAQ listing and relocating its headquarters to the US in order to be more closely connected both politically and in terms of regulation. In recent weeks, two US military representatives, General Gustave Perna and Alan Estevez, have joined Almonty's board of directors.

Conclusion: From mine operator to guarantor of Western supply security

At a time when China is deliberately using its economic power as a political lever, independent sources of raw materials are becoming increasingly important. Almonty Industries (TSX: AII) not only meets this requirement but also offers a stable foundation for Western industrial policy thanks to its geographical diversification, operational experience, and political connections. The beginning of the restructuring of global supply chains is no longer theory – it is reality. And right at the heart of it: a tungsten producer that is in the right place at precisely the right time.

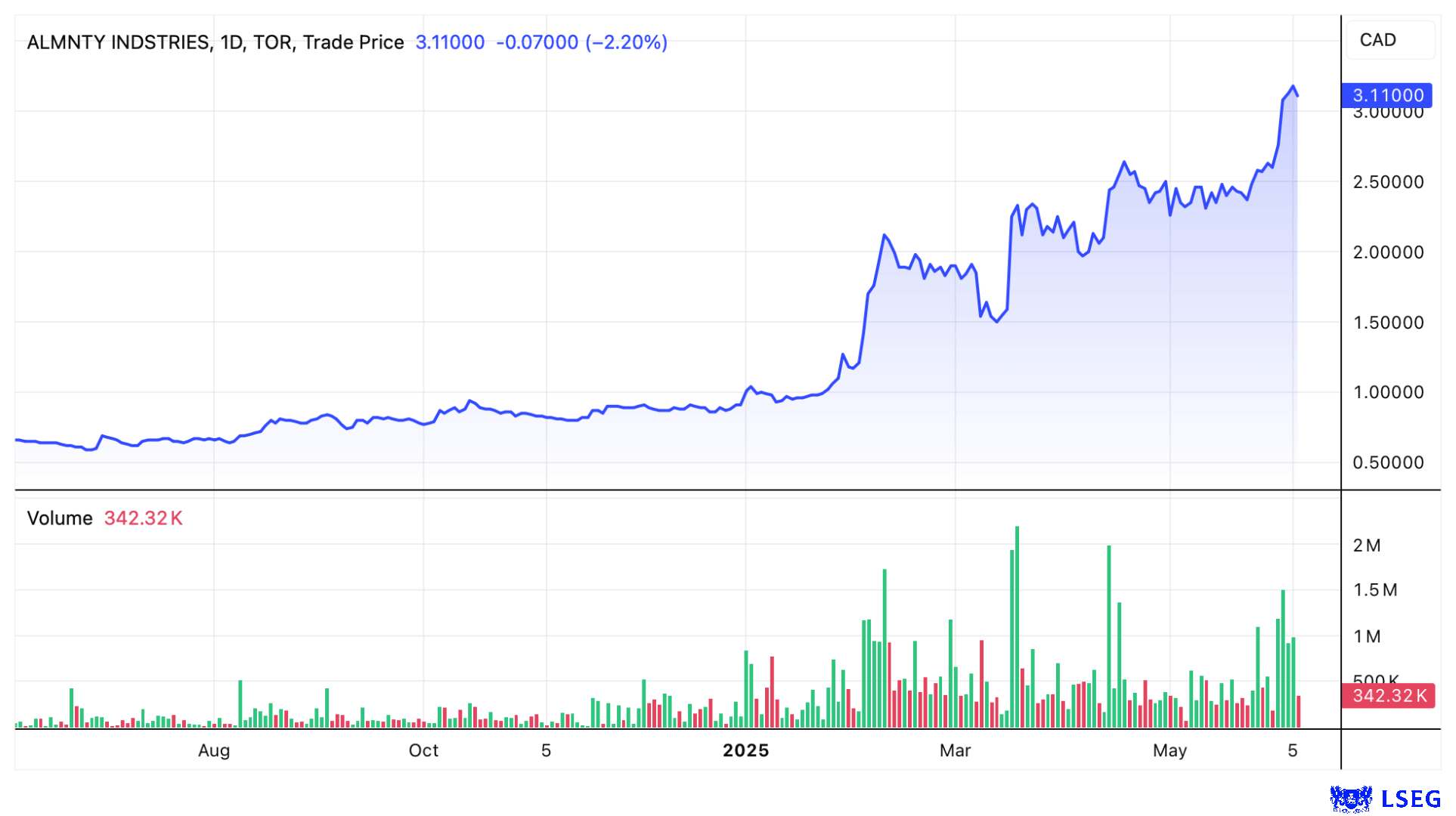

The planned NASDAQ listing will open access to the world's largest capital market and should significantly increase demand for Almonty shares. Peter Thilo Hasler, an analyst at Sphene Capital, has issued a "Buy" recommendation for Almonty with a price target of CAD 5.40.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.