March 10th, 2025 | 08:15 CET

Alibaba, naoo, Amazon: Where innovation leads and profits rise

In early March 2025, Alibaba made a move with its AI model QwQ-32B, which is set to challenge DeepSeek. The stock immediately rose by 8.4%, and even institutional investors like Berkshire are getting involved. Markets are buzzing and are fueled by user interactions on social networks. A hidden gem in the USD 234 billion social media market is naoo AG. The Swiss company focuses on local networking and rewards users with an AI-based point system that they can use at local businesses. With 75,000 users and 6.5 million impressions, interactions are increasing rapidly. Amazon is focusing on real-time streaming of computer games in its AWS division. With GameLift Streams, they have been conquering the gaming market since March 2025, bringing games directly to billions of devices – a cost-efficient game changer for developers and investors.

time to read: 5 minutes

|

Author:

Juliane Zielonka

ISIN:

Table of contents:

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

Alibaba presents AI model: Berkshire joins and strengthens investor confidence

Alibaba made a remarkable move in the global AI competition at the beginning of March with the presentation of its new AI model QwQ-32B which has taken a remarkable step in the global AI competition. The Chinese retail giant's model is set to win the battle against DeepSeek. QwQ-32B excels in mathematics, programming, and problem-solving benchmarks and is available via the chatbot Qwen. The language model is said to have critical thinking and adaptive reasoning skills, enabling unique interaction.

The market welcomed this development: Investors rewarded it with a price jump of 8.4%. Alibaba's announcement also fits with the Chinese government's promise to promote AI and technologies like 6G, aiming to make the country even more advanced and innovative.

It is also interesting for investors to note that Warren Buffett's Berkshire Asset Management has entered into Alibaba and acquired 10,225 shares worth USD 911,000 in the fourth quarter, as reported by MarketBeat. Berkshire is one of the institutional investors that hold a total of 13.47% of Alibaba shares. Analysts are also confident about the integration of AI into the retail platform. Barclays, JPMorgan, and Morgan Stanley are raising their price targets to up to USD 180. On average, the stock is trading at USD 144.07, with a "Buy" rating. For investors, Alibaba offers strong growth potential with AI innovation and institutional support.

naoo AG: A Swiss highlight in the social media billion-dollar market

Social media is a global multi-billion-dollar market with a revenue volume of USD 234 billion, according to Statista. The annual growth rate of 6.7% shows that there are still numerous opportunities for scaling here. For investors, the appeal lies in the sheer size and dynamics: platforms such as Facebook, Instagram, and TikTok generate billions through advertising, while new players with innovative concepts are capturing market share. Or, as with Meta, inventing new markets in the digital space. The key to success? User retention and monetization. This is precisely where the Swiss social media company naoo comes in – with a concept that sets it apart from the competition and piques investors' curiosity.

Unlike Instagram or YouTube, where only the biggest influencers earn the most and organic reach is declining (approx. 6%), naoo rewards all users. Via an integrated points system – "naoo points" – users can collect points through posts, likes, or store visits and exchange them for cash or vouchers. Such point systems are used in other countries such as payback points or loyalty points. This direct reward through gamification has a positive effect on user engagement**: naoo registered a doubling of user time in just 6 months.

The global trend in social networks is increasingly towards localization and personalization. naoo implements the hyper-localization concept directly: AI-powered technology delivers location-based offers that connect local businesses with potential customers. While Google Maps, for example, lists businesses, naoo offers real interaction through discount codes, daily offers, or similar.

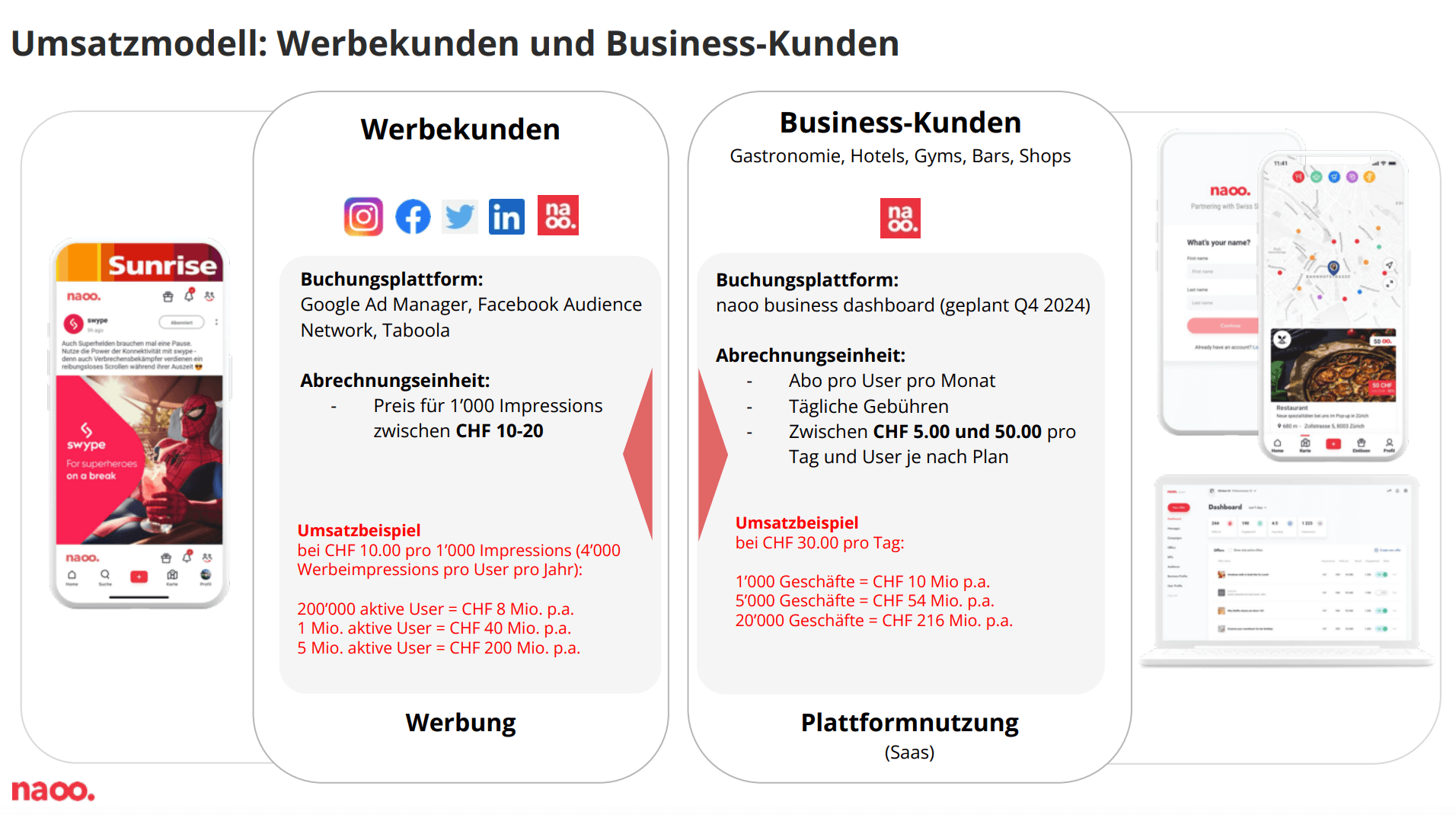

For investors, the potential for scaling is crucial. With 75,000 users and 6.5 million monthly impressions, naoo is showing initial success in Switzerland. Regular advertising revenue (10–20 CHF per 1,000 impressions) and the planned business dashboard for local companies (up to 216 million CHF turnover with 20,000 businesses) promises strong returns.

User retention is already in the top 10% worldwide, supported by a scalable architecture with AWS support. naoo is not just another US clone – it is a platform that is rethinking the social media market and offering investors an opportunity for sustainable growth.

Amazon GameLift Streams: A giant leap in the gaming market

Amazon Web Services (AWS) launched Amazon GameLift Streams, an extension of Amazon GameLift, in the first week of March. Developers can now stream games to WebRTC-enabled devices such as PCs, smartphones, tablets, and smart TVs – without code adjustments or the need for their own infrastructure.

The platform technology supports Windows, Linux, and Proton in browsers installed worldwide, such as Chrome and Firefox. Real-time publishing means users can start playing immediately and report possible bugs directly. Developers save millions in costly development costs and reach an audience of billions through streaming – without downloads. "This creates completely new revenue opportunities," emphasizes Lee. For investors, Amazon, along with GameLift Streams, is a key player in the expanding gaming market. Since 2016, industry giants such as Ubisoft and Meta have been using GameLift for scalable servers with up to 100 million concurrent users. GameLift Streams is now opening up new horizons by making games instantly accessible.

The global video game market is growing rapidly: In 2022, it was valued at USD 217.06 billion, according to https://www.grandviewresearch.com/industry-analysis/video-game-marke text: Grand View Research). By 2030, experts predict a volume of USD 583.69 billion, with a compound annual growth rate of 13.4% from 2023. "With over 750 million monthly players on AWS, we are deeply rooted in the industry," says Chris Lee, AWS Head of Immersive Technologies. GameLift Streams is taking advantage of this boom by transforming billions of everyday devices into gaming platforms – a real innovation for developers.

Alibaba is introducing its own AI model called QwQ-32B, which can compete with DeepSeek and is already impressing investors: the share price rose by 8.4% when the news was announced. The entry of Berkshire also makes investors sit up and take notice. Rethinking social media is the core topic of naoo AG. The Swiss company excels in the USD 234 billion social media market with an innovative reward and points system, including AI-supported localization that binds users and strengthens local businesses. With 75,000 users, 6.5 million impressions, and a scalable model, it offers investors a rapidly growing investment opportunity. Amazon is also banking on gamification and launching GameLift Streams, a true innovation that enables developers to stream cost-effectively to billions of devices and drastically reduces debugging costs. AWS also remains a key player with high return potential.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.