March 17th, 2025 | 07:20 CET

After the NASDAQ correction – Hightech on the rebound: Palantir, Amazon, MiMedia, SMCI, and Intel on the rise

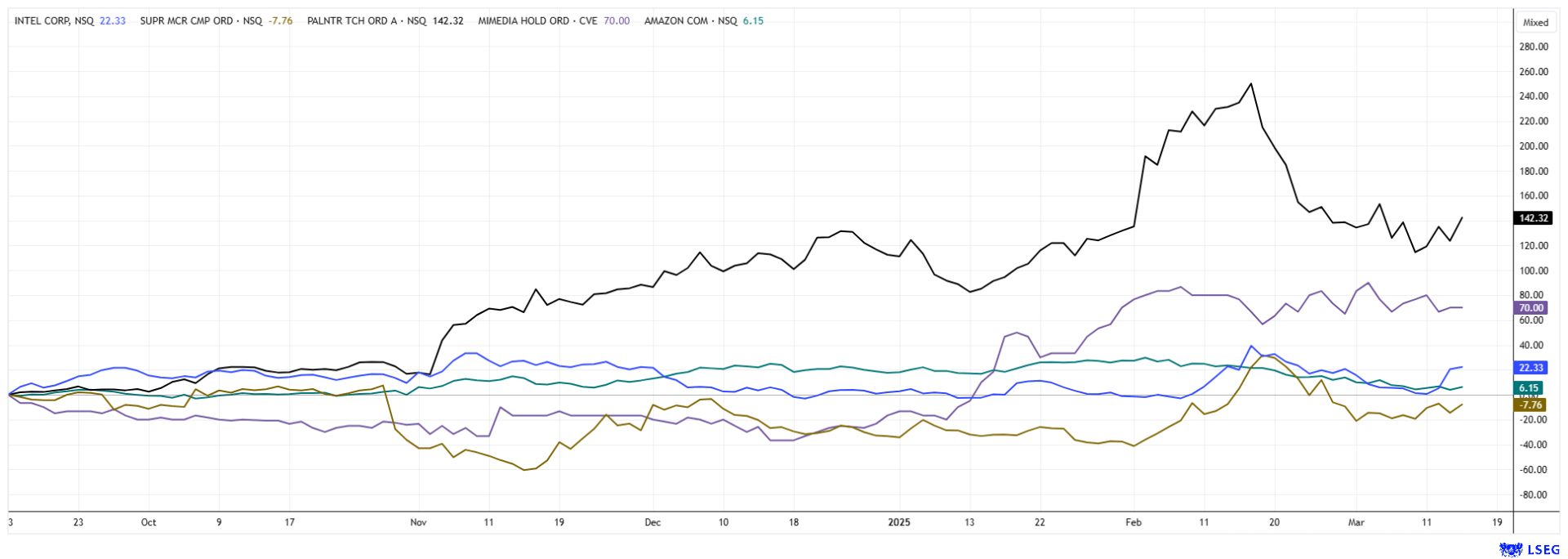

The NASDAQ correction was sharp and brief, with a 15% drop from 22,200 to 19,100 in just 4 weeks. In the context of a normal consolidation, that might be enough to bring the heavily overbought tech stocks back to normal levels. Unfortunately, however, there are also valid fundamental reasons that can be traced back to the official chaos of the new US President, Donald Trump. He is making wild tariff demands and withdrawing key resources from all international partnerships. This departure from normal political behavior could have a much more significant impact on the stock market, as global trade relations are faltering, while inflation and currency devaluation continue. Which tech stocks should be considered now?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

PALANTIR TECHNOLOGIES INC | US69608A1088 , AMAZON.COM INC. DL-_01 | US0231351067 , MIMEDIA HOLDINGS INC | CA60250B1067 , SUPER MICRO COMPUT.DL-_01 | US86800U1043 , INTEL CORP. DL-_001 | US4581401001

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Palantir and Amazon – Big Data in the spotlight

When it comes to cutting-edge big data business models, Palantir and Amazon are the top choices with their software and cloud offerings. Palantir went public on September 30, 2020, with an opening price of USD 10 per share via a direct listing. The Company provides highly sensitive data to B2B customers in the public sector, including some defense departments. Ukraine also uses Palantir systems to analyze enemy troop movements. The stock is growing strongly, but with a 2025 P/E ratio greater than 150, it is one of the most expensive IT defense stocks on the market. The current price is around USD 86, representing a value increase of about 760% for first-time buyers. Should one buy now? The question is rather philosophical.

A real force in the cloud business is Amazon with its subsidiary AWS. Amazon Web Services (AWS) is a leading provider of cloud computing services, serving over 50 million customers worldwide, including businesses of all sizes, start-ups and public sector organizations. In 2023, AWS generated revenues of USD 90.8 billion, corresponding to approximately 16% of Amazon's total revenues. The Company will grow by around 9% in revenues in 2025, with EBIT expected to increase from around USD 69 billion to USD 81 billion. The 2025 P/E ratio is, therefore, a comparatively low 31. With a valuation of over USD 2 trillion, Amazon is one of the "Magnificent 7", and the stock is a heavyweight in international ETF portfolios. On the LSEG platform, analysts expect 12-month share prices of USD 93.50 for Palantir and USD 263 for Amazon. In direct comparison, the e-commerce giant from Seattle appears to be really cheap.

MiMedia – Groundbreaking cloud services ensure growth

A comparatively small provider of cloud services is the Canadian company MiMedia (MIM). For smartphone users with the Android operating system, it offers a next-generation cloud platform based on artificial intelligence that allows users to back up all types of personal media permanently and independently of location. Once stored, the user can access it seamlessly and at any time via all devices and operating systems. The platform features the latest technological standards, offers an inspiring and comprehensive media experience, robust organizational tools, and a variety of private sharing features. MiMedia works with several smartphone manufacturers and telecommunications providers worldwide, offering its partners recurring revenue streams, greatly improved customer retention, and unique market differentiation. MiMedia's platform technology works independently of the device and is intuitive, easy to use and visually appealing. Based on the idea of saving the digital life of users, organizing it in a meaningful way and delivering added value, MiMedia clearly stands out from the pre-installed storage solutions. In recent weeks, MiMedia has provided several updates to its platform, including improved user interfaces, faster upload speeds, and advanced security features.

CEO Chris Giordano wants to create the world's largest and most independent AI-powered data and cloud platform. From the Mobile World Congress in Barcelona, he can report some encouraging results. Among many active partners, MiMedia spent some time with US OEM partner Orbic. Orbic presented its impressive new range of smartphones that will be launched worldwide in 2025 and will include MiMedia as the standard media gallery. This is a revolution because, for the first time, MiMedia is available in the starting configuration. Partner Orbic presented extremely robust devices designed for use in harsh environments with integrated functions such as Bluetooth, walkie-talkie, data and voice communication, GPS tracking, and WiFi. They are therefore ideal for industries such as construction, emergency services, hospitality, and emergency response. The market for rugged devices is expected to grow from the current USD 1.3 billion to USD 3.7 billion by 2033, so the proliferation of the MiMedia app should also increase dramatically. MiMedia has already contractually implemented 35 million installations with additional partners for the next 24 months.

MiMedia can also increase its pace in the area of AI. CEO Giordano explains this point: "From a market trends perspective, one takeaway from this week was the growing role of AI in our industry. Given the years of development of our patented, proprietary technology platform and the strength of our AI offering, we are confident in our competitive advantages in AI. We will continue adding AI-driven features to expand our market leadership." MiMedia is currently growing rapidly after 6 years of development and investments of more than CAD 50 million. MiMedia is becoming indispensable as a central player, particularly in Africa, where smartphones are increasingly becoming part of everyday life. Large telecom providers and OEMs have neglected the cloud market for too long and are no longer able to monetize their customer base fully. MiMedia, on the other hand, can enforce margins of over 80%, strengthen customer loyalty and generate recurring revenues through storage subscriptions and mobile advertising. The success is also boosting MIM's share price, which has more than doubled from CAD 0.22 to CAD 0.57 since the end of December. However, the ICE is only just leaving the station.

SMCI and Intel – Strong recovery after the sell-off

Two high-tech stocks in a good technical situation deserve a mention. Nvidia partner SMCI was able to answer the SEC's questions in a timely manner by hiring a new auditor, and the necessary documents have been submitted. After crashing below USD 20, the value rose back above USD 40 last week, and the shorties continue to cover. Analysts on the LSEG platform see further potential of up to around USD 53.50.

Chip giant Intel disappointed in 2024 with a major profit warning and fell below the USD 20 mark after trading above USD 60 in 2023. The planned major investment in Magdeburg was put on hold, and around 15,000 jobs are to be cut worldwide. On March 13, Lip-Bu Tan was appointed as the new CEO, succeeding Pat Gelsinger. Intel is currently considering selling its subsidiary Altera and has already sold its ARM shares in order to focus on its core competencies. Around USD 10 billion is to be saved by the end of 2026. The experts on the LSEG platform remain skeptical, with an expected price target of USD 23.50. The stock can currently be bought there. Technically, the USD 19 mark offers good support.

The stock market has been in a bit of a muddle in recent weeks. While financial and defense stocks in Germany have risen significantly, some tech stocks in the Nasdaq index have plunged. Together, Nvidia and Tesla have now lost around USD 1 trillion in value. For the next cycle, it will be important to pick the right sectors. Tech stocks will likely recover in the near term, and cloud companies such as MiMedia, Amazon, and SAP are also in high demand. Investments should be hedged with a consistent stop loss to avoid a prolonged correction.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.