At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories. That it depends thereby less on large names, but on the future potential and whether the market also recognizes these perspectives, was one of its first learnings at the stock exchange.

On these pages, Nico examines current events at listed companies and takes a closer look at companies that are traded under the radar of the market, in addition to well-known securities.

In order to be able to take advantage of speculative opportunities on the stock exchange, Nico not only focuses on a balanced asset allocation of defensive and opportunity-oriented securities, but also on an intact risk management. "In addition to position size and entry in several tranches, investors should also develop a sense of timing and get to know a stock better before investing," says the columnist.

Commented by Nico Popp

Commented by Nico Popp on June 30th, 2025 | 07:40 CEST

Everything is going electric – and this detail could make investors wealthy: Power Metallic Mines, Rio Tinto, Freeport-McMoRan

The future is electric – heating systems and vehicles are already running on electricity today. Those with their own rooftop solar panels welcome this shift, as solar energy becomes essentially free after the initial investment. But this transition also requires massive investment. Experts at EY report that global electrification will require 115% more copper to be mined over the next thirty years than has been mined in all of human history. The scale of the challenge is, therefore, enormous. Making copper mining sustainable is even more so. But there are solutions.

ReadCommented by Nico Popp on June 26th, 2025 | 07:05 CEST

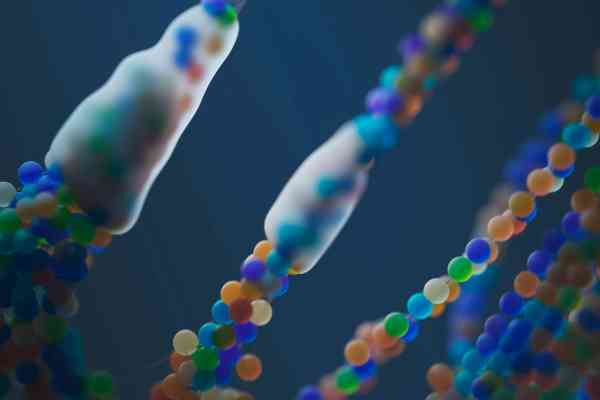

Decoding the Code of Life – What comes next? Illumina, PanGenomic Health, Moderna

Genetic information is the blueprint of life. Even today, genome sequencing enables us to gain insights that can extend our lives. This is especially true when we can identify certain predispositions to diseases in advance and respond with a healthy lifestyle. Numerous business models are currently emerging around this technology. Some of these are very capital-intensive. Others leverage existing research and artificial intelligence, making them incredibly smart opportunities for investors.

We provide an overview.

Commented by Nico Popp on June 25th, 2025 | 07:15 CEST

New trends in aerospace are driving growth: Volatus Aerospace, Lockheed Martin, Boeing

The new global security situation shows that military potential can secure peace. Even if staunch pacifists proclaim the opposite, the latest measures taken by Israel and the US against Iran have demonstrated that decisive action pays off – the mullah state's nuclear program appears to have been significantly delayed, at the very least. Military innovations have been particularly significant in the aerospace sector in recent years. However, many formerly purely military approaches are also proving their worth in civilian applications. We take a look at Lockheed Martin, Boeing, and Volatus Aerospace, highlight their innovations, and venture a look at how their shares are likely to perform.

ReadCommented by Nico Popp on June 25th, 2025 | 07:05 CEST

The economy is becoming sustainable – and the stock market is delighted: dynaCERT, Siemens, Shell

ESG criteria have become established across all industries. The prevailing principle in today's business world is that even producers of fossil energy must take action to become more sustainable. This principle is known as "Best-in-Class" and ensures that every industry makes the most of its opportunities to move toward greater sustainability. We present three exciting sustainable business models - Shell, Siemens, and dynaCERT - and explain where opportunities may lie for investors.

ReadCommented by Nico Popp on June 24th, 2025 | 07:40 CEST

Hydrogen – The new trends: Plug Power, Pure Hydrogen, thyssenkrupp

German industry is set to go green. But once again, reality is proving more complex. In March, Thyssenkrupp withdrew a hydrogen tender because all submitted bids significantly exceeded the assumed cost conditions for hydrogen. So, is the hydrogen hype failing to take hold in the real economy? We take a closer look at the latest developments and explain which companies are now in pole position.

ReadCommented by Nico Popp on June 24th, 2025 | 07:00 CEST

Escalation in the Middle East – Why the US military needs Almonty Industries

Following the US attack on Iranian nuclear facilities using bunker-busting weapons, Iran's response, and the very brief ceasefire, the war in the Middle East continues. On Monday night, Israel bombed the entrance to a prison, among other targets, without destroying buildings housing prisoners. In doing so, Israel emphasized that the war is not being waged against the Persian people, but against the theocratic regime of the mullahs. However, a regime change in the theocracy currently appears unlikely. It is far more probable that Iran's revenge will sooner or later also target US soldiers stationed at the numerous bases in the region. Iran's retaliatory strike on Monday evening - in which it gave the US prior warning - is unlikely to be the final escalation following the collapse of the ceasefire. It, therefore, looks as if the US will continue to face military challenges. One company whose products are essential not only for the construction of bunker-busting weapons but also for other types of ammunition and armor could benefit from this scenario: Almonty Industries.

ReadCommented by Nico Popp on June 23rd, 2025 | 07:15 CEST

The next cash cow? Quick profits with NetraMark, Moderna, and BioNTech

Do you remember the vaccine race during the coronavirus pandemic? Back then, the duel between BioNTech and CureVac dominated the stock market. Early investors quickly made a fortune. Now, pandemic winner BioNTech aims to swallow up its Swabian competitor. What does this mean, and where is one of the most fascinating industries headed?

ReadCommented by Nico Popp on June 23rd, 2025 | 07:00 CEST

This trillion-dollar disruption is also sustainable for your portfolio: Argo Living Soils, Beyond Meat, Heidelberg Materials

Investors have seen it before: ambitious plans and grand revolutions that ultimately come to nothing - at least from an investor's perspective. The best example is the vegan revolution led by Beyond Meat – the Company's share chart certainly leaves a bad taste for any investor. But does that mean investors should be particularly critical of major innovations? We explain which disruptions truly deliver sustainable returns. It is all about sustainable construction - and benefits for all parties involved.

ReadCommented by Nico Popp on June 10th, 2025 | 07:20 CEST

Future market – Worth about USD 50 billion: Illumina, Moderna, PanGenomic Health

Medicine is becoming personal. The era of one-size-fits-all drugs is coming to an end. Experts at BCC Research predict that the market for personalized medicine will grow from USD 54.2 billion in 2023 to USD 100.5 billion by 2028. That represents an annual growth rate of 13.2%. Other analysis firms, such as Grand View Research and Market Research Intellect, confirm this promising outlook for investors. All the more reason to take a closer look at Illumina, Moderna, and PanGenomic Health and explore the opportunities they present for investors.

ReadCommented by Nico Popp on June 10th, 2025 | 07:10 CEST

Great potential for emerging markets in the cloud: Apple, Microsoft, MiMedia

Digital subscriptions are big business: Market researchers, such as the experts at Juniper Research, estimate that digital subscriptions will generate USD 1 trillion in revenue worldwide by 2028. Major tech providers, in particular, have been fully focused on services for several years now. However, in the wake of the big names, smaller companies are also gaining market share. We take a look at Apple, Microsoft, and MiMedia and explain how their shares could perform in the future.

Read