At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories. That it depends thereby less on large names, but on the future potential and whether the market also recognizes these perspectives, was one of its first learnings at the stock exchange.

On these pages, Nico examines current events at listed companies and takes a closer look at companies that are traded under the radar of the market, in addition to well-known securities.

In order to be able to take advantage of speculative opportunities on the stock exchange, Nico not only focuses on a balanced asset allocation of defensive and opportunity-oriented securities, but also on an intact risk management. "In addition to position size and entry in several tranches, investors should also develop a sense of timing and get to know a stock better before investing," says the columnist.

Commented by Nico Popp

Commented by Nico Popp on December 8th, 2025 | 07:00 CET

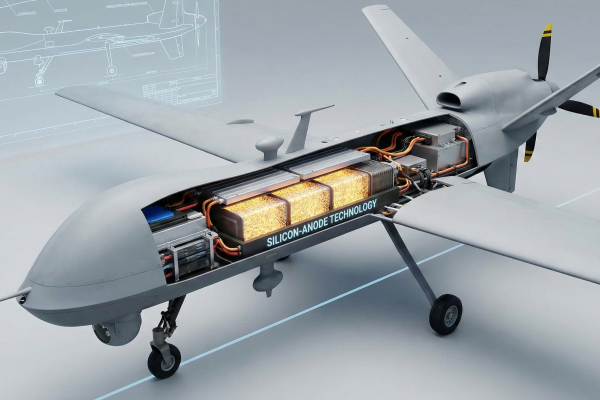

Even in times of peace, these defense stocks have a future: NEO Battery Materials, Hensoldt, DroneShield

There is a lot at stake for Ukraine these days: Will there be a dictated peace, will the war continue, or is a long-term viable solution in sight after all? Some defense stocks have fallen in recent weeks. However, regardless of the current peace negotiations, it looks as if Europe in particular will have to invest heavily in military capabilities in the coming years. We explain why and present some exciting stocks.

ReadCommented by Nico Popp on December 5th, 2025 | 07:00 CET

Siemens Energy, Deutsche Bank, Almonty: Why 2025 belonged to the tankers – and 2026 will be the year of the speedboats

There are years on the stock market that are remembered for decades. 2025 was one such year. It was the year the old economy made its comeback. Who would have thought 12 months ago that a former DAX turnaround candidate would outperform tech stocks? Or that a major German bank would suddenly be viewed as a highly attractive core investment? The scoreboard does not lie: the big tankers delivered. However, stock market history rarely repeats itself exactly. While many blue chips are now trading at high valuations and no longer offer much upside potential, experienced investors are already positioning themselves for the next cycle. A presentation at the International Investment Forum (IIF) on Wednesday provided a decisive clue as to where the momentum may shift in 2026.

ReadCommented by Nico Popp on December 4th, 2025 | 07:05 CET

Hype fades, substance remains: Why Bank of America, Commerzbank, and Nakiki are now winners

"The tide lifts all boats, but it is only at low tide that you can see who is swimming without swimming trunks." This stock market bon mot from Warren Buffett perfectly describes the current state of the crypto market. While Bitcoin is stabilizing after its volatile phase and reaching a new stage of maturity, speculative bubbles are bursting at the edges - the best example: American Bitcoin from the Trump universe. Investors increasingly understand that quality is what matters when it comes to blockchain. We present financial stocks with substance that also exude crypto fantasy.

ReadCommented by Nico Popp on December 4th, 2025 | 06:55 CET

How suppliers like Aspermont, CATL, and Continental turn the world's complexity into profit

"During a gold rush, don't sell shovels - sell treasure maps." In a world driven by technological disruption, geopolitical tensions, and the trend toward decarbonization, investors need to think one step ahead. Often, it is not the end manufacturers who benefit most, but the specialized suppliers and service providers operating behind the scenes. They take the complexity off their customers' hands – whether it is building an electric vehicle, optimizing tyre compounds, or deciding where to build the next billion-dollar mine. Those who understand this principle will find exciting options on the stock market right now. We present three companies.

ReadCommented by Nico Popp on November 26th, 2025 | 07:00 CET

Two new mines in 12 months – Analysts give the thumbs up: Almonty, MP Materials, Rheinmetall

The rush for shares in defense and strategic metals drove prices in 2025. However, the market also gave premature praise. In the case of companies such as MP Materials and Rheinmetall in particular, the market has already anticipated many future revenues. Tungsten producer Almonty Industries is also one of the stock market winners of the year. However, the difference between Almonty and other stocks in the critical metals sector that have risen sharply is that Almonty will also be making a significant operational impact in 2025. The Sangdong mine in South Korea is considered a groundbreaking project for the supply of critical raw materials. The last time a mine of this size went into production was in the 1970s. What opportunities does this mega-project offer investors?

ReadCommented by Nico Popp on November 25th, 2025 | 07:30 CET

Is the next super mine emerging here? Power Metallic Mines, Vale, Rio Tinto

History has shown what happens when resource properties turn into super mines. Many projects developed or acquired by companies such as Vale or Rio Tinto, for example, have been in production for many years and generate enormous returns. The Canadian company Power Metallic Mines, active in the province of Québec, has also been able to continuously expand its NISK project in recent years. Now, the team led by CEO Terry Lynch sees even more potential there. Here, we discuss what gigantic raw material discoveries can mean and why Power Metallic Mines' polymetallic deposit is considered particularly interesting.

ReadCommented by Nico Popp on November 25th, 2025 | 07:15 CET

Crisis investments – Why anything can happen today: AJN Resources, Newmont, B2Gold

Volatility is increasing – and not just on the capital markets. Geopolitically, and even in German domestic politics, which is actually relatively calm by international standards, completely new developments are suddenly conceivable. When the range of possibilities expands so dramatically on many levels, uncertainty grows. Ten years ago, the US withdrawal from NATO would have been a gradual process, but today, Trump and his ministers are making their intentions abundantly clear. Investors should protect themselves against these new eventualities and consider gold as an investment.

ReadCommented by Nico Popp on November 25th, 2025 | 07:05 CET

Silver better than gold – things can move quickly here: Silver North Resources, First Majestic Silver, Hecla Mining

Investors like it when companies benefit from multiple growth drivers. In the case of stocks from the silver sector, these include growing industrial demand in the wake of electrification and high-tech applications, and the increasing importance of precious metals as an asset class. While gold is considered a classic crisis insurance, investors do not automatically think of silver in this context. Yet silver has also benefited from crises in the past. We show why silver is an interesting investment right now and present three companies from this promising sector.

ReadCommented by Nico Popp on November 24th, 2025 | 07:10 CET

Is the banking crisis returning? LAURION Mineral Exploration, Deutsche Bank, and Barrick Mining

Nervousness is mounting in the US credit market due to asset-backed securities, the Bundesbank warns of the risk of a new banking crisis, and geopolitical tensions persist, especially following the peace plan for Ukraine developed by the US and Russia. Given this multitude of events, one might wonder why market prices remain so high. Yet, the growing popularity of gold already indicates that trouble could be looming in the capital markets. We examine which gold stocks have the most potential right now - but first, a brief look at the banking sector.

ReadCommented by Nico Popp on November 24th, 2025 | 07:00 CET

AI as a growth driver? This small-cap has found its niche! UMT United Mobility Technology, Amazon, SAP

By now, even many of the skeptics are likely to be convinced: AI is a powerful tool that can significantly increase efficiency and productivity. The beauty of AI is that while traditional data processing works precisely, AI can also cope with less exact instructions. This feature ensures that AI agents are taking on more and more tasks that humans did just a few years ago – including "thinking" outside the box. Three examples from different sectors illustrate this development: UMT United Mobility Technology, a niche provider with ambitious plans; Amazon, the market leader and retail giant; and SAP, the specialist for enterprise software. We examine the business models, current figures, and developments from an investor's perspective.

Read