At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories. That it depends thereby less on large names, but on the future potential and whether the market also recognizes these perspectives, was one of its first learnings at the stock exchange.

On these pages, Nico examines current events at listed companies and takes a closer look at companies that are traded under the radar of the market, in addition to well-known securities.

In order to be able to take advantage of speculative opportunities on the stock exchange, Nico not only focuses on a balanced asset allocation of defensive and opportunity-oriented securities, but also on an intact risk management. "In addition to position size and entry in several tranches, investors should also develop a sense of timing and get to know a stock better before investing," says the columnist.

Commented by Nico Popp

Commented by Nico Popp on June 6th, 2025 | 07:05 CEST

Hydrogen enters critical phase – New momentum ahead? thyssenkrupp, Plug Power, First Hydrogen

Developments at Thyssenkrupp, which is soon to be restructured as a holding company, show what lies ahead for German industry – the sale of previously important divisions has long been decided. There are several reasons for the radical restructuring in German industry – the energy transition, competition from China and other countries, and new technologies. Hydrogen, in particular, is considered the key to decarbonizing energy-intensive sectors. Experts at Straits Research estimate that the market for green hydrogen could grow from USD 1 billion in 2021 to a whopping USD 72 billion by 2030. That is 55% growth every year. Given these figures, one thing is clear: the cards in the hydrogen economy are being reshuffled – we explain which stocks stand to benefit.

ReadCommented by Nico Popp on June 5th, 2025 | 16:10 CEST

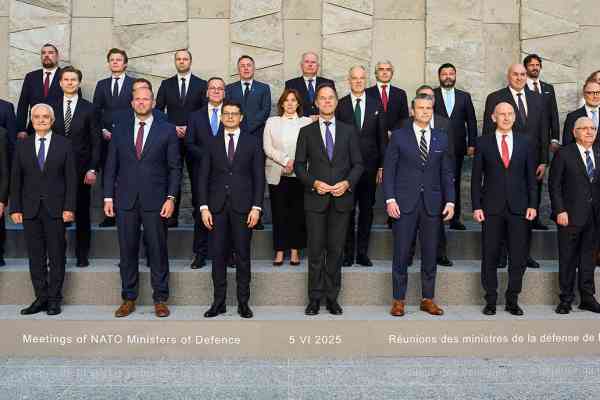

Urgent: NATO approves largest rearmament program since the Cold War - Almonty, Hensoldt, Rheinmetall

The news is a bombshell: In light of an acute threat from Russia, NATO is opening the money floodgates. The most extensive rearmament since 1990 not only provides for a massive increase in conventional military capabilities, but also reveals the dependence of modern armed forces on critical raw materials – especially tungsten. The decision was made during a meeting of NATO defense ministers in Brussels and has far-reaching consequences. For investors, but also for all of us.

ReadCommented by Nico Popp on June 5th, 2025 | 07:00 CEST

These ESG innovations really exist: Bayer, Deere & Company, Argo Living Soils

Sustainability is anything but boring: Companies such as Bayer and Deere & Company are scoring points with technological innovations that are more reminiscent of Elon Musk and SpaceX than specialists in seeds and agricultural machinery. The small Canadian agricultural company Argo Living Soils has even found a solution to completely revolutionize CO2-intensive processes in construction. We present the business models and take a look at the outlook for the three stocks.

ReadCommented by Nico Popp on June 4th, 2025 | 07:10 CEST

Rethinking country risk! BHP Group, Commerzbank, AJN Resources

Commodities are in demand like never before! Gold is trading above the USD 3,000 mark, and the World Bank forecasts that cobalt consumption will rise to 344,000 tons by 2030 - equivalent to annual growth of around 9.6%. Over 70% of cobalt comes from the Democratic Republic of Congo – a country that is repeatedly viewed critically in Western media. But what are the real disadvantages of this location? Which mining jurisdictions are safe? Where are the returns?

ReadCommented by Nico Popp on June 3rd, 2025 | 07:00 CEST

Get more out of your money! Scaling is happening here: Apple, Credissential, and Shopify

For years, banks have controlled how we manage our money. The structures surrounding payment flows and investments are still quite rigid. But the old structures are breaking up and offering new potential - for digitally savvy users and investors alike. We show you what is happening in fintech and e-commerce and how investors can benefit.

ReadCommented by Nico Popp on May 30th, 2025 | 10:15 CEST

Defense boom, tungsten shock, Nasdaq listing: Is Almonty the most exciting stock of 2025?

Many investors dream of getting in on a stock at the right time - just before it takes off. Shares in tungsten producer Almonty Industries have already staged a unique rally this year. The revaluation is, therefore, in full swing. But how much further can the stock go? While analysts at Sphene Capital see further upside potential of 100%, events are unfolding rapidly – at Almonty and around the world. We explain what makes Almonty Industries such an interesting investment story.

ReadCommented by Nico Popp on May 29th, 2025 | 07:30 CEST

"Best-in-Class" – How sustainability generates returns: Rio Tinto, Barrick Gold, and Power Metallic Mines

Large commodity companies such as Rio Tinto and Barrick Gold regularly had to listen to criticism at their annual general meetings: Activist shareholders and investors with a long-term focus called for greater sustainability. And not without reason: In 2020, mining was responsible for 4 to 7% of greenhouse gas emissions. A lot has happened since then. Regulatory requirements and investment principles, such as the "Best-in-Class" approach, reward innovators in the field of sustainability. We explain how ESG can boost returns in mining.

ReadCommented by Nico Popp on May 29th, 2025 | 07:00 CEST

The next AI revolution is being spearheaded by these hidden champions: Palantir, NetraMark, Roche

Are you still working the same way you did five years ago? Let's be honest: AI has changed a lot. The opportunities are enormous, especially in biotechnology. Already in 2024, one in four venture capital dollars for AI projects went to the healthcare sector, according to Silicon Valley Bank. Although around 80% of the industry already works with AI, there is a wide range of applications, with significant differences between experiments and groundbreaking innovations. We present three AI beneficiaries from the healthcare sector and explain how investors can profit.

ReadCommented by Nico Popp on May 28th, 2025 | 06:55 CEST

Smart innovations for strong returns: BioNTech, BioNxt Solutions, and Siemens Healthineers

For a new drug to hit the market, it has to outperform existing alternatives – so innovation is key for biotech companies. In medical technology, too, innovations must first and foremost benefit patients. However, research and development are expensive. We analyze how BioNTech, BioNxt Solutions, and Siemens Healthineers are driving innovation and what that means for investors.

ReadCommented by Nico Popp on May 27th, 2025 | 07:00 CEST

This commodity rule no longer applies: Barrick Gold, BHP Group, Globex Mining

The mining industry is undergoing change: ESG criteria are playing an increasingly important role. Megatrends such as the electrification of mobility and industry are changing global demand for commodities. At the same time, security of supply is becoming more critical due to increasing geopolitical tensions. Today, we take a look at three companies – Barrick Gold, BHP Group and Globex Mining – and explain why investors need to rethink their approach to commodity stocks, as old principles no longer apply in today's market.

Read