For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

He first came into contact with the stock market and shares during his banking apprenticeship. After completing this in 2000, he gained his first journalistic experience in the editorial department of a financial portal. During his subsequent studies in business administration, he also worked in the area of investor relations.

Since then, he has remained true to the capital markets and is excited to report on every newly discovered interesting story - as well as on long-standing success stories.

Commented by Fabian Lorenz

Commented by Fabian Lorenz on October 15th, 2025 | 08:35 CEST

BUYING OPPORTUNITY or Sell? Plug Power, Gerresheimer, AI insider tip NetraMark!

The stock markets are using the tariff dispute between the US and China as a reason for a correction. As a result, AI insider tip NetraMark has lost around 30% of its value in recent weeks. However, there is positive company news, and pressure from the US government on the biotech and pharmaceutical industry should generate additional interest in NetraMark's technology. So, is the correction a buying opportunity? And what about Plug Power? After the spectacular rise in the share price, the first analyst is already sounding a warning. Losses, and thus financing requirements, are likely to remain high. Gerresheimer's price targets are currently tumbling. Unfortunately, however, analysts are only just catching up with the stock's decline. Buy now or even sell?

ReadCommented by Fabian Lorenz on October 14th, 2025 | 07:30 CEST

Alternative to BioNTech, Evotec, and Co.: BioNxt Solutions impresses at investor conference and sparks takeover speculation

While the shares of BioNTech and Evotec are treading water, BioNxt Solutions is on an upward trajectory. The Company is currently shaking up Big Pharma. The announcement to replace the weight-loss injection Ozempic with an oral dissolvable film has sparked takeover speculation. BioNxt also aims to make waves in multiple sclerosis, another multi-billion-dollar market, by significantly simplifying the administration of a blockbuster drug for patients. At last week's IIF investor conference, the management board delivered a convincing presentation. Partnerships and licensing opportunities were outlined - assuming no acquisition occurs beforehand. This could prove highly rewarding for both a pharmaceutical company and shareholders.

ReadCommented by Fabian Lorenz on October 13th, 2025 | 07:30 CEST

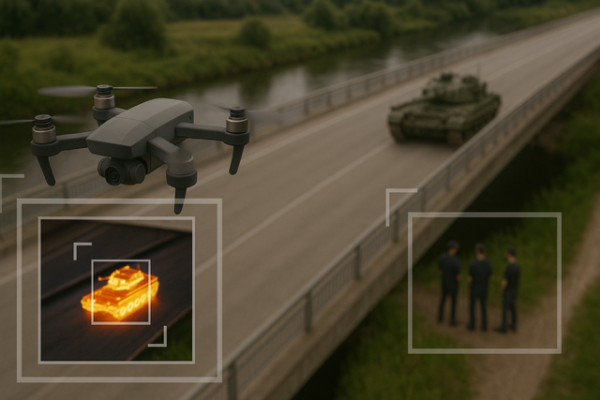

Drone boom and multiplication: Following DroneShield, RENK, and Standard Lithium, NEO Battery Materials shares are taking off!

Missed out on the multiplication of shares such as DroneShield, RENK, and Standard Lithium? Investors can still get in early with NEO Battery Materials. The Company is benefiting from the drone boom and the raw materials conflict between the US and China. NEO Battery Materials has developed advanced battery technology. The first manufacturer of drone batteries has already placed an order. In the future, the Company also plans to offer complete batteries itself. To save time in commercialization, a factory has been leased. This will allow for rapidly increasing sales and profits. The tariff and raw materials conflict between the US and China is likely to give NEO an additional boost. When will the stock take off?

ReadCommented by Fabian Lorenz on October 13th, 2025 | 07:05 CEST

Winners in the tariff war: Almonty Industries, MP Materials, Bayer

Stock market turmoil on Friday: Donald Trump once again threatens to wield the tariff club. This came in response to China's announcement to tighten export controls on rare earths. Yet, there are also winners in the raw materials battle between the two superpowers. In recent months, the US government has invested in companies such as MP Materials, focusing so far on rare earths and lithium. Will tungsten be next? This critical metal has not been mined in the US for a long time, and Almonty would be the logical partner to change that. Notably, while US stocks lost ground, in some cases heavily, on Friday, Almonty shares recovered significantly from their intraday lows.

ReadCommented by Fabian Lorenz on October 10th, 2025 | 07:20 CEST

Bombshell at Plug Power! Things are getting "critical" at Standard Lithium and Graphano Energy! Donald Trump is shaking up commodity stocks!

Investors are currently rushing to buy stocks in the rare earths, tungsten, and lithium sectors. The driving force behind this is the US government, which is investing in companies involved in critical raw materials to secure independence from China. Could Graphano Energy be next in line for government participation? In any case, no battery can function without the critical mineral, graphite. Graphano Energy is attractively valued and holds projects in Canada. Standard Lithium is benefiting from the hype surrounding critical metals. After rising more than 60% in four weeks, has a correction now arrived? Plug Power is in the midst of one. This week, the stock fell by over 20%. A capital measure and the surprising departure of the CEO are causing uncertainty.

ReadCommented by Fabian Lorenz on October 9th, 2025 | 07:20 CEST

GOLD RUSH to USD 5,000? DEFENSE STOCKS set for a billion-dollar contract! Barrick Mining, Hensoldt and Kobo Resources!

While the US government shutdown drags on, the rush for tangible assets persists. The pace at which gold and silver prices are climbing is almost alarming. On the stock market, AI and defense remain key drivers. With surprising ease, the price of gold has broken through the USD 4,000 mark - could USD 5,000 be next? Barrick Mining is also continuing its rally, while those looking for undiscovered gems amid this hype should take a closer look at Kobo Resources. The junior explorer could soon become a potential takeover target. In the defense sector, the capital market is waiting for major orders. One such order could now come from the German government. Hensoldt stands among the likely beneficiaries.

ReadCommented by Fabian Lorenz on October 8th, 2025 | 07:15 CEST

More than 50% upside potential! Zalando, thyssenkrupp, and stock market newcomer Finexity!

What is happening at thyssenkrupp? After the marine division (TKMS) drove the share price up this year with its defense fantasies, the planned IPO now appears to be stalling. Meanwhile, the steel division is once again dominating the headlines. Finexity, on the other hand, has successfully made the leap onto the trading floor. The next step is to attract greater investor attention. Those who get in early could profit, as the Company's growth prospects are excellent. Recently, Finexity announced plans for international expansion, targeting one of the most dynamic real estate markets in the world. In contrast, Zalando is facing strikes. When will the stock react? According to analysts, it might not. Yet they still see up to 50% upside potential.

ReadCommented by Fabian Lorenz on October 8th, 2025 | 07:05 CEST

New opportunities in GOLD and defense! Are Steyr Motors and AJN Resources better than RENK? Profit-taking at First Majestic?

The rally in defense, gold, and silver is underway! Is it time to take profits and take a closer look at latecomers like Steyr Motors and AJN Resources? Steyr is digesting its 200% rally since March and continues to deliver positive news. AJN Resources shares have catch-up potential in the gold sector. In the vicinity of a mega mine, the Company's project shows potential for several million ounces of gold. Exciting results are expected in the coming weeks. And what are the core investments RENK, Barrick Mining, and First Majestic Silver doing? Are gains of up to 380% enough?

ReadCommented by Fabian Lorenz on October 7th, 2025 | 07:25 CEST

NATO shock boosts DroneShield and Volatus Aerospace! Major order and Buy recommendation for Nordex!

The drone pure plays, DroneShield and Volatus Aerospace, have ended their consolidation with price explosions. In just a few days, both stocks rose by more than 50%. Volatus also shines with a follow-up order from NATO. Before the last order was fully delivered, a repeat order was already placed. In addition, a million-dollar order was also secured in the civilian sector. Drone defense is proving challenging in Germany. Why is that? How does DroneShield score? Nordex is also one of the price winners of the year, recently securing a crucial large order. Analysts recommend buying the stock.

ReadCommented by Fabian Lorenz on October 7th, 2025 | 07:10 CEST

SHARE PRICE EXPLOSION at Standard Lithium, European Lithium, MP Materials! These commodity stocks are outshining Barrick Mining!

It does not always have to be gold! Barrick has gained around 80% so far this year. The following commodity stocks are outperforming it significantly. European Lithium's share price has exploded by over 100% since Friday. Initially, a share buyback sparked the euphoria, then came the bombshell: Reuters reported a possible US government investment in Critical Metals. European Lithium holds the majority of the Company, which is focused on the exploration of a massive rare earths project in Greenland. The impact of a US entry was already demonstrated by MP Materials this summer, where Apple is also involved. Standard Lithium has gained an impressive 200% in six months. How far will the boom in critical raw materials drive these stocks?

Read