Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets. In the historic dot.com year 2000, he trained as a CEFA analyst in Frankfurt and has since then accompanied over 20 IPOs in Germany.

Until 2018, he held various positions at banks as an asset manager, capital market and macro expert as well as fundamental equity analyst. He is passionate about the energy, commodity and technology markets as well as the tactical and strategic asset allocation of liquid investment products. As an expert speaker at investment committee meetings of funds as well as at customer events, he can still describe the course of the 1987 crash, one of the major buying opportunities of the last 33 years on the stock market.

Today, he knows that the profit in shares is not necessarily the result of buying cheaply, but above all of avoiding mistakes and recognizing in good time when markets are ready to let air out. After all, in addition to basic fundamental analysis, investing in stocks is above all a phenomenon of global liquidity and this must be monitored regularly.

Commented by André Will-Laudien

Commented by André Will-Laudien on June 8th, 2022 | 13:26 CEST

Split fantasy: Amazon, Aspermont, Alibaba, Tencent - After the sell-off is before the rally!

In bull market movements, shares become more and more expensive. Private small investors simply cannot afford an Amazon share at USD 3,000 and stay away as investors. US technology stocks, therefore, often use a trick: The SPLIT! In the case of Amazon, the investor receives a further 19 shares booked into the securities account in addition to a share held. In purely arithmetical terms, this does not make the Company cheaper, but in purely visual terms, the value is 95% cheaper than before the split. In most cases, the share price rises again very quickly because smaller tranches can now be transacted on the stock exchange again. But it is not always like this. In this context, we are looking at other tech titles with more than 100% potential.

ReadCommented by André Will-Laudien on June 7th, 2022 | 13:23 CEST

Rheinmetall, Thyssen, Defense Metals, Airbus: Fighting the war with these blockbuster shares

The German government has reaffirmed the need for a powerful army and anchored the 100 billion euro special fund in the constitution before the Whitsun recess. The reason why the Basic Law had to be used for this was supposedly due to the budget issue because the red and green members of the government, in particular, do not want the general budget to be diminished by defense spending. Now it is here again, the reversal of the "peace dividend"; for many years, Germany in particular was able to profit from the reduction in defense spending. NATO welcomes the German decisions and now sees Germany as a paying "full partner" again. This also finally puts to rest Trump's demand for Berlin to contribute more to NATO peacekeeping costs. Where are the opportunities for investors now?

ReadCommented by André Will-Laudien on June 2nd, 2022 | 14:36 CEST

Gold comes back: B2Gold, Desert Gold, Barrick Gold - The year of acquisitions!

The ever-increasing inflation is on everyone's lips. A stick of butter, for example, has risen in price from an average of EUR 1.30 in 2020 to now EUR 2.60. A blatant example of 100% inflation within just two years. Typically, prices rise in a market economy when there is more demand than supply. There can be two reasons for this. Either demand increases faster than supply or supply decreases more than demand. This can be the result of production stoppages, for example. Wars or catastrophes are often responsible for this. However, inflation can also set in when central banks excessively increase the money supply, which was the case between 2008 and 2022. In the past, precious metals were always well suited to compensate for losses in purchasing power and moved upwards in line with the money supply. This process could now begin.

ReadCommented by André Will-Laudien on June 1st, 2022 | 12:10 CEST

Plug Power, Siemens, Triumph Gold - These stocks will outperform Tesla!

In times of high inflation and further rising interest rates, good advice is expensive for investors. Looking back at the correction that has already taken place in the stock markets, there could well be a stronger technical recovery at some point, but in our view, this would be more of a Bear market rally in the beginning economic downturn. The pressure comes via the long-term capital market interest rate, which gives investors high losses in bonds, but at the same time, offers new yield opportunities to those who shift out of the stock market. Historically, large interest rate increases are therefore accompanied by stock market losses. Here are three examples of stocks that could still be in demand in the next upward cycle.

ReadCommented by André Will-Laudien on May 31st, 2022 | 12:03 CEST

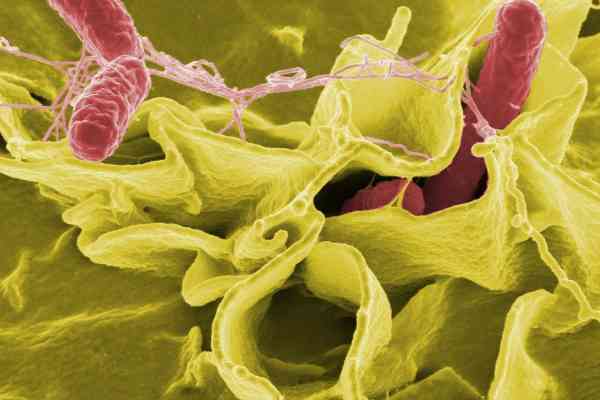

Watch out: BioNTech, NervGen, MorphoSys, Valneva: Biotech shares in check!

The initial sell-off in biotech stocks seems to have been digested. With last week's NASDAQ turn, spring air is now moving through the stock markets again. That is because many investors realize that, in the face of a multitude of new diseases, a major research effort is needed to protect humanity from the burgeoning dangers. Financing via the stock market was correspondingly easy for the biotech giants during the last pandemic because investors sensed big profits in the event of success. This picture is likely to repeat itself in the next movement. Where are the current opportunities in the biopharma sector?

ReadCommented by André Will-Laudien on May 30th, 2022 | 11:57 CEST

Turnaround stocks: Amazon, TUI, Desert Gold, Deutsche Bank - Easily 100% in it!

Fearing Western expropriation, the Russian oligarchs are trying to bring their belongings to safety. Since the beginning of the invasion of Ukraine, they have lost access to their luxury yachts, real estate and other assets with a total value of about EUR 10 billion. A good 2.3 billion of this comes from the EU's securing of the ostentatious ships owned by oligarchs close to the Kremlin. In order to locate the valuable goods for insurance purposes, all vessels over 300 gross tons would have to be equipped with a GPS tracker. These systems are now being uninstalled one after the other, as the owners hope to save their ships undetected in friendly waters. Meanwhile, asset shifts in the capital markets continue briskly, with Bitcoin weak, bonds beginning to stabilize, and stocks testing the first countermovement. Gold is also looking good technically. We go in search of prime turnaround opportunities.

ReadCommented by André Will-Laudien on May 25th, 2022 | 11:46 CEST

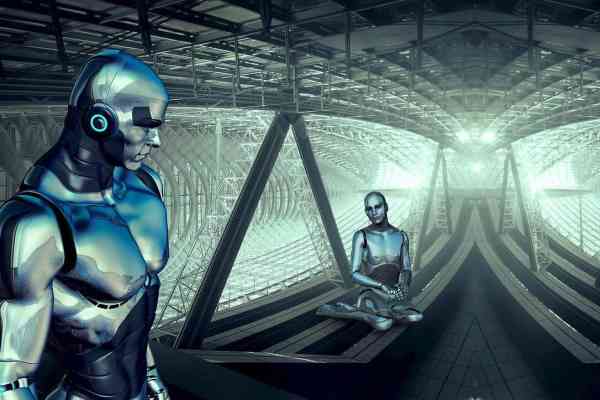

Infineon, BrainChip, Daimler, Volkswagen - High-tech stocks at their best!

The global automotive business is operating according to new laws. That is because e-mobility is a done deal, and if politicians' pronouncements are anything to go by, combustion engines will be history from 2030. As a result, the prerequisites for the industry are also changing because intelligent and powerful chips remain the basis for the further development of future mobility. Supply chains and Chinese reliability are still a problem, and high raw material prices will not make the new vehicles any cheaper. Innovations could be an effective means of combating the erosion of margins. Who is ahead in the market of high-tech players?

ReadCommented by André Will-Laudien on May 23rd, 2022 | 11:42 CEST

Share sell-off: TUI, Barsele Minerals, Nel ASA - Buy or sell these stocks?

The sell-off in equities entered a new round in May. With rising inflation, disrupted supply chains and uncertain energy supplies, the risk for investors is increasing as interest rates are now exploding to unprecedented levels in parallel with the highly volatile environment. The 10-year yields on government bonds in Germany and the USA have moved up from near zero to 1.14% and from 1.5% to 3.12%, respectively. Whenever there was a noticeable rise in interest rates for bonds, things became critical on the stock market. At the moment, this is weighing on technology stocks in particular. The DAX and S&P have already lost 20% in the current correction phase. After initial losses, gold is now accelerating. Where are the opportunities for investors?

ReadCommented by André Will-Laudien on May 20th, 2022 | 10:31 CEST

Energy shares: Plug Power, Saturn Oil + Gas, Nordex, Siemens Energy: The race for our future

With a view to the future energy supply, big question marks remain, especially in Europe. Dependence on Russia remains a permanent topic in government debates. Commission President Ursula von der Leyen presented a plan to break away from fossil fuels from Russia and accelerate the energy transition. In order to become self-sufficient, the European Union will have to invest nearly EUR 300 billion by 2030, according to the EU Commission. Investors are currently focusing very strongly on this future topic. Which stocks hold the greatest opportunities?

ReadCommented by André Will-Laudien on May 18th, 2022 | 12:48 CEST

Biotech stocks: BioNTech, XPhyto Therapeutics, Novavax, Valneva - Crashing, the choice remains difficult!

For pure play vaccine companies, the environment is getting tougher. On the one hand, the winter is over, and on the other, Corona has lost its horrors, especially as the Omicron variant presented like a cold for most infected people. 77.6% of the German population have received at least one vaccination dose so far. 63.1 million people have thus already received basic immunization, and 49.5 million people went for another shot. Only 4.6 million people, or 5.5%, have already received a second booster vaccination. 18.6 million people have not been vaccinated, or 22.4% of the population. With currently only 4,000 vaccinations per day, the many millions of vaccine doses ordered are likely to remain on the shelf. For vaccine manufacturers, future orders will plummet. Which Company has a plan B in place?

Read