Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets. In the historic dot.com year 2000, he trained as a CEFA analyst in Frankfurt and has since then accompanied over 20 IPOs in Germany.

Until 2018, he held various positions at banks as an asset manager, capital market and macro expert as well as fundamental equity analyst. He is passionate about the energy, commodity and technology markets as well as the tactical and strategic asset allocation of liquid investment products. As an expert speaker at investment committee meetings of funds as well as at customer events, he can still describe the course of the 1987 crash, one of the major buying opportunities of the last 33 years on the stock market.

Today, he knows that the profit in shares is not necessarily the result of buying cheaply, but above all of avoiding mistakes and recognizing in good time when markets are ready to let air out. After all, in addition to basic fundamental analysis, investing in stocks is above all a phenomenon of global liquidity and this must be monitored regularly.

Commented by André Will-Laudien

Commented by André Will-Laudien on May 10th, 2022 | 11:54 CEST

GreenTech stocks are on the rise! Buy now: BASF, Meta Materials, Nordex, Siemens Energy

The distortions on the capital markets can hardly be topped at the moment. The nickel price has risen by 300%, only to drop by 70% again. And all this in only 48 hours. There are countless examples in the current stock market environment that are historically unparalleled. In just 2 months, the Bund Future fell from 178 to 151, a loss of 16% in the 10-year Bund. In parallel, the capital market interest rate rose from minus 0.45% to a whopping plus 1.15%. So interest rates are back, inflation is spreading, and supply deficits continue to fuel the underlying stagflation scenario! One major trend should bounce back after the end of the many corrections: GreenTech! Here is a selection of interesting stocks.

ReadCommented by André Will-Laudien on May 4th, 2022 | 11:26 CEST

Pay attention to financial stocks: PayPal, MAS Gold, Deutsche Bank, Commerzbank - inflation, real interest rate and precious metals!

It is going to be a lot of work! The Ukraine war is leaving its ugly mark on the humanitarian and material aspects. A lot of money is needed for reconstruction and the return of the many refugees. Since debt levels are high, interest rates will likely continue to rise to meet the growing need for capital. In addition, there is a shortage of fossil raw materials, and there is a threat of supply shortages. In order to avert a default, Russia has settled USD 650 million in interest on various foreign securities, as expected. Can financial chaos still be averted? Who will pay for the war damage? Financial stocks and gold come into focus during large debt movements. Where are the opportunities for investors?

ReadCommented by André Will-Laudien on May 3rd, 2022 | 12:11 CEST

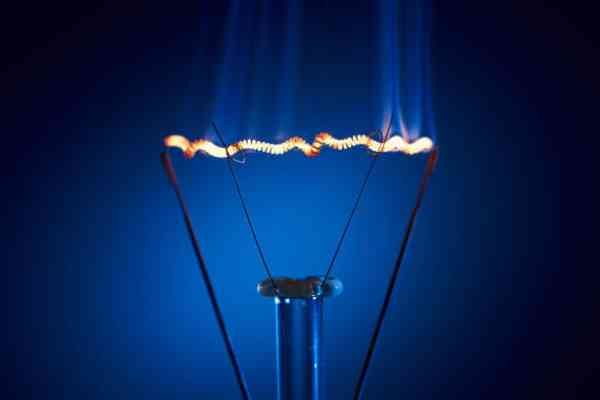

The energy madness: NEL, dynaCERT, Plug Power, FuelCell Energy - Hydrogen shares and the next price explosion?

If not now, when? Never before have there been so many arguments for new technologies that improve energy generation and distribution. After years of globalization, local connections are becoming important again in the current dislocation of international relationships, as the world has truly come apart at the seams. Supply relationships, price relations and availability, are under scrutiny. For the GreenTech movement, the current conditions could not be better, with climate protection and new technologies for decarbonized mobility leading the way. We take a look at the protagonists of hydrogen technologies.

ReadCommented by André Will-Laudien on May 2nd, 2022 | 13:27 CEST

BioNTech, Defence Therapeutics, Valneva, MorphoSys - Biotech stocks that will still be fun tomorrow!

One of the most churned areas on the growth stock market is the biotech sector. There was too much disappointment on the drug development side; even in the COVID sector, only a few winners remain. However, the current sell-off could turn out to be an entry opportunity in the medium term because there are more and more people on earth and, fortunately, they are getting older and older; even the Corona pandemic is not likely to change this. There are already 1 billion people worldwide over the age of 60, and forecasts predict that this figure will rise to 2 billion by 2050 - with a total population of more than 9 billion people predicted at that time. Which values have been unjustly neglected, and where are the current opportunities for investors?

ReadCommented by André Will-Laudien on April 29th, 2022 | 12:20 CEST

BASF, Standard Lithium, Almonty Industries, BYD - Industrial shares in focus: Now it matters!

Poland and Bulgaria no longer receive gas from Russia because they cannot pay in hard rubles. Feat: No one has larger stocks of this exotic currency because until now, all energy deliveries could be paid for in foreign currency. The situation has reached a new level of escalation between the Russian government and resource-hungry Central Europe. With further arms deliveries, this political issue will become even more acute. We look at existing dependencies and the dangers for German industrial stocks.

ReadCommented by André Will-Laudien on April 28th, 2022 | 13:32 CEST

Alibaba, Netflix, Meta Platforms, Globex Mining - Find the best turnaround stocks in 2022!

Rising interest rates and inflation - Central banks worldwide now have to tighten the reins to keep demonetization from getting out of hand. Traditionally, technology stocks, which are otherwise in demand, tend to do poorly in such phases because they have higher financing costs. The higher discount rate makes corporate cash values less profitable than in low-interest rate environments. The NASDAQ-100 Index hit its high of 16,767 points in November 2021, just as the 10-year interest rate began to rise. Since then, the technology index has lost about 22%. But some stocks have more than halved in value. We take a closer look at the former high flyers.

ReadCommented by André Will-Laudien on April 27th, 2022 | 12:26 CEST

Barrick Gold, Desert Gold, K+S - Inflation: Is fertilizer the new silver and gold?

Inflation and rising interest rates are an argument in favor of precious metals - that is the opinion of many investors who suspect a loss of monetary value and want to protect themselves against it. But the stock exchanges had other topics on their radar in the last few days. Because due to strongly correcting share prices, there was primarily an urge for liquidity, in part to satisfy margin requirements of the bank. Such times also lead to the realization of price gains in gold and silver. So regardless of the environment, precious metals fall at times. For the long-term investor, this is a clear buying opportunity. We look at which stocks are promising here.

ReadCommented by André Will-Laudien on April 26th, 2022 | 11:12 CEST

Varta, Nordex, Nevada Copper, JinkoSolar: supply chain broken, copper is the new gold!

Global copper inventories and production rates are currently below the level of recent years. This is due to the limited availability of new projects, which can only be put into production slowly and will still consume some investment. In copper recycling, the industry is making progress, but the necessary rates of increase to supply new markets remain too low. Then there are the troubled supply chains, which make it difficult to move larger volumes of raw material at the moment. In the first four months of 2022, copper inventories on commodity futures exchanges were below 2021 levels, and LME inventories in London are likely to fall further because of the demand-pull. The physical copper shortage is not hysteria - it is now a reality on the exchange with spot prices above USD 10,000. Where are the opportunities for investors willing to take risks?

ReadCommented by André Will-Laudien on April 25th, 2022 | 10:48 CEST

Plug Power, First Hydrogen, Daimler Truck, Ballard Power - Revolution of transport: Hydrogen versus oil and gas!

It is hard to find more arguments in favor of hydrogen than right now! The element burns cleanly, it can be produced infinitely from nature and is currently even competitive given the high prices for oil and gas. Now the governments must act and direct their one-sided firing of e-mobility in the direction of hydrogen. Given the raw materials crisis, the year 2022 should be defined as an initial departure into the future. The last climate conference in Glasgow in 2021 has set the course - now, we must not stand still but get out with the budgets. What helps the environment is ultimately also good for the economy. Hydrogen drive is an alternative to ecologically questionable battery production! As an investor, these shares should be kept in mind.

ReadCommented by André Will-Laudien on April 22nd, 2022 | 12:59 CEST

Exploding interest rates: Nordex, Hong Lai Huat, Deutsche Bank, Commerzbank - How to escape inflation?

And once again, lockdown in China. According to the International Monetary Fund (IMF), a prolonged downturn in Asia would leave significant signs of a slowdown in the global economy. The upward trend of the economies is already permanently burdened by disrupted supply chains, exploding supplier prices, and sharply rising interest rates. Actually, this would be the programmed swan song for the stock markets. But far from it: For 4 weeks, the stock markets have been gradually rising, and the DAX is currently even delivering buy signals. Investors are probably speculating on the lush dividend season and an imminent end to the war in Ukraine. Until then, however, the conveyor belts in some industries will stand still for a while. What are the current opportunities and risks?

Read