Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets. In the historic dot.com year 2000, he trained as a CEFA analyst in Frankfurt and has since then accompanied over 20 IPOs in Germany.

Until 2018, he held various positions at banks as an asset manager, capital market and macro expert as well as fundamental equity analyst. He is passionate about the energy, commodity and technology markets as well as the tactical and strategic asset allocation of liquid investment products. As an expert speaker at investment committee meetings of funds as well as at customer events, he can still describe the course of the 1987 crash, one of the major buying opportunities of the last 33 years on the stock market.

Today, he knows that the profit in shares is not necessarily the result of buying cheaply, but above all of avoiding mistakes and recognizing in good time when markets are ready to let air out. After all, in addition to basic fundamental analysis, investing in stocks is above all a phenomenon of global liquidity and this must be monitored regularly.

Commented by André Will-Laudien

Commented by André Will-Laudien on July 4th, 2022 | 12:25 CEST

Attention, turnaround! Lufthansa, TUI, Desert Gold, Deutsche Bank: These stocks are taking off again!

From several perspectives, the ongoing crisis is a mammoth task for asset managers and private investors. First, after the long uptrend and the absolute boom valuation of growth stocks from 2015 to 2022, no one knows when a sufficiently high discount has been reached to re-enter. Some stocks, such as Plug Power, are very forward-looking and dependent on government contracts. Here there have already been sales valuations of a factor of 200. So is a P/S ratio of currently 12 after an almost 80% share price loss cheap or still hopelessly overpriced? We do not know because the ongoing war sets new market parameters daily. The major indices will therefore continue to search for a valuation basis in a very volatile manner. We pick out a few selected opportunities.

ReadCommented by André Will-Laudien on June 30th, 2022 | 13:49 CEST

Biotech blockbusters: BioNTech, XPhyto Therapeutics, Valneva, CureVac - What to expect from these stocks?

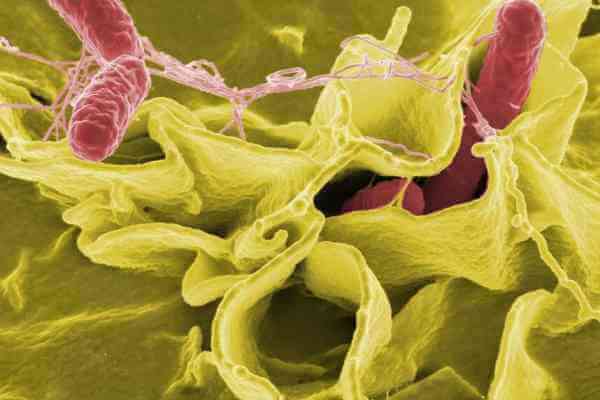

Now that we have arrived in summer, the pandemic is weakening, and the media presence of the flu disease is also declining. That means less attention for pure-play vaccine makers, and now investors are asking how perhaps alternative money can be made. Is the pipeline of the protagonists strong enough to attract further investor capital, or will the whole industry go underground for the time being? We try our hand at being a truffle pig and dig beneath the surface. Which biotech stock has something up its sleeve?

ReadCommented by André Will-Laudien on June 29th, 2022 | 12:10 CEST

The super battery is coming: Varta, Altech Advanced Materials, BYD, VW - Who will supply it?

In times of energy scarcity, storage is essential in addition to generation. Engineering firms worldwide are currently searching for the "super battery." It should contain fewer pollutants, be rechargeable many times, allow for a high capacity and not cause problems during later disposal. We will not be able to reconcile all of these criteria anytime soon, but in the overall process, even incremental steps are having a significant effect as the energy storage sector evolves into the next trillion-dollar market. Here is a selection of companies that are already making a major contribution.

ReadCommented by André Will-Laudien on June 28th, 2022 | 16:10 CEST

Hydrogen once again: Nel, Plug Power, dynaCERT - Shares for the next climate rally

For the GreenTech movement, the current malaise could not be more appropriate. All governments worldwide have felt the dangerous dependence on fossil fuels in their budgets. The approach of winter in the northern hemisphere has power plant planners trembling. Hydrogen, at least as an energy supplier in terms of locomotion, is a tried and tested means of supporting the unbinding of oil & gas over the medium term. However, investments in new H2 technologies are still too low to speak of an alternative to conventional drive systems. We take a look at the protagonists of hydrogen technologies.

ReadCommented by André Will-Laudien on June 27th, 2022 | 11:08 CEST

The solution is here: BASF, Nordex, Barsele Minerals - Energy disaster across Europe

Europe's energy supply cannot be managed from its own resources; many components of the energy mix have been imported for years. However, Germany is one of the leaders in the field of alternative energies. In the first four months of 2022, 174 TWh of electricity was generated here in Germany. The share of renewable energies in electricity generation was a high 52%. With 90 TWh produced, solar, wind & co. are the most important sources. The picture is rather gloomy in the case of fossil primary energy sources, which are important for industry. After the end of hard coal mining in 2019, Germany as an industrial location is 95% dependent on imports of crude oil and natural gas from abroad, 40% of which have so far come from Russia. A disaster from the current perspective. Which shares are worth watching out for now?

ReadCommented by André Will-Laudien on June 24th, 2022 | 11:19 CEST

TUI, Pathfinder Ventures, Lufthansa - The travel market is back - where are the share prices?

The travel market has changed dramatically since 2019 in light of the Corona pandemic. Due to the most extensive pandemic standstill in 2020, the capacities for flights, rail traffic and accommodation were adjusted downwards dramatically. Major cost reductions occurred primarily through de-occupancy and staff reductions. Travel companies cut their basic capacity utilization with partners to such an extent that many smaller operations had to pull out of the race, and large corporations could only survive with extensive state aid. Now, however, the situation has turned 180 degrees and demand for travel is exploding. However, this time it seems difficult to ramp up the reduced capacities in line with demand. We look at the opportunities of three typical industry players.

ReadCommented by André Will-Laudien on June 23rd, 2022 | 14:06 CEST

Deutsche Bank, Commerzbank, wallstreet:online, Allianz - High turnover, wild prices - what are brokers and financial stocks doing?

In addition to the high price increases and the permanently rising interest rates, the highest volatility has now broken out on the stock exchanges. Investors have to adjust to new scenarios almost every day, especially the timing of the news about the state of the international economy is causing more and more headaches for economists. That is because the increased prices of raw materials are now considered standard and put a strain on the purchase prices of intermediate products and the calculation of the Company's own supply list. In some cases, this leads to dramatic adjustments, as impressively demonstrated by the manufacturer price index with +33.6% in May. How are the financial and broker stocks doing in this swing market?

ReadCommented by André Will-Laudien on June 22nd, 2022 | 14:35 CEST

Metal rally: BYD, Almonty Industries, BASF, Nordex - Which shares will be climate change winners?

Germany is bracing itself for a difficult winter. Gas supplies from Russia are dwindling. The reason that Siemens Energy is not getting a move on with urgent maintenance here is more likely to be interpreted politically. If Germany continues to join the international arms deliveries to Ukraine, things will likely get tense in the winter. Minister Habeck is calling on the German people to save energy and wants to offer corresponding rewards, but nuclear power plants are still being left out. It is all a bit confusing, but France is already standing by to compensate for Germany's botched energy policy with high-priced electricity supply contracts. So the citizen will have to pay for the red-green climate policy. Where are the opportunities for investors in this environment?

ReadCommented by André Will-Laudien on June 20th, 2022 | 12:58 CEST

Nel ASA, Nordex, Nevada Copper, Siemens Energy: Energy Crisis 3.0 - Copper is the solution!

The copper market is constantly on the move. Along with Shanghai and New York, the London Metal Exchange (LME) is now one of the world's largest metal trading centers. In Europe, the LME is the benchmark for copper prices and metal trading. In contrast to other exchanges, part of the trading is still done by call and floor trading by brokers in an open ring. The LME copper contract is the second-largest exchange-traded contract on the London Metal Exchange. The demand volume for copper has been at a very high level since 2018, currently even at a 25-year high. Last week, prices came under slight pressure as the specter of recession flew through the trading halls. Where are the biggest opportunities at the moment?

ReadCommented by André Will-Laudien on June 10th, 2022 | 19:43 CEST

Turnaround stocks: BYD, JinkoSolar, MAS Gold, Nordex - Watch out for China & Tesla!

After China's foreign trade initially suffered heavily from the consequences of imposed lockdowns, the country now seems to be recovering. Thus, the current export figures are much higher than expected. However, unstable supply chains and high inflation rates continue to put pressure on international trade. Against the backdrop of a somewhat more stable pandemic situation, however, China's foreign trade grew faster than expected in May. Exports from the second-largest economy rose 16.9% YOY to USD 308.3 billion. Against this backdrop, China stocks are back on the buy list. We take a closer look!

Read