May 28th, 2025 | 07:00 CEST

Volatus Aerospace – A key player in the booming drone market

Global conflicts are currently drawing attention to drone technology, yet its civilian potential is often underestimated. Whether in industry, logistics, or environmental projects, unmanned systems are fundamentally changing work processes. Volatus Aerospace, based in Canada, operates strategically as a dual-use provider, combining commercial and security applications. Following a comprehensive restructuring through 2024, the Company could emerge as a hidden champion in this billion-dollar market - driven by strategic partnerships and regulatory adjustments.

time to read: 4 minutes

|

Author:

Armin Schulz

ISIN:

VOLATUS AEROSPACE INC | CA92865M1023

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

The Company

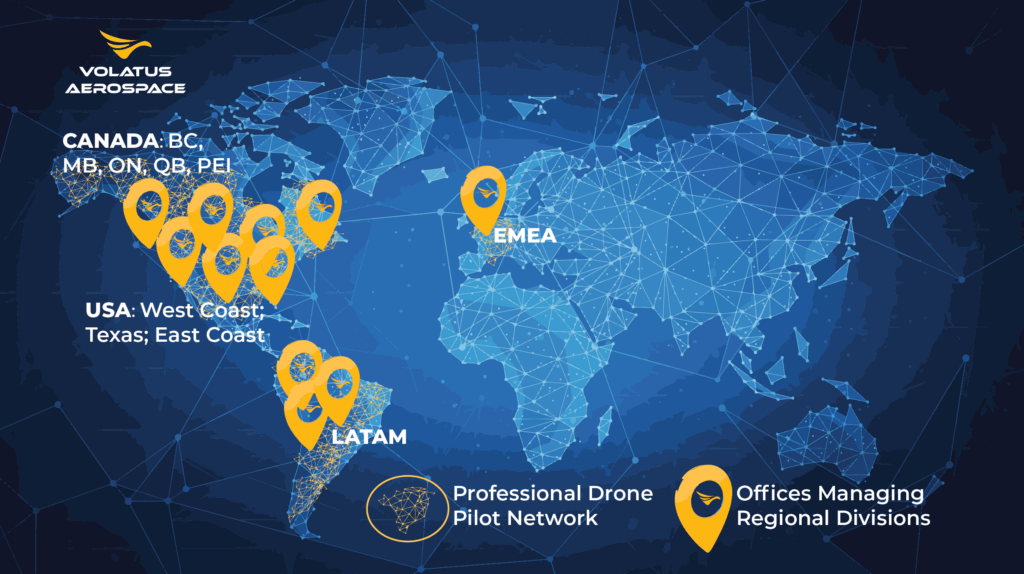

Volatus Aerospace has been developing aviation solutions for businesses, government agencies, and the military since 2018. Its portfolio ranges from personalized drone missions to manned and unmanned aircraft. Real-world applications include energy sector operations, infrastructure monitoring, and the protection of critical facilities. High-precision mapping, autonomous controls, and AI-driven real-time analytics are core technological competencies. The Company also offers certified training programs for skilled workers. The global drone market is currently estimated at USD 1.8 billion, with forecasts predicting dynamic growth through 2030.

Financial consolidation as a springboard

In fiscal year 2024, Volatus underwent a strategic change that resulted in a decline in revenue to CAD 27.1 million, down 22% compared to 2023. Despite this, management succeeded in significantly increasing profitability. The decisive factor was the focus on high-margin services and technology solutions, which accounted for 60 to 70% of revenue. This drove the gross margin from 32% to 35%, while cost synergies of CAD 3.77 million from the merger with Drone Delivery Canada were realized faster than expected. The Company also eased its financial burden through debt-to-equity conversions and an oversubscribed capital raise. Around CAD 8.9 million in debt has already been repaid by the end of 2024, and the Company is on track to profitability.

Regulatory first-mover advantages

Volatus is leveraging Canada's progressive drone legislation as a competitive advantage. The Company recently received Canada-wide approval for night flights in uncontrolled airspace. This is a breakthrough for applications such as border surveillance and early forest fire detection. "The ability to operate drones remotely over long distances at night is a critical step forward in enabling our customers to operate drones 24/7 and access critical nighttime operations across Canada," said Glen Lynch, CEO of Volatus Aerospace. On May 27, the Company announced that Transport Canada had granted it an expanded SFOC certification allowing nationwide BVLOS flights, both day and night, for drones up to 25 kg near infrastructure, as well as operations in controlled airspace and northern Canada. Approvals for heavy drones (>25 kg) open up applications in logistics, rescue operations, and energy infrastructure inspections. The Company is also authorized to operate in wildfire zones to provide fire support. Supplemented by existing approvals - including night BVLOS, medical transport missions, and operations meeting the SAIL-4 safety level - Volatus is consolidating its leading position in the Canadian drone market. The plan is to expand sustainable, efficient services through cutting-edge technology.

The extension of the framework agreement with Public Works and Government Services Canada (PWGSC) until 2026 also secures access to lucrative government contracts. Volatus is the only company to have qualified for all five service areas. These regulatory milestones also serve as a blueprint for global expansion.

Military expansion as a growth driver

In light of rising defense budgets worldwide, Volatus is positioning itself specifically in the defense sector. A successful test run for a G-20 country with two drone systems, including a VTOL fixed-wing drone for contaminated environments, paves the way for potential follow-up orders worth up to USD 8 million. Partnerships with defense companies such as Kongsberg strengthen credibility, while civilian technologies from projects such as pipeline monitoring are being militarized. This dual-use strategy offers cost advantages over pure defense players and opens up opportunities for synergies.

Energy sector: The silent cash machine

Away from the media attention focused on military projects, the oil and gas sector is delivering steady returns. Approval from two industry giants allows drones to be used for inspections, leak detection, and emergency response at the same cost structure. Revenues could climb by 20% in the future. The data collected from over 75,000 flight hours in pipeline monitoring forms the basis for predictive maintenance algorithms, which are marketed as Software-as-a-Service solutions. At the same time, leak and environmental damage detection using multispectral cameras addresses ESG requirements from investors, which increases attractiveness in times of green transition.

Scaling leverage through technology

Toronto's Operations Control Center (OCC) will be at the heart of the expansion. Remote piloting allows a single operator to control up to five missions simultaneously, reducing personnel costs by up to 60%. A total of up to 100 drones can currently be flown simultaneously. Artificial intelligence now evaluates millions of inspection images, unlocking upselling potential through automated damage diagnostics. The Company is preparing for swarm flights in the future as soon as regulatory approvals are granted.

Volatus Aerospace combines regulatory expertise with technological pragmatism. Government framework agreements, military know-how, and industrial data competence create high entry barriers for competitors. The current potential revenue pipeline of approximately CAD 600 million highlights the Company's latent potential. If these opportunities can be converted into stable contracts, the share, currently trading at CAD 0.14, is poised for a revaluation. For long-term investors, the Company could serve as a lever in a key technology of the 2030s. If management implements its scaling plans successfully, Volatus Aerospace may no longer remain an insider tip.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.