May 27th, 2025 | 07:15 CEST

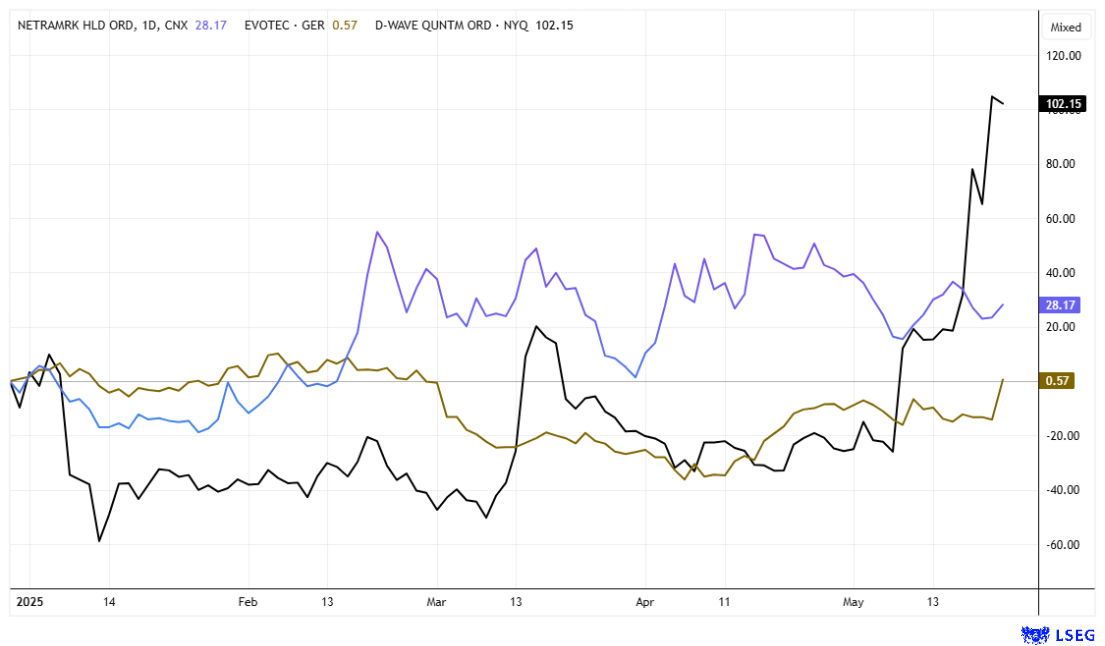

Up to 1500% with high tech and artificial intelligence – Incredible price movements at Evotec, NetraMark Holdings, and D-Wave

Artificial intelligence can now be found in all sectors of the economy. Search processes, validations, and historical comparisons now take place in a matter of seconds, and a dramatic leap in productivity is on the horizon. The capital markets have set themselves the task of evaluating these future processes. This is no easy task, as most topics cannot be viewed in isolation. Last week, renewed tariff threats led to a short-term price correction. These losses had to be offset yesterday, with political denials from the US sending share prices skyrocketing again. Under intense pressure, investors now have to decide whether investments promise short- or medium-term success. We use three examples to show how challenging this has become. Where are the opportunities and risks?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , NETRAMARK HOLDINGS INC | CA64119M1059 , D-WAVE QUANTUM INC | US26740W1099

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec – A pawn in the game

The pharmaceuticals researcher Evotec, based in Hamburg, is an outstanding example of how expectations and fears influence share price movements. With a high short ratio, the share has been burdened ever since the departure of its long-standing CEO, Lanthaler - a stigma that is difficult to shake, even amid improving prospects. Following a successful restructuring process to date, the Company has now provided a more concrete outlook for 2025. In recognition of good data, the share price rose by over 15% last week, reaching its highest level since mid-February. Nevertheless, it was unable to break through the resistance level of EUR 9.

With a market capitalization of only EUR 1.4 billion, the Company is now one of the lightweights in the MDAX; in 2021, the Hamburg-based company was still worth over EUR 7 billion. The new CEO, Christian Wojczewski, recently announced a strategic realignment. According to this, Evotec intends to focus on high-quality services and therapies in the future and cut its project portfolio by 30%. Because the stock is no longer falling, speculators now have a takeover scenario in mind, forcing short sellers to cover their positions. Canadian investment bank RBC also sees light at the end of the tunnel and has given the stock a "Buy" rating with a price target of EUR 11.90, while Warburg has gone one better with EUR 12.10. The lean period seems to be over, so an increased stop price of EUR 7.50 is appropriate for existing holdings. Exciting!

NetraMark Holdings – Growth for the coming years

Last week, the 15th virtual International Investment Forum took place, and AI expert NetraMark Holdings took the opportunity to provide an update to interested investor groups. The Canadian company specializes in analyzing large amounts of data from electronic health records, genome data, and patient registries. Through targeted analysis, it is able to quickly identify analogies and patterns. The largest area of application is supporting the design of clinical trial phases in order to identify suitable participants more quickly and accurately. This enhances the efficiency of the studies and increases the validity of the results.

In April, NetraMark signed a global agreement with Worldwide Clinical Trials, a global full-service contract research organization (CRO). CEO George Achilleos explained the significance of this cooperation in the online conference. With currently 148 leads, he expects a high volume of contracted orders for the coming months. Because NetraMark can onboard a new pharmaceutical partner within just 4 to 6 weeks of processing the data supplied, the Company can move quickly. New customers are usually acquired directly or through such channel partners. The average deal size is approximately USD 175,000, and 5 deals have already been completed. The 3-year cooperation with Worldwide Clinical Trials could, therefore, prove to be extremely positive. This relationship, coupled with 148 leads in the Company's sales pipeline, is expected to generate an order book of CAD 8 to 10 million over the next 12 months.

In parallel with its direct sales activities, the Company is expected to hear back from the FDA in the coming weeks on its application for a "Critical Path Innovation Meeting". The aim is to discuss innovative technologies and their relevance for health and research. The objective is to determine whether new approaches could increase the efficiency of pharmaceutical development. NetraMark's AI platform is participating in this discussion, and a response from the FDA is expected by June 30, 2025.

NetraMark shares (ticker symbol AIAI) are currently trading at around CAD 1.38, bringing the approximately 80.2 million shares to a market value of CAD 111 million. Investors should assume that a positive vote by the FDA for an intended listing on the NASDAQ will likely be successful. NetraMark is bringing completely new approaches to drug development, so the AI story is likely to be just beginning.

For those who want to dive deeper, here is the presentation from May 21, 2025, at the 15th International Investment Forum with CEO George Achilleos.

D-Wave Quantum – Faster, higher, further

The example of D-Wave Quantum demonstrates how quickly promising stocks can rise in value. Just a few months ago, analysts were surprised by the Company's high valuation. With projected revenues of just USD 24 million for 2025, the valuation exploded to over USD 2.5 billion in February. This results in a price-to-sales ratio of more than 100. With current issues coming to the fore, supercomputers are now proving to be a valuable aid in tackling major tasks. Often referred to as the key to the digital future, quantum systems enable lightning-fast calculations that remain unsolvable even for today's most advanced supercomputers. The areas of application are diverse, including defense, space exploration, traffic optimization, and the development of new drugs. The technology is still in its infancy but holds immense potential! D-Wave is already collaborating with top-tier organizations like the Jülich Supercomputing Center in Germany. The sixth generation of the current quantum platform was also unveiled in recent days - with a surprising outcome: D-Wave technology solves real-world problems considerably faster and with less energy than conventional high-performance systems. D-Wave shares have now gained over 1,500% since October 2024. Who still dares to bet against it?

Artificial intelligence is on the rise in all sectors of the economy. Since this involves processing huge amounts of data, stocks related to the high-performance segment remain firmly in the spotlight. Biotech and pharmaceutical companies are increasingly using AI-powered models to drive their clinical trials toward regulatory approval. As a highly specialized service provider, NetraMark Holdings delivers advanced data analysis methods that improve participant selection and enhance the validity of study results. This is a field with excellent growth opportunities!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.