July 16th, 2024 | 07:00 CEST

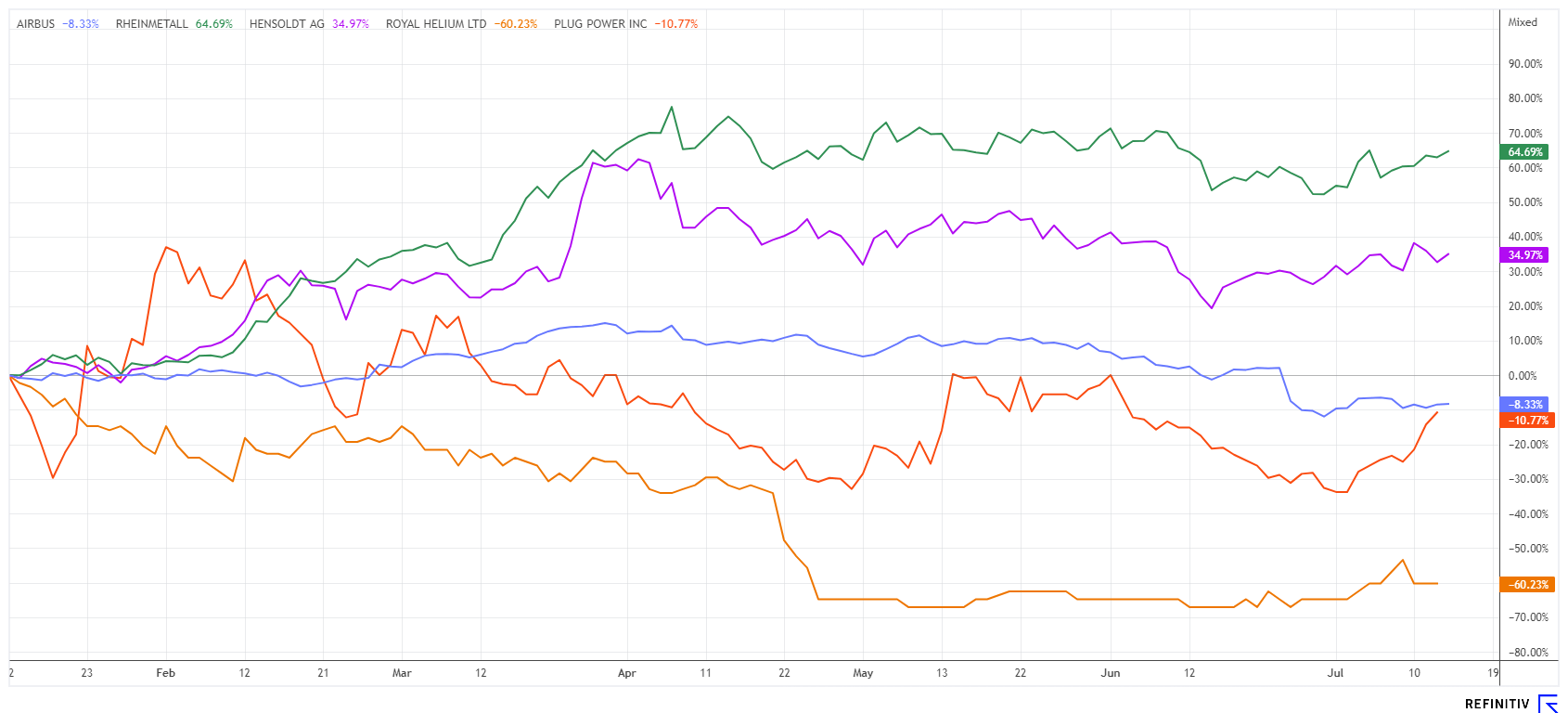

Trump shares: Airbus, Royal Helium, Hensoldt, and Rheinmetall appear systemically relevant, and Plug Power aims high!

The world seems to be coming apart at the seams! While the capital markets are skyrocketing, we find ourselves in the midst of several geopolitical conflicts and a brutalization of social conditions. In Saxony, poster-holders are being beaten up; in the US, presidential candidates are being shot at, and in Ukraine and the Middle East, there seems to be no end in sight to the warfare. No wonder the population's need for security is at an all-time high. This also drives up gold and Bitcoin, as political confidence is waning. Donald Trump may be a flamboyant and over-excited politician, but he is right when he says that the current situation is almost unbearable. He wants to invest a lot of money in security and get "his country" back on track. Strategically relevant shares remain in demand in this context. Here is a current selection!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

AIRBUS | NL0000235190 , ROYAL HELIUM LTD. | CA78029U2056 , HENSOLDT AG INH O.N. | DE000HAG0005 , RHEINMETALL AG | DE0007030009 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] We expect the first three wells to be drilled, cased, completed and tested by the second week of March [...]" Andrew Davidson, CEO, Royal Helium Limited

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Armaments and security - Comparing Rheinmetall and Hensoldt

After an extensive rally in the German defense stocks Rheinmetall and Hensoldt, it is time to reassess the fundamental outlook. In March, both stocks had already reached unimagined price highs of EUR 570 and EUR 44.9, respectively. All in all, this is astonishing because, with valuations of 4 to 5 times sales, the higher valuation already deviates by more than 100% from the long-term average for machinery and high-tech stocks. It is clear that the lavish contracts awarded for the politically promoted Ukrainian military aid and the renewal of European NATO equipment have resulted in considerable increases in turnover and profits of 20 to 40%. However, these companies need to manage this growth effectively.

It should also not be overlooked that Rheinmetall, for example, has increased sixfold since the start of the war, and Hensoldt has quadrupled its market value. The fact that these increases represent a big gulp from the bottle, which the two companies will only be able to fundamentally redeem in 2026 to 2027, opens up a large window for profit-taking in the short term. Moreover, even the slightest disappointment in the quarterly figures carries the risk of an ad hoc loss of 30% or more in the share price. While Hensoldt has already lost 28% from its high, the Rheinmetall share is still sailing at full speed with only a 10% correction from the top. A major sell-off trigger also looms if peace negotiations with Russia are unexpectedly initiated. Then the vote of the traders could be: "Out with armaments!". However, the stocks remain systemically relevant even 30% lower, and their fundamental metrics might then be more convincing!

Royal Helium - A gas with strategic relevance

In addition to high-tech and defense stocks, suppliers of strategic raw materials should also be considered in a security-focused investment structure. They are the focus of Western governments when it comes to securing supply chains in the areas of sensitive technology, high-tech metals, and defense. Technical gases are essential for the production of these goods. Among them is the rare gas helium, which is in high demand as a gas in the production processes of fiber optics, defense, computer technology, and the aerospace industry. It is also used as a coolant in nuclear power. Buyers such as Linde, Airbus, NASA, and SpaceX are on the customer list, but there are only a few suppliers worldwide.

There are larger deposits in the US and Canada, which are now in the pipeline for development. The political goal is to reduce dependency on crisis-ridden countries as quickly as possible. The Canadian company Royal Helium Ltd. is focusing on exploring and developing a major helium production project. The Company controls over 400,000 hectares of prospective land concessions and leases in southern Saskatchewan and southeastern Alberta. In 2024, the Company intends to complete and test existing wells on the Val Marie, Ogema and Steveville properties and the new 40-Mile project in Alberta. In early May, the Company began licensing and permitting the Forty Mile No. 1 helium exploration well in southeastern Alberta. Progress should now be made with the funds from the latest capital increase. Meanwhile, the Company reports the shipment of filled helium trailers 12 and 13 from Steveville. **The Canadians are continuing to ramp up production at the local purification plant in order to soon reach the nominal capacity of 15 million cubic feet of raw gas per day.

CEO Andrew Davidson commented: "We are pleased that the Steveville helium purification plant is running at a steady production rate and that the entire team is advancing the plant into the final stages of capacity expansion under PTT's world-class supervision. The plant is designed to be fully automated and self-powered so that once stable, the operation can quickly become cash flow positive with very low operating costs." After a prolonged consolidation down to USD 0.08, the share price has rallied to over USD 0.12 in the last week. It is possible that the recent sell-off may now be over. We would not be surprised to see the RHC price back above CAD 0.20 by the end of the year. The risk/reward ratio is excellent, but investors should maintain a risk-aware mentality.

Airbus and Plug Power - Keep a close eye on these charts

In March, the Airbus share was still sailing from high to high and reached prices of over EUR 170. With a 2024 P/E ratio of a good 30, however, the share was no longer cheap. When problems with the supply chains were then reported in June, research houses downgraded the share. This lowered the average expected price from over EUR 180 to the current EUR 163. Investors cashed in on an ad hoc basis and knocked the share price down to EUR 128. Now, however, there is good news again: Deliveries rose from 53 to 67 aircraft in June, while 73 new orders were received at the same time. A record total of 770 jets are to be delivered throughout the year. Airbus is currently valued at only EUR 1.5 billion and has a surplus of EUR 4.5 billion; its competitor Boeing will make no profit at all in 2024 and is valued at a similarly high level. This means there is a noticeable valuation gap for Airbus and good catch-up potential for the share price.

We have reported on Plug Power many times recently. With the severe price collapse in May, the chart reached the important zone of USD 2.20 to 2.40 again. The price has already been held here three times, which quickly explains why we are seeing another yo-yo movement. In just two trading weeks, Plug Power has gained a full 25% and is now at the important resistance zone between USD 2.85 and USD 3.15. If it is overcome, traders will reload, and a rapid development to USD 4.50 to 5.00 should follow. However, those hoping for a fundamental improvement, on the other hand, will have to wait until 2027. By then, however, risk-conscious investors will have long since made a 200% profit from the current level of USD 2.85.

Difficult, difficult, difficult. The well-known summer slump following the dividend-rich May did not materialize in 2024. Instead, high-tech stocks, in particular, sparked a new surge. This resulted in new NASDAQ highs and also caused the DAX to rejoice. Given the overall weak economic environment, we find a 25% rise in tech stocks and a 13% improvement in the DAX quite generous. Therefore, do not forget to tighten your safety stops.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.