April 10th, 2025 | 07:00 CEST

The tariff crash à la Trump is on! dynaCERT is causing a stir at the world's largest construction machinery trade fair

Traffic in Munich is currently at a standstill for a week. With the start of the largest trade fair for construction machinery, building material machines, mining machines, construction vehicles, and construction equipment, "bauma" in Munich is taking a future-oriented look at innovations across many sectors of the economy. With over 600,000 square meters of exhibition space and more than 3,500 exhibitors, it offers a platform for cross-border exchange. More than 500,000 visitors are expected. Even though the stock markets are currently correcting, climate change issues remain high on the agenda. Companies that can deliver productive approaches in this area remain the focus of sustainably-minded investors. The Canadian innovator dynaCERT (WKN: A1KBAV | ISIN: CA26780A1084 | TSE: DYA) can deliver significant savings in energy consumption with its combustion optimization via hydrogen and provides its customers with access to the coveted CO2 certificates. The international rollout is already in full swing. Trump's tariff madness and the current stock market correction offer a sustainable opportunity for investors.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

DYNACERT INC. | CA26780A1084

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Germany invests another 100 billion in the climate turnaround

In 2022, Germany created a "special fund" of around EUR 58 billion, which was originally set up to address the consequences of the COVID-19 pandemic but was then reallocated to finance the climate turnaround. The so-called Climate and Transformation Fund (KTF) is now being revived under the new Berlin government with an additional EUR 100 billion increase. It also includes revenues from carbon pricing and emissions trading. The focus is on projects that increase energy efficiency in transportation and climate-friendly building technologies, such as heating systems and thermal insulation. Within the industrial measures, the hydrogen economy, in particular, is being promoted; the aim here is to develop infrastructure solutions that enable medium-term carbon neutrality. The newly created funds support the decarbonization of industry, energy, and transport and, at the same time, promote economic growth through green technologies. In addition to electromobility, hydrogen plays a crucial role in leading the commercial vehicle sector into a low-emission future.

A lot going on behind the scenes

Canada has abundant fossil fuels and a huge arsenal of various critical metals. No wonder innovative companies are settling there and offering investors good investment opportunities. After several years of development, the Canadian technology company dynaCERT, a supplier of hydrogen-based add-on devices for diesel engines in all areas of use, stands out. With the in-house product series under the name HydraGEN™, combustion processes can be optimized to such an extent that, depending on the type of use, fuel savings of between 5 and 15% can be achieved. After a long lead-up, a major milestone was reached in early October 2024 with official certification from the internationally recognized VERRA organization. HydraGEN™ technology is now a recognized process and part of the VERRA organization's range of applications, meaning that users of the technology can generate CO2 certificates from its use. This makes it easier for logistics companies, large fleet operators, and mining companies to comply with existing ESG principles. Public transportation must also reduce carbon emissions to meet governments' "Net Zero" targets. Regulatory pressure is high.

The international rollout is underway

dynaCERT Inc. and Simply Green Distributors Inc. have recently experienced record growth in sales of the patented HydraGEN™ technology in Canada, marking a significant milestone in promoting sustainable energy solutions across multiple industries. In the past two-plus years, Simply Green has received more than 200 HydraGEN™ units from Toronto. These applications are used by customers in the oil and gas industry and agriculture and underscore Simply Green's commitment to a greener future. After an extremely successful pilot project, one of Canada's largest oil and gas drilling companies, based in Alberta, purchased 170 of these HydraGEN™ devices. According to Simply Green, the resource company is determined to further expand the use of this technology. With the appointment of long-time industry professional Bernd Krüper, dynaCERT is moving the development of its international sales organization to Germany. The new COO, Kevin Unrath, is also responsible locally. The German subsidiary, dynaCERT GmbH, is located at Munich Airport. The Bavarian metropolis gives the Canadian company direct access to one of the largest economic areas in Europe and the industrial belt within Germany. With 1,000 pre-produced units, the Company is ready for delivery at the bauma trade fair.

The market is ready

In addition to a successful appearance at the PDAC conference in Toronto, the Canadian government recently increased the Hydrogen Innovation Fund (HIF) by a further CAD 30 million. The Ontario government's announcement of the HIF expansion took place at dynaCERT's headquarters. For over six years, dynaCERT's management and its stakeholders have been meeting with cabinet ministers, elected officials, and senior government representatives to advance and support the implementation of clean technology legislation, as well as grants, loans, tax deferrals, and tax credits.

Mr. Oosterhoff, Deputy Minister of Energy and Intensive Industries, stated, "Ontario-based companies like dynaCERT are leading the way – exporting homegrown hydrogen technologies around the world and driving industrial growth here at home."

The Company's market presence is expected to increase significantly due to the latest measures, and the associated volume growth will enable further business opportunities to be developed. While new model series and innovative industry solutions take up additional months for delivery from when contracts are signed, dynaCERT can deliver on its promises directly on-site. The well-attended industrial fair in Munich is therefore likely to deliver some news of business deals in the coming weeks. For the first time, public transport operators, as well as companies from the mining, energy, and logistics sectors, are meeting dynaCERT experts in person. The revenue potential for the coming months is now clear, as the Company is expected to be able to invoice several orders based on numerous prior discussions and its current presence at the trade fair.

Analysts confirm buying opportunity

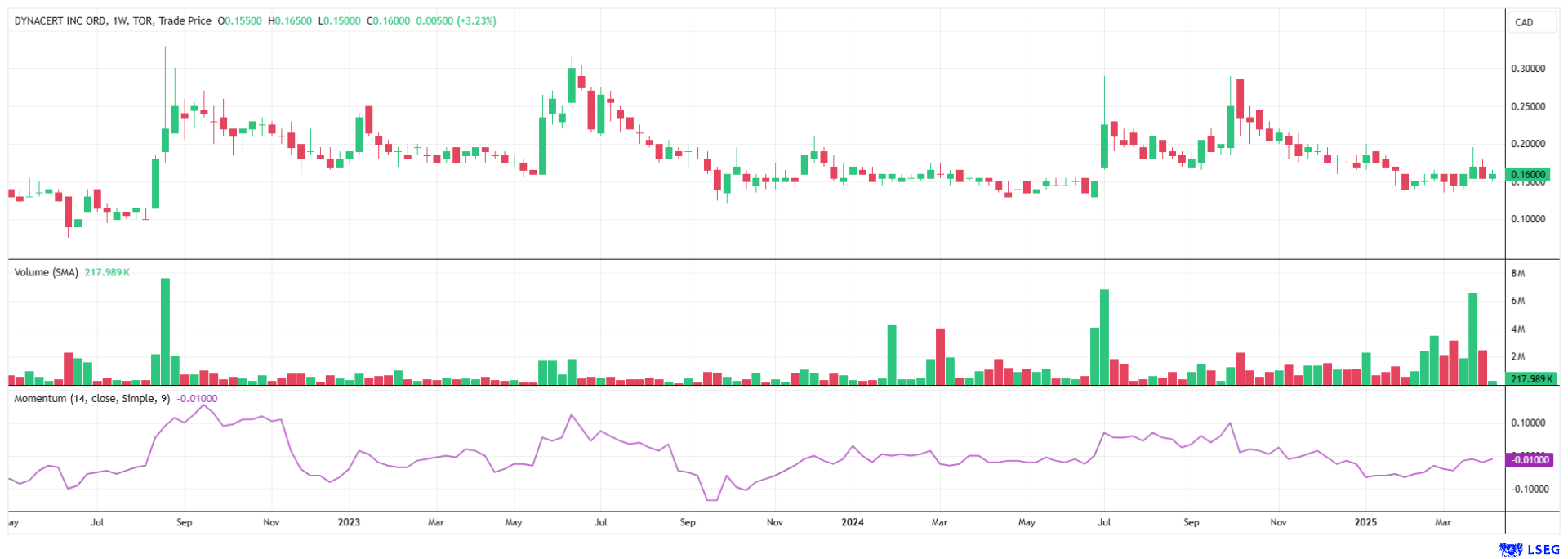

dynaCERT recently raised an additional CAD 5 million at a price of CAD 0.15 per share, so the coffers are well filled. Analysts from the research firm GBC have released their initial study with preliminary revenue estimates, as the increased pace of deliveries has significantly improved visibility for the coming years. The Company will presumably have to increase its production capacities soon. In their initial report, the experts see a dynamization of sales in 2025 and 2026, with total revenues projected at CAD 12 and CAD 21 million, respectively. Based on a DCF model and key market assumptions, the GBC experts rate the stock as a "Buy" with a 12-month target price of CAD 0.75 (approx. EUR 0.48) per share. The DYA share has seen strong momentum and rising trading volumes in recent weeks. The number of shares traded in Germany often exceeds the volume at the home exchange in Canada.

CEO Jim Payne at the HIF press conference at the Company's headquarters in Ontario. Click here for the video

dynaCERT is now poised to take off! Analysts estimate that the medium-term upside potential is around 370%. This projection implies accelerated revenue growth, improved margins, and strategic positioning within the rapidly growing cleantech and hydrogen economy. The stock market crash initiated by Trump offers risk-conscious investors excellent entry points.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.