Digitization

Commented by Armin Schulz on February 5th, 2024 | 07:15 CET

Nvidia, Saturn Oil + Gas, PayPal - Money printing machines for the portfolio

In an economic landscape that is becoming increasingly volatile and unpredictable, the movement of interest rates plays a crucial role for companies and investors alike. In particular, the recent phenomenon of rising interest rates has drastically changed the rules of the game for those seeking capital. The incentive to invest capital in companies without a proven business model or secure cash flows is decreasing noticeably. Instead, companies that generate solid profits are increasingly becoming the focus of investors. Investors are now looking more at profitability than possible future prospects. We have picked out three companies that are making money and are expected to continue to do so in the future.

ReadCommented by Stefan Feulner on January 29th, 2024 | 06:45 CET

The next upward wave is underway - Coinbase, Desert Gold Ventures, Infineon

The opinions of so-called experts vary widely regarding the largest cryptocurrency on the planet. After Bitcoin marked a new interim high of over USD 48,000 at the beginning of the year, disillusionment followed with a correction of 20%. While crash prophets are already predicting the end of decentralized digital currency, for others, such as star manager Cathie Wood, Bitcoin is "one of the most important investments of our lifetime". However, not only cryptocurrencies offer unique opportunities; other asset classes affected by the correction also offer significant potential.

ReadCommented by Juliane Zielonka on January 25th, 2024 | 07:30 CET

BASF, Desert Gold, PayPal: Creating growth and value with the circular economy

BASF and Iveco are planning a partnership for the battery recycling of electric vehicles. This will fill a gaping hole in the economic cycle of e-mobility. Raw materials such as lithium and gold are only available in limited quantities and are increasing in value. The explorer company Desert Gold Ventures stands out in the robust precious metals business with promising gold projects in Africa. The Desert Gold Venture site holds mineral resources of 8.47 million tons, with a gold content of 1.14 g/t, equivalent to 310,300 ounces. Gold is mainly used in the jewellery industry. Digital payments have now established themselves as a currency. In this industry, the new PayPal CEO, Alex Chriss, is leading the technology platform into the next growth phase with a strongly customer-oriented strategy. The upcoming financial results on February 7 could provide new impetus for investors. Three industries, three perspectives - BASF, Desert Gold and PayPal offer different opportunities for investors seeking innovative growth and value preservation.

ReadCommented by Stefan Feulner on November 2nd, 2023 | 07:10 CET

These companies defy the crisis - TeamViewer, Smartbroker Holding AG, JinkoSolar

The past weeks have brought many negative surprises with the publication of the figures for the third quarter. Last week, in addition to Volkswagen, Mercedes Benz and Hypoport also lowered their forecasts. However, there were also companies that performed better than expected by the consensus of analysts despite the difficult conditions. It is precisely here that enormous turnaround opportunities lie due to the consolidation of the past months.

ReadCommented by Juliane Zielonka on August 31st, 2023 | 09:05 CEST

Strategic turning points in Chemicals, Automotive and Energy: Investment opportunities with Defense Metals, Volkswagen and BASF

Rare earths are becoming increasingly important due to digitalization, especially for the electronics industry. Defense Metals, a company from Canada, is focusing on the extraction of rare earths at the Wicheeda project. Geotechnical investigations are progressing rapidly in order to develop the valuable raw material. Volkswagen reports an impressive 17.9% increase in car sales in July. Nevertheless, the Company is lowering its annual sales forecast due to growing competition in China. Germany's energy transition is affecting major corporations like BASF. The US company Cheniere Energy will supply BASF with liquefied gas in the future. To adapt to the new market conditions, BASF has successfully completed the spin-off of its mobile exhaust catalyst and precious metal services businesses. The new site surprises.

ReadCommented by Stefan Feulner on June 22nd, 2023 | 08:20 CEST

PayPal, Star Navigation Systems, Palantir - Fully on course

Since the start of generative AI around Chat GPT, Google Bard & Co at the latest, artificial intelligence has become mainstream. There are many beneficiaries of the hype, above all, the graphics card specialist Nvidia, which exceeded the average expectations of analysts by about 50% with its current sales forecast. The reason for these numbers surpassing the consensus was the Company's "incredible orders" for data center upgrades. In addition to Nvidia, lesser-known companies are also benefiting from the revolution based on information and communication technology.

ReadCommented by Juliane Zielonka on June 15th, 2023 | 07:25 CEST

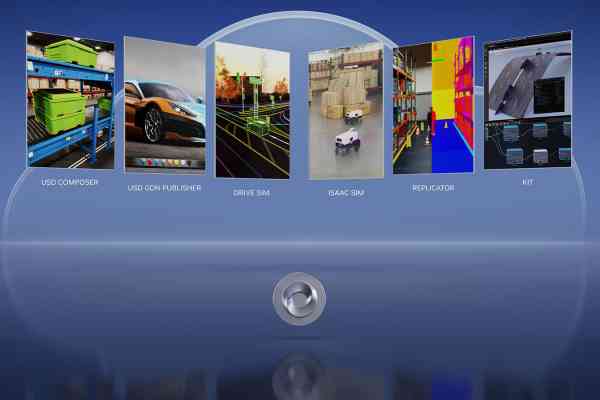

Nvidia, Defense Metals, Uniper - Valuable commodities for trillion-dollar digital market

Digital transformation is critical for industrial companies worldwide to remain competitive and gain strategic advantage. In this context, Nvidia and Hexagon have partnered to provide companies with a comprehensive set of solutions for accelerating industrial digitalization. Defense Metals, on the other hand, secured the supply of essential rare earths for the global energy transition with a successful hydrometallurgical trial and feasibility study. The Wicheeda project in British Columbia strengthens the local energy supply and offers strategic advantages in defence, security and green technology. Uniper, an international energy company, relies on biomass instead of natural gas for energy production. With the construction of a syngas plant in the Netherlands, the Company aims to replace natural gas with sustainable gas in chemical production processes.

ReadCommented by André Will-Laudien on June 1st, 2023 | 09:00 CEST

Heating chaos in Berlin! Palantir, Defense Metals, Borussia Dortmund - Do governments use artificial intelligence like ChatGPT?

Artificial intelligence (AI) is a key driver for the digital transformation of our society. Some technologies have been around for over 50 years but advances in computing power and the availability of big data and new algorithms have led to breakthroughs in AI in recent years. Even if AI is only slowly becoming present in our everyday lives, new applications are likely to bring enormous changes in the future. Decision-making processes, for example, can be strongly supported digitally since today's computers can sift through hundreds of years of knowledge within a few seconds. But does this necessarily mean that the quality of results will also increase?

ReadCommented by Stefan Feulner on May 15th, 2023 | 07:30 CEST

PayPal, Defiance Silver, Palantir - The rebound is firmly in sight

In the dynamic and volatile financial markets, finding investment opportunities that offer above-average returns is a constant challenge for investors. One way to achieve significant outperformance compared to the overall market is to identify promising rebound candidates that have experienced a disproportionate decline in value following weak earnings or other negative events but are likely to stage a comeback due to their business model.

ReadCommented by Juliane Zielonka on May 5th, 2023 | 08:05 CEST

Star Navigation Systems, AMD, Freyr Battery: Where high-tech stocks are shaping the future

This week, there was unrest over the Russian presidential palace in Moscow as two drones reportedly violated the airspace. This makes the monitoring and optimization of airspace even more critical. High-tech companies such as Star Navigation Systems are taking action precisely where Moscow seems to be cutting corners a little too much. Thanks to modern technology, real-time data can be analyzed, and responses can be made accordingly. High-tech also requires the necessary chip and cloud technologies. Investors were thus able to follow AMD's first results this year with excitement. Are they really ahead of their competitor NVIDIA? The latter company finds its use in the new partnership between FREYR Battery and Siemens.

Read