Defense

Commented by Nico Popp on July 31st, 2025 | 07:10 CEST

Following in the footsteps of PayPal and Co.? Deutz and Veganz dare to spark a revolution

PayPal's share price climbed from USD 30 to over USD 260 in just four years – but what fueled the hype between 2016 and 2021? PayPal was perceived as a driver of innovation. Even back then, the market praised its significant market position and potential opportunities, for example, in cryptocurrencies. Just a few days ago, PayPal finally rolled out crypto payments within its platform. However, the market had already anticipated this move years ago. This shows that companies that the market believes will continue to innovate often receive advance praise in the form of sharply rising share prices. In addition to PayPal, we present two other innovation drivers of today that could become the new darlings of the markets.

ReadCommented by Fabian Lorenz on July 31st, 2025 | 07:05 CEST

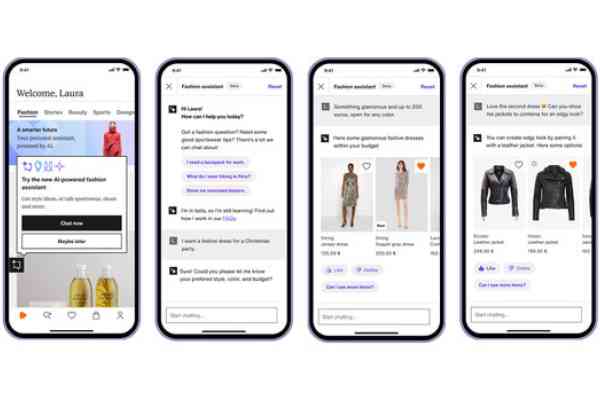

270% surprise! Rheinmetall, Zalando, Walmart partner MiMedia – Time to buy shares?

With a strong performance of 270%, MiMedia shares are one of this year's surprises. And the chances are good that the stock will continue to perform well in the future. With strong partners such as Walmart behind it, the cloud specialist aims to grow significantly in the coming years. Rheinmetall needs to grow massively to justify its ambitious valuation. However, the supercycle in the defense industry promises golden years ahead. The group also wants to carve out a large slice of the billion-dollar pie in other European countries. After a strong start to the year, Zalando shares have slipped considerably. The takeover of competitor AboutYou has now been completed, and analysts see upside potential.

ReadCommented by Fabian Lorenz on July 30th, 2025 | 07:05 CEST

RENK facing takeover? Crash at Novo Nordisk! Buying opportunity in AJN Resources shares!

AJN Resources shares currently offer an exciting opportunity to position yourself for the next rally in the gold price. The Company announced yesterday that it has received approval to explore its property in the vicinity of the largest gold deposit in Ethiopia. The regular news flow expected in the coming months should give AJN shares new momentum. There are currently exciting developments in the European defense industry. Ahead of its IPO, KNDS has further increased its stake in supplier RENK. There were problems with another major shareholder in the run-up to the IPO. Novo Nordisk is currently facing completely different issues. The Danish company has lowered its revenue and profit forecasts, causing its share price to crash. Is now the time to buy?

ReadCommented by Nico Popp on July 29th, 2025 | 07:30 CEST

Drone hype: Who is getting the best deal? Volatus Aerospace, Renault, Rheinmetall

The days of tanks and howitzers are over. The war in Ukraine shows that drones are changing the face of combat—they provide reconnaissance, carry out precision strikes, and score points with low acquisition costs and high effectiveness. It is no wonder that major arms manufacturers and industrial companies want to jump on the drone bandwagon. Renault has even been asked by the French government to enter the business. But the barriers to entry in this market are high. We explain who is likely to profit from the drone business in the future and why size and capital are no guarantee of long-term success.

ReadCommented by Armin Schulz on July 29th, 2025 | 07:10 CEST

RENK, Almonty Industries, thyssenkrupp: Three stocks that are benefiting NOW from the new security dividend

Geopolitical turmoil is accelerating growth in key sectors. As defense budgets rise worldwide and supply chains are realigned, specialized players are positioning themselves as indispensable partners. High demand for security-critical technology, strategic raw materials, and innovative industrial solutions is driving this development, giving selected companies extraordinary momentum. We take a look at RENK, Almonty Industries, and thyssenkrupp to see who is benefiting now.

ReadCommented by Fabian Lorenz on July 29th, 2025 | 07:00 CEST

YIELD MONSTERS 2025: Hensoldt, Steyr Motors, Veganz shares – another 250% gain?

When it comes to German return monsters for 2025, investors rightly think primarily of defense companies like Rheinmetall, RENK, Hensoldt, and Steyr Motors. However, with a 250% gain, the Veganz Group may well be the surprise of the year. The Company is currently reinventing itself and attacking a billion-dollar market. Analyst estimates appear to be far too conservative and are likely to be revised upward soon. The stock, therefore, remains very attractive. Hensoldt has multiplied in value in recent years and is now supplying radar systems for the protection of Ukraine. The order volume is in the mid-three-digit million range. Steyr Motors will have to grow to this revenue range in the coming years to justify its current valuation. Analysts nevertheless recommend buying the stock.

ReadCommented by Stefan Feulner on July 28th, 2025 | 07:10 CEST

Hensoldt, Almonty Industries, MTU Aero Engines – Profit-taking after milestone

The signs of a correction on global stock markets are growing. In addition to the historically high Shiller P/E ratio, call options reached their highest share since the meme stock euphoria of 2021 last week, accounting for almost 70% of total option volume. Market sentiment is extremely bullish, which could indicate an imminent consolidation. One of the most promising commodity companies of the future consolidated last week. Following outstanding news, investors cashed in, which could offer long-term entry opportunities.

ReadCommented by Fabian Lorenz on July 28th, 2025 | 07:05 CEST

Shares with up to 200% Upside! Barrick Mining, RENK, and Dryden Gold

RENK's share price has more than tripled in the current year, and analysts still see further upside. However, expectations for revenue growth and order intake are sky-high, so investors are advised to proceed with caution. According to analysts, Dryden Gold is set to triple in value. The Company is currently developing a high-grade deposit where visible gold can be seen on surface - a promising indicator of future resource potential. Analysts also see a bright future for Barrick Mining. With a gold price of USD 4,000, they estimate the stock could gain 50%—or potentially even more.

ReadCommented by Armin Schulz on July 28th, 2025 | 07:00 CEST

War, raw material shortages, cancer: Capitalize on megatrends with Rheinmetall, Antimony Resources, Merck KGaA

Three megatrends are expected to drive global markets in 2025. Revolutionary technologies, such as AI and cybersecurity, are fundamentally changing the defence sector. At the same time, demand for critical raw materials for defense, high-tech applications, and the energy transition is exploding, requiring new, sustainable supply chains. In parallel, the pharmaceutical industry is undergoing a dramatic shift due to advances in AI-driven research and intensified competition. These forces are shaping the future opportunities for companies. Those who are strategically positioned here will win, as key players Rheinmetall, Antimony Resources, and Merck KGaA demonstrate.

ReadCommented by André Will-Laudien on July 23rd, 2025 | 07:25 CEST

After a 500% increase - is the next rocket stage about to launch? Rheinmetall, Almonty, Hensoldt, and Steyr in focus!

Some investors are reluctant to add stocks that have already performed strongly to their portfolios. In general, this is not good advice, as a sharp rise often has fundamental reasons. For example, the Düsseldorf-based defense company Rheinmetall is expected to increase its business volume roughly fivefold in the coming years. However, its share price has already skyrocketed by a factor of 20 since the start of 2022. The second-tier defense stocks have not been able to make the same leap, but some have managed gains of up to 500%. What happens next? Technical analysts often say: "The trend is your friend." This suggests that after a correction, the sun will soon shine again. In the strategic metals sector, Almonty Industries has recently made strong progress, and the rally could continue significantly regardless of defense investments. We have done the math for you.

Read