Commodities

Commented by Stefan Feulner on August 26th, 2025 | 07:15 CEST

Freeport-McMoRan, Desert Gold Ventures, Rio Tinto – Investing in the future

What happens after Jackson Hole? Following Federal Reserve Chairman Jerome Powell's speech, which boosted the markets with the prospect of possible interest rate cuts later this year, Nvidia's earnings report on Wednesday will take center stage this week. Any disappointment could cause recent gains to vanish into thin air. Meanwhile, the price of gold remains stable and, after a brief sideways movement, could take off to new heights.

ReadCommented by Nico Popp on August 26th, 2025 | 07:00 CEST

Two-tier market for raw materials: BHP Group, Power Metallic Mines, BYD

The term "commodity" refers to a standardized, interchangeable product with no unique characteristics. However, this principle is beginning to falter. On the one hand, production conditions are becoming increasingly important for raw materials; on the other, in an era of conflicting power blocs, tariffs, and other trade barriers, raw materials are far from interchangeable. The further processing of raw materials also gives companies in the sector the opportunity to set themselves apart from the competition and generate unique selling points. Commodity? That was yesterday! We explain the current development using the examples of BHP Group, Power Metallic Mines, and BYD, and highlight the opportunities for investors.

ReadCommented by André Will-Laudien on August 25th, 2025 | 07:00 CEST

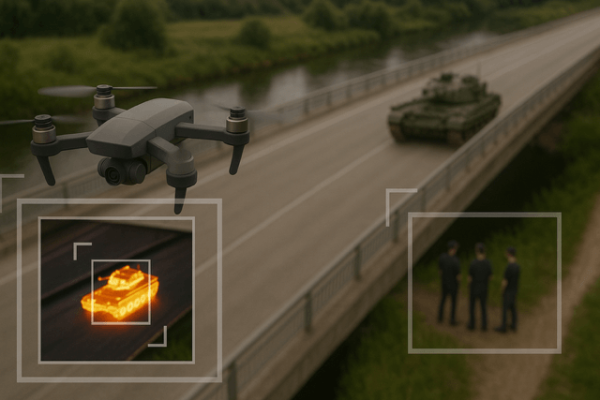

100% with NATO contracts from the air! Airbus, Globex Mining, Boeing, and Lufthansa

The craziness continues! NATO member states have agreed on new planning targets for armaments and capabilities and, according to Secretary General Mark Rutte, have increased the requirements for air and missile defense by about 30%. Rutte stated: "We need more resources, troops, and capabilities to be prepared for any threat." German Chancellor Friedrich Merz emphasised that Germany would provide all the necessary resources to expand the Bundeswehr into the strongest conventional army in Europe. According to experts, large-scale defense projects, particularly in the aerospace sector, will require enormous investments and far-reaching acquisitions. Across Europe, around EUR 300 billion is expected to be invested in air forces by 2030. Investors should now set the course to benefit from the flood of orders in the aerospace sector.

ReadCommented by Fabian Lorenz on August 21st, 2025 | 07:00 CEST

Up to 300% with raw materials and defense! Standard Lithium, DroneShield, and zinc play Pasinex!

DroneShield's stock has plummeted by around 20% in recent days. However, with a performance of over 300% in 2025, the Australian company remains one of the top performers. The drone defense specialist recently reported on its performance in Q2. Revenue is at record levels, and the order book is full. Will that be enough? Pasinex Resources remains in rally mode. The chances of a continuation are high, as important milestones are coming up and the stock remains favorable. Standard Lithium has celebrated a comeback in recent months, recovering from its brutal crash at the turn of the year. What is next?

ReadCommented by Nico Popp on August 19th, 2025 | 07:00 CEST

Ethiopia – The underestimated growth hotspot: WeBuild, Heineken, AJN Resources

Prejudices serve a purpose in the human psyche: they simplify things and help us process information more efficiently. But every now and then, we should take a critical look at our prejudices - especially when it comes to investing in Africa. Experts on the continent have always pointed out that each economy must be viewed on its own merits. Some countries have been making steady progress for years, and only the most astute investors are taking advantage of this. We take a look at Ethiopia and show that instead of suffering and misery, the country is increasingly offering stability and prosperity. It is no coincidence that major corporations like WeBuild, Heineken, and young innovators like AJN Resources are investing in this East African country.

ReadCommented by André Will-Laudien on August 12th, 2025 | 07:25 CEST

Crash in the defense sector? Geopolitical conflicts drive up metal prices! Rheinmetall, Sranan Gold, Hensoldt, and RENK

Strategic metals are a decisive factor in the economic strength and military power of entire nations. International hotspots like the Middle East, Ukraine and, most recently, Africa are exacerbating shortages, as long-established trade routes can collapse abruptly. The high concentration of production in a few countries increases the vulnerability of supply chains to political intervention. Export bans, sanctions or targeted supply restrictions by China or Russia can quickly lead to critical supply shortages. In this environment, precious metals like gold, which is currently trading at historic price levels, are becoming even more important for investors, not least against the backdrop of record-high government debt worldwide. Those who act flexibly can benefit from this commodity dynamic. The long-running favorites of recent months in the defense sector now appear to be consolidating. Where to put the money?

ReadCommented by Stefan Feulner on August 12th, 2025 | 07:00 CEST

Canopy Growth, Silver North Resources, Vonovia – Clear signals

Market volatility continues to rise, yet the US stock markets are still managing to defend their record highs. The price of silver made a comeback last week, closing above the USD 38 mark after several weeks of sideways movement. The ongoing uncertainty in both geopolitical and fiscal policy could help propel the precious metal to reach new highs, which should benefit both producers and exploration companies alike.

ReadCommented by Armin Schulz on August 6th, 2025 | 07:05 CEST

Interest rate poker and commodity chess: Deutsche Bank, Globex Mining, and Rio Tinto in focus

Geopolitical tensions are the new market standard, not the exception. Trade conflicts are escalating globally, tariffs are becoming a chess game over commodities and influence, and military shifts are destabilizing supply chains. At the same time, central banks are hesitating to cut interest rates despite lower inflation, keeping the pressure high. In this turbulent environment, an understanding of macroeconomic forces determines profit or loss. Those who read the signs will find opportunities. Which of these three players—Deutsche Bank, Globex Mining, and Rio Tinto—offers potential?

ReadCommented by André Will-Laudien on August 5th, 2025 | 07:10 CEST

Palantir, Rheinmetall, RENK, and Dryden Gold: Winners in the crossfire of trade war and NATO agenda

Tariffs, defense, and infrastructure! No wonder there is a considerable gap of around EUR 172 billion in the German federal budget between 2027 and 2029. Although the federal government is attempting to counter this with spending cuts, tax increases will ultimately be necessary, as migration and climate costs are also taking their toll. Those in government who now have to juggle everything at once are in for a rough ride! Government revenues are expected to continue to decline due to the sluggish economy and high inflation, meaning the government will face higher refinancing costs due to rising interest rates. For investors, this means that the price of gold is likely to increase further, making selective investments in precious metals a sensible move. We will briefly analyze whether there is still room for growth in the well-performing defense and military stocks.

ReadCommented by Fabian Lorenz on July 31st, 2025 | 07:20 CEST

BYD facing problems! 300% stock Steyr Motors delivers! Green light for Sranan Gold!

Steyr Motors appears to be delivering what shareholders were hoping for. Following the rapid rise in its share price this year, the Austrian company has now reported new orders. This could enable the Company to grow into its ambitious valuation. Gold explorer Sranan Gold is still attractively valued. The important drilling program will start soon. Is this also the starting signal for a rally in the share price? There is currently no talk of a rally at BYD. The Chinese company is facing challenges both in its domestic market and in Europe. In Europe, sales figures are falling short of expectations. Can new personnel and a revamped sales strategy bring about a turnaround?

Read