October 22nd, 2025 | 07:35 CEST

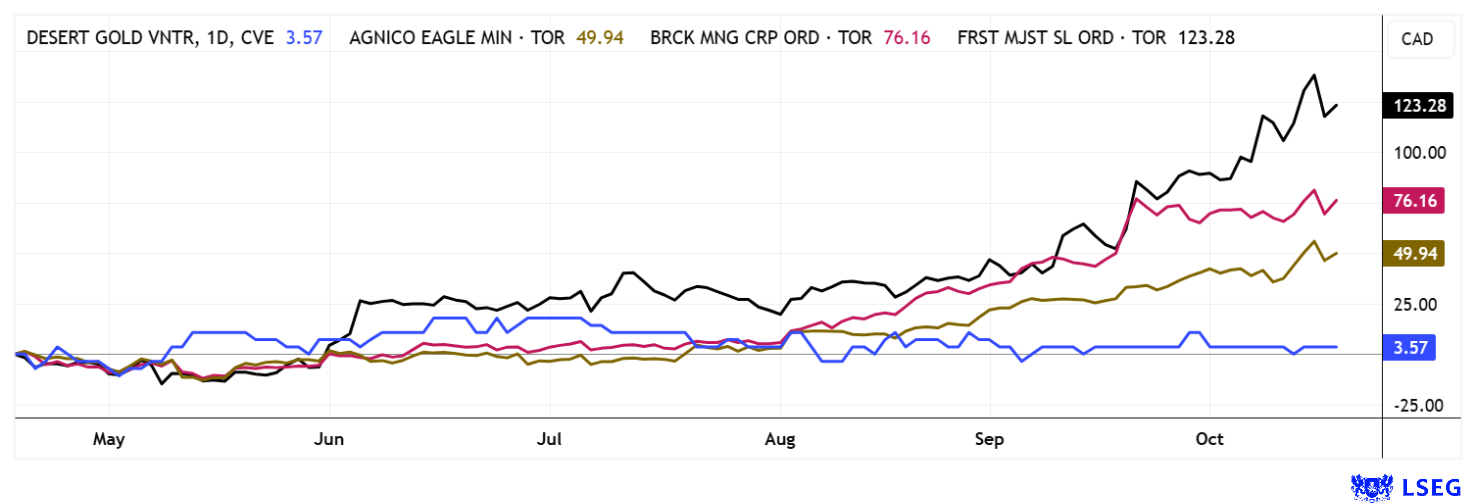

Gold and silver – New record highs! Keep an eye on Barrick, Agnico Eagle, Desert Gold, and First Majestic!

Silver prices broke through the USD 53 mark for the first time at the beginning of the week, and gold is attempting to reach the USD 4,300 mark. Precious metal enthusiasts have been anticipating these moves for a long time, but traders on the futures exchanges clearly have not. In addition to extreme physical scarcity, the exploding prices are also attributed to heavy short squeezes. The physical silver market is under tremendous pressure as the availability of real metal to hedge the numerous futures transactions is severely limited. This imbalance is causing erratic market reactions and driving the spot price into an almost exponential sell-off. The current rally in precious metals is driven by geopolitical uncertainty, industrial demand factors, and the search for safe investments. In times of excessive government debt, the weakness of the US dollar is now also weighing on the market. Which companies should investors keep a close eye on now?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BARRICK MINING CORPORATION | CA06849F1080 , AGNICO EAGLE MINES LTD. | CA0084741085 , DESERT GOLD VENTURES | CA25039N4084 , FIRST MAJESTIC SILVER | CA32076V1031

Table of contents:

"[...] Both the geology and the infrastructure around the project make for a very attractive cost structure. We expect to be able to produce at 50% of the current gold price. [...]" Bill Guy, Chairman, Theta Gold Mines Limited

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Barrick Mining and Agnico Eagle – Different perspectives

West Africa is facing new momentum! After months of stagnation, Barrick's key project in Mali is back on track. The gold giant has reported significant progress in the resumption of operations at its Loulo underground mine, which is set to gradually return to regular operation from mid-October after four months under court supervision. Until now, work has been limited to ore that has already been mined, but explosives are now permitted again for the first time to extract new mineral deposits. The delay was partly due to unfounded claims in connection with the new Malian mining law, which provides for higher taxes and greater state participation. Barrick holds an 80% stake in the Loulo-Gounkoto mine, making it one of the country's most important international partners - arguably, the Company deserves more respect. With the restart of production, output is likely to increase significantly in the coming weeks, even though open-pit mining will only resume once outstanding claims have been settled. Barrick Mining is well-positioned globally, thanks to its diversified mine locations, and is benefiting from higher gold prices. The share is currently trading at EUR 27.5, up more than 45% since the beginning of the year, but with yesterday's correction, it now has a P/E ratio of only 12.7. There will be news on November 10, when the outlook is also likely to be clarified. Things will get exciting from 2027 onwards, when one of the largest new gold-copper mines, "Reko Diq," is expected to begin production in Pakistan.

Unlike Barrick, Agnico Eagle Mines is very focused on gold production, with an emphasis on stable, well-developed regions such as Canada, Finland, and Mexico. Agnico Eagle tends to own smaller but high-grade mines that are designed for sustainability and longevity. The Company has earned a reputation for conservative management and a strong balance sheet, with a focus on long-term shareholder value creation through controlled expansion and financial stability. Management is more focused on technological innovation and environmentally friendly mining practices to increase efficiency and sustainability. Agnico Eagle produced significantly less than Barrick in Q2, at just under 874,000 ounces of gold, but impressed with low costs of USD 903 per ounce (AISC) and strong margin development. With a dividend yield of over 3% and net cash reserves of over USD 1.1 billion, Agnico has a solid balance sheet and sustainable growth. Agnico will report on the third quarter on October 29. In the long term, both stocks are well-suited as a basis for a diversified commodity portfolio.

Desert Gold – Relaxation in Mali, progress in Côte d'Ivoire

Desert Gold Ventures has properties in Mali and is benefiting from the military government's new willingness to negotiate. The SMSZ gold project has taken a significant step forward in recent weeks. The initial economic analysis indicates that efficient open-pit mining could produce around 5,500 ounces of gold per year from 2026 onwards. Based on conservative assumptions, gross cash flows of over USD 5 million are expected. At a gold price of USD 2,500 per ounce, the study indicates a net present value of approximately USD 24 million and an internal rate of return of 34%. If the current gold price of over USD 3,600 were to be reflected in the calculation, a value of over USD 54 million and a return of over 65% would even be possible. The modular structure of the project, with a mobile processing plant, allows for flexible use between the two targeted deposits, Barani and Gourbassi. Discussions with international investors regarding project financing are currently in full swing. In addition, Desert Gold has significantly expanded its activities in West Africa through the acquisition of the Tiegba Gold project in Côte d'Ivoire. This 297-square-kilometer area is located in a productive gold belt, close to major producers such as Barrick and Endeavour Mining. Initial surface samples of up to 900 ppb gold over several kilometers indicate promising exploration potential.

CEO Jared Scharf emphasizes that the Company has great confidence in the project's discovery potential. The Tiegba property is located in an area with favorable geological structures that are similar to the well-known Bonikro-Agbaou mining complex. After completion of the initial exploration phase, a reverse circulation drilling program will follow to test the most promising zones at depth. If successful, Desert Gold could quickly transition from an explorer to a producing company in West Africa. With a market capitalization of approximately CAD 20 million, many analysts believe the stock offers significant upside potential. The current correction in the gold-silver sector could provide dream entry prices for promising West African projects at around CAD 0.07!

There is a fresh update from GBC analyst Matthias Greiffenberger in an interview with Lyndsay Malchuk: https://youtu.be/d_4b3IGKwf0

First Majestic Silver – At the top with a 100% gain

First, the USD 50 silver mark, familiar from the great Hunt market manipulation of the 1980s, was broken, and yesterday it was again significantly underpriced at USD 47.8. Prices recently skyrocketed as supply and demand continued to diverge. Industrial customers, private investors, and ETFs are vying for a metal whose physical availability is shrinking worldwide. Those who want to profit from the rising price of silver can hardly ignore profitable producers. First Majestic Silver took a strategically important step toward expansion with the acquisition of Gatos Silver in January 2025, securing a 70% stake in the high-margin Cerro Los Gatos complex. This expands the group's already robust production base, which continues to be supported by San Dimas, Santa Elena, and La Encantada in Mexico.

First Majestic expects production of between 14.8 and 15.8 million ounces of silver in 2025, putting another record year within reach. In Q2 2025, the Company already recorded a 48% increase in production to 7.9 million ounces of silver equivalent. The focus is now on optimizing mine yield and reducing costs, with the sustainable mining price margin set to fall further thanks to productivity gains. Around USD 170 million will be invested this year in exploration, plant modernization, and development to secure sustainable growth. Although the share price has already risen by over 100% in the last 12 months, the fundamentals justify further positioning. The 12-month price expectation on the LSEG platform is CAD 21.11, with the share price most recently correcting to CAD 17.85. Promising opportunities for silver long investors!

Due to ongoing volatility and geopolitical tensions, financial markets are showing growing interest in stocks from the commodities and precious metals sector. Major producers such as Barrick Gold and Agnico Eagle Mines are benefiting from their stable production base, strong balance sheets, and a clear focus on cost efficiency. First Majestic Silver is also becoming increasingly attractive due to its high leverage on the silver price and the successful optimization of its production sites. Against this backdrop, Canadian explorer Desert Gold Ventures is coming into focus. Despite a low market capitalization of only CAD 20 million, the Company has promising gold deposits in West Africa, which the stock market has so far failed to recognize. That could change dramatically!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.