April 12th, 2023 | 10:23 CEST

Stocks in rally mode - Shop Apotheke, Tocvan Ventures, MicroStrategy

Despite the uncertainties concerning geopolitics and the continuing danger of a recession, the stock markets continue to run smoothly. Germany's leading index, the DAX, is close to a new high for the year at 15,650 points and is chasing the historic high of 16,299.50 points. Bitcoin, at over USD 30,000, and gold, at over USD 2,000 per ounce, have also cleared important hurdles. The signs are pointing to a rally in several asset classes.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

SHOP APOTHEKE EUROPE INH. | NL0012044747 , TOCVAN VENTURES C | CA88900N1050 , MICROSTRATEG.A NEW DL-001 | US5949724083

Table of contents:

"[...] We have a clear strategy for neutralizing sovereign risk in Papua New Guinea. [...]" Matthew Salthouse, CEO, Kainantu Resources

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

MicroStrategy - Buy, buy

Based in Vienna, Virginia, in the USA, the Company originally started in 1989 as a provider of analytics software and services for businesses. MicroStrategy's platform supports interactive dashboards, scorecards, comprehensively formatted reports, ad hoc queries, thresholds and alerts, and automated report distribution.

Since the beginning of the decade, MicroStrategy, led by founder and then-CEO Michael Saylor, has made a name for itself as the world's biggest Bitcoin Hodler. Despite the sharp decline of the largest cryptocurrency last year, the former company boss and current board of directors chairman affirmed that he would hold Bitcoin for the long term and gradually increase its value. Saylor kept his word. With the most recent acquisition on 4 April of another 1,045 Bitcoin, MicroStrategy has increased its holdings to 140,000, more than any other company globally. The equivalent value of the holdings is around USD 4 billion. In comparison, the Americans have a market capitalization of USD 3.61 billion, including the enterprise software business.

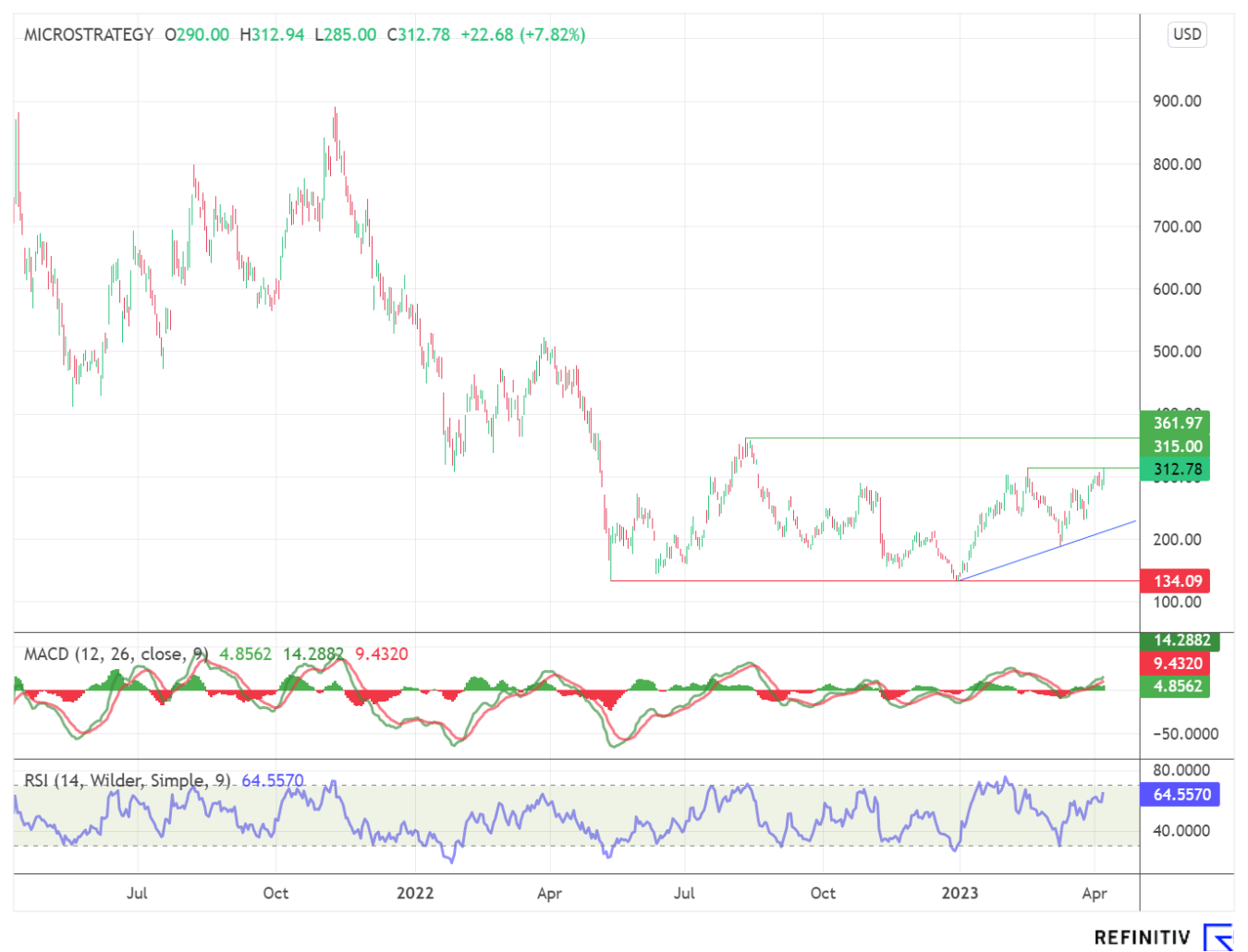

But this is not the only reason why MicroStrategy's stock could boom. With the crossing of the psychologically important USD 30,000 mark, bitcoin has further upside potential. MicroStrategy's share price crossed a prominent resistance at USD 315. Thereafter, there is follow-up potential at least to the area of USD 355.00.

Tocvan Ventures - Better than expected

Analysts agree that the precious metals gold and silver are about to rise to new highs despite the correction of the past 2 years. The US investment bank Goldman Sachs, for example, sees a 12-month price target of USD 2,050 per ounce. Gold is the best hedge against financial risks and has already benefited from the search for a safe haven in the environment of the Credit Suisse emergency takeover. However, the US investment bank does not expect a breakout above the USD 2,100 mark until the Fed lowers interest rates again, which in our opinion, does not seem unlikely due to the ongoing recessionary environment.

Exploration companies such as Tocvan Ventures, which has a market capitalization of CAD 27.90 million, benefit from the long-term rise in gold and silver prices. The focus of its development activities is in Sonora in Mexico, the place with the largest silver production in the world; in addition, about 40% of Mexico's gold is mined there. The Canadians have the Pilar and El Picacho gold-silver projects, which are located in the vicinity of producing mines and are thus equipped with first-class infrastructure.

At the Pilar property, Tocvan Ventures recently reported some of the best drill results in the region, moving closer to producer status. Pilar is interpreted to be a structurally controlled epithermal system with low sulphidation in andesite rocks. Three zones of mineralization have been discovered, with the Main Zone and "4-T" Zone trends open and new parallel zones explored. The mineralization extends along a 1.2 km trend, with only half having been tested by drilling of 23,000 m to date.

The value of the Pilar project was also demonstrated in the recently released diagnostic precious metal leach study. Five composite samples were taken. These showed a high percentage of recoverable gold of 95 to 99% and recoverable silver of 73 to 97%. In addition, the ore samples contain from 2.7 to 24.9 high-grade gold and 8.8 to 74.2 g/t silver. Gravity concentrate grades range from 35.6 to 290.3 g/t for gold and 53 to 1,152 g/t for silver. Most of this can be recovered by gravity enrichment techniques and cyanide leaching with constant agitation. Another positive aspect is that the drill core sample shows the same recovery potential at 150 m depth as at surface.

In this regard, the results far exceeded management's projections. "Having such a large percentage of the gold and silver exposed and accessible to multiple recovery methods allows us to evaluate the most efficient methods of developing the project. That is a big plus for the project and exactly what the major producers want to see, as it is a great indicator to the industry that Pilar can be developed. We look forward to further evaluating the bulk sample data in the coming months," said Tocvan Ventures CEO Brodie Sutherland.

Shop Apotheke - Successful first quarter

The chart picture of Shop Apotheke Europe NV, a company based in the Netherlands that sells pharmaceutical products online and focuses on over-the-counter medicines and pharmacy-related beauty and body care products, is also positive. Shop Apotheke is represented in Belgium, Spain, Italy, France, Austria, the Netherlands and Germany. Since the beginning of the year, the share has performed over 100% and is currently trading at EUR 85.66.

Following the announcement of the figures for the first quarter, the consensus of analysts believes that the online sales company has further upside potential. Warburg Research, for example, has raised its price target for Shop Apotheke from EUR 108 to EUR 114 and left its rating at "buy". The growth of the online pharmacy exceeded expectations in the first quarter, wrote analyst Michael Heider. The specialists at AlsterResearch also see an upside of up to EUR 100. The Company had a good start to the new financial year. In the first quarter of 2023, the highest sales growth since Covid was achieved. According to preliminary figures, sales in Q1 grew by around 22% YOY to EUR 371 million, exceeding analysts' estimates of EUR 344 million.

Equities, cryptos and gold are all still on an upward trend. MicroStrategy is on the verge of a breakout. Analysts see much higher price targets for Shop Apotheke. Tocvan Ventures far exceeded forecasts in its latest results.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.