February 4th, 2026 | 07:10 CET

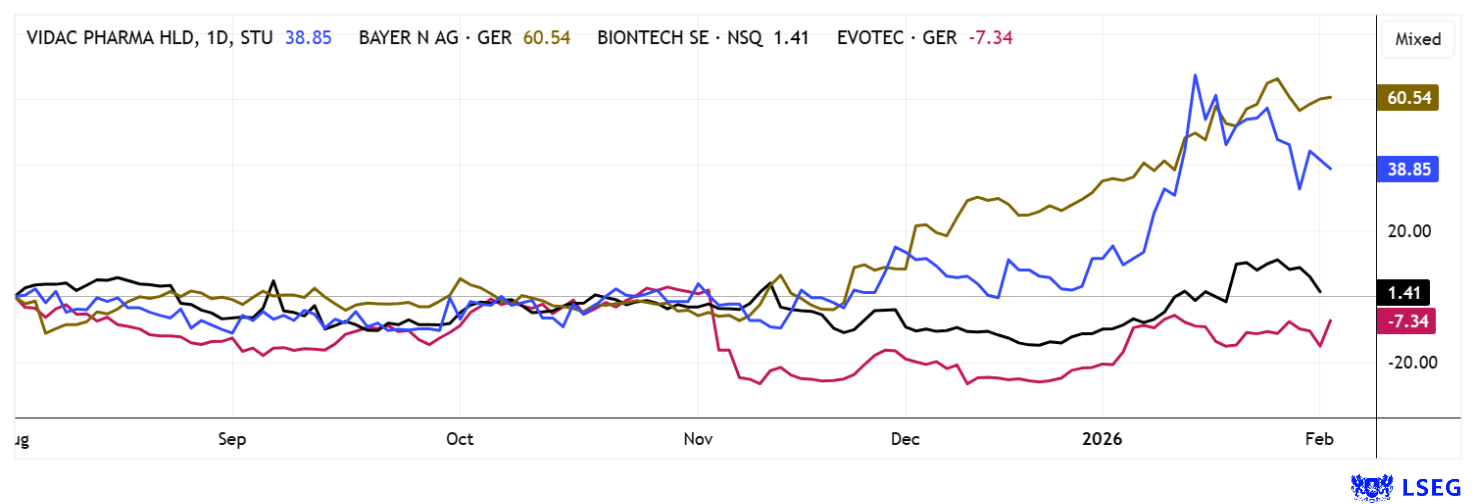

Starting signal! Biotech sector benefits from rotation! Keep an eye on Evotec, Bayer, Vidac Pharma, and BioNTech

The stock market has started 2026 on a positive note. The mining and commodities sector recently proved that return opportunities are not limited to the technology sector, with several stocks doubling in price and a few even increasing tenfold. A breath of fresh air is needed, because other sectors also want to enjoy the stock market spring. Life science stocks have indeed taken a break for almost three years. But now they are back! After a long period of silence, selected companies are showing the first signs of a technical recovery. For investors with a penchant for opportunities and timing, now is the time to rethink old strategies and realign portfolios. In cancer research, recent breakthroughs in personalized immunotherapies have significantly increased the prospects of success for clinical trials. We take a closer look.

time to read: 6 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , BAYER AG NA O.N. | DE000BAY0017 , VIDAC PHARMA HOLDING PLC | GB00BM9XQ619 , BIONTECH SE SPON. ADRS 1 | US09075V1026

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Bayer – Analysts revise price targets upward

After years of underperformance, Bayer has clearly stabilized and, with a price increase of around 90% over the year, is once again one of the strongest stocks in the DAX. The main driver is the clinical success of Asundexian, which convincingly demonstrated both efficacy and safety in a Phase III study following non-cardioembolic stroke. This strengthens Bayer's cardiovascular pipeline and opens up additional revenue prospects beyond mature blockbusters. At the same time, the company is gradually compensating for the foreseeable decline in sales of Xarelto and Eylea with new products. Particularly noteworthy is Nubeqa, which has received expanded approval in China for metastatic hormone-sensitive prostate cancer and is positioning itself in a structurally growing market. The underlying study data demonstrate significant clinical added value and strengthen the competitive position in Asia. On the risk side, the legal situation regarding glyphosate could ease significantly, as political and legal developments in the US suggest that further lawsuits will be limited. A ruling by the highest court could significantly ease the burden on the German pharmaceutical giant's balance sheet and valuation.

The capital market is reacting increasingly constructively. Analysts are raising their price targets. JPMorgan, for example, has given the stock an "Overweight" rating with a target price of EUR 50, while investment bank Goldman Sachs has raised its target price from EUR 42.50 to EUR 54.50 and added the stock to its European "Conviction List." February 25 is almost here: Bayer will present its 2025 figures and provide an update for the current year. Technically, the share price has already broken through EUR 36, and fundamentally, the 2026 estimates point to a low P/E ratio of 9.5. The Leverkusen-based company is back on stage with a high of EUR 45!

Vidac Pharma – Metabolic oncology as a platform for structural revaluation

These have been two volatile weeks! With good news, the Vidac share price exploded by 90% from EUR 0.50 to EUR 0.96 in the first weeks of January, followed by the first profit-taking. The price increase is understandable, as Vidac Pharma is strategically positioning itself at the center of a new oncological development paradigm that does not address individual molecular target structures, but instead attacks the disturbed tumor metabolism as an overarching disease principle. This approach targets the Warburg effect, an almost universal characteristic of solid tumors, thus opening up a cross-indication range of applications beyond classic target or immunotherapies.

The scientific core of the platform is the targeted modulation of the interaction of hexokinase 2 with mitochondria, a central switching point of tumor-typical hyperglycolysis. This intervention weakens the energetic dominance of the cancer cell and, at the same time, promotes a return to regulated cellular processes, which increases susceptibility to apoptosis. The resulting drug pipeline, including VDA-1275 and VDA-1102, is based on a common mechanism, thereby reducing the development risk of individual programs. Preclinical data show that VDA-1275 not only has a direct antitumor effect but also triggers immunological follow-up reactions and can exert synergistic effects in combination with established therapies.

With the recent US patenting of this mechanism of action, Vidac has long-term, strategically relevant IP protection that secures the platform well into the coming decades. This protection forms the basis for sustainable value creation and increases the attractiveness for international pharmaceutical companies, for whom robust intellectual property is a key requirement. At the same time, the company is demonstrating its clinical implementation expertise through the progress of Tuvatexib in the indication of actinic keratosis. The approval of the Phase 2b study by the European Medicines Agency is to be seen as a regulatory quality signal and significantly reduces development risks. Collaboration with specialized clinical networks further strengthens the data quality and industrial connectivity of the program. Beyond dermatological oncology, Vidac's VDA-1102 also addresses highly complex indications such as brain tumors, where the metabolic approach is particularly relevant.

Against the backdrop of expiring blockbuster patents in the pharmaceutical industry, Vidac's platform is gaining strategic importance as a complementary technology without internal cannibalization effects. Scientific differentiation, regulatory progress, and IP protection form the basis for partnerships or larger transactions. Our buy recommendation at the start of the year hit the mark – but the journey can go much further!

BioNTech – With plenty of cash and imagination

Cash is king! Mainz-based biotech company BioNTech is entering a transition year in 2026 with around USD 17 billion in cash. It is already worth taking a closer look, as many parameters are improving. Although the balance sheet is marked by declining COVID revenue, many sector experts are enthusiastic about an exciting oncology pipeline. Several Phase III studies in major tumor indications such as breast, lung, colon, and head and neck cancer could mark a decisive turning point in the company's profile. While no significant revenues are expected from these programs in the short term, the clinical agenda promises data-rich momentum and the possible preparation of initial marketing authorization applications. Management is deliberately setting lower financial expectations in order to focus attention on the study results, which are likely to determine the next growth spurt. If the clinical breakthrough is successful, BioNTech could establish itself as a sustainable multi-asset oncology specialist beyond its COVID legacy. Following the merger with CureVac, the target revenue for 2026/27 rises to an estimated EUR 3.7 to 3.9 billion. EUR 4 billion is also conceivable in the wake of various collaborations with British and American partners. In view of the company's healthy position, a market value of EUR 22 billion is too low. The long-term key lies in ongoing research and testing for a total of four cancer therapies using mRNA technology. This could get exciting, because the news pipeline is well filled! Nineteen out of 22 analysts on the LSEG platform continue to see attractive price potential of around 20% over the next 12 months. Technically, a jump above the EUR 95 mark is on the agenda, perhaps as early as the 2025 figures. Collect!

Evotec – Will Berenberg give the starting signal?

It took a long time, but now the share price of Hamburg-based drug researcher Evotec is also moving. With yesterday's "Buy" recommendation from a renowned research firm, the stock gained a full 10% and easily surpassed the EUR 6 mark. Nevertheless, after a weak 2025, Evotec is still in a phase of restructuring and reorientation, which is now beginning to bear fruit. Analysts are also slowly warming up to the company after two years of sideways movement. Private bank Berenberg has initiated coverage with a price target of EUR 10 and a "Buy" rating. The Hamburg-based company is a globally recognized contract research institute, wrote analyst Christian Ehmann in his buy recommendation. The comprehensive solutions in drug research and development have been met with enthusiasm. Evotec is positioned at the intersection of rising outsourcing demand among pharmaceutical companies and the pursuit of cost-efficient research. Evotec's valuation leaves plenty of room for growth, even if demand merely normalizes. The mood is also positive on the LSEG platform: 7 out of 10 experts are giving it the thumbs up and calculating an average 12-month price target of EUR 8.67, which is 35% above the last price. We already recommended the stock at EUR 5.40 and EUR 5.70 – with the new data, it makes perfect sense to buy more! We are raising the stop price to EUR 5.95. It will be exciting to see where this goes!

The outlook in the life sciences sector is looking up again. After all, no one has been able to make any headway here in the last three years. But the current year is certainly good for surprises. Vidac Pharma and Bayer are showing technical strength, while Evotec and BioNTech are still somewhat speculative, but not uninteresting at their low levels.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.