Comments

Commented by Nico Popp on October 14th, 2025 | 07:10 CEST

Raw materials war sends industry into panic – New buyers enter the resource sector: SAP, Barrick Mining, Globex Mining

Industry and the commodities sector are in turmoil. China's latest trade restrictions on critical raw materials are causing widespread uncertainty. Last week, China announced its intention to severely restrict exports of rare earths. In addition, raw materials that can serve military purposes will no longer be allowed to leave the country. Also on the list: Chinese expertise related to the extraction and processing of these raw materials. The Frankfurter Allgemeine Zeitung (FAZ) has already quoted a China expert who sees a new dimension of extraterritoriality in these measures. Here is what investors should keep in mind now.

ReadCommented by Stefan Feulner on October 14th, 2025 | 07:05 CEST

Tilray, Graphano Energy, Arafura Rare Earths – Battle for raw materials intensifies

While the US appeared to be heading for a trade war with China on Friday, US President Donald Trump posted a message on his social media platform, "Truth Social", on Sunday, giving a slight all-clear. But is this really the end of the dispute between the world's two largest economies? Hardly. In fact, the battle for critical raw materials is likely to intensify in the coming months, if not years, meaning Western producers could benefit disproportionately.

ReadCommented by Armin Schulz on October 14th, 2025 | 07:00 CEST

Why RENK Group needs Antimony Resources just as much as the largest US defense contractor, RTX

The global defense industry is facing a fundamental supply crisis. Antimony, a largely overlooked metal that is indispensable for high-performance electronics, armor-piercing alloys, and flame-resistant propulsion systems, is becoming a key strategic factor. Prices are skyrocketing, and massive supply bottlenecks are emerging. This shortage is hitting defense giants and suppliers hard, forcing them to radically rethink their procurement strategy. Today, we take a closer look at the current situation of the RENK Group, the explorer Antimony Resources, and the largest US defense contractor RTX.

ReadCommented by Stefan Feulner on October 13th, 2025 | 07:35 CEST

BioNxt Solutions – Attack on new highs

After global stock markets had been on an upward trajectory in recent weeks, US President Donald Trump caused some irritation with a post on his social media platform, "Truth Social." The escalating trade dispute with China, the world's second-largest economy, caused the already overvalued markets to falter. The DAX lost just under 1.8% at the end of the week, while the Nasdaq technology index suffered significantly more, losing just under 4.3%. In the coming weeks, stock picking is likely to take center stage. Against this backdrop, BioNxt Solutions, a life sciences company specializing in innovative technologies for next-generation drug delivery, was able to shine with fundamental milestones and buck the negative trend.

ReadCommented by Fabian Lorenz on October 13th, 2025 | 07:30 CEST

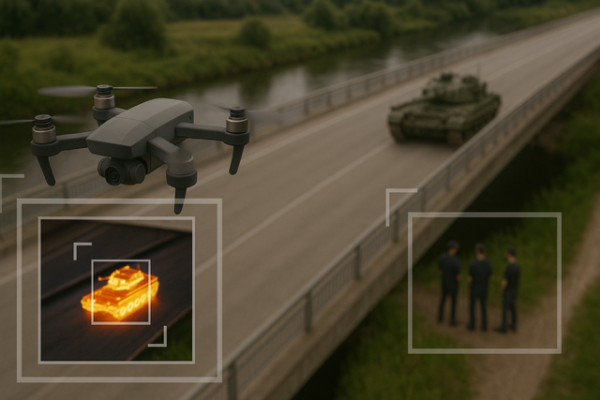

Drone boom and multiplication: Following DroneShield, RENK, and Standard Lithium, NEO Battery Materials shares are taking off!

Missed out on the multiplication of shares such as DroneShield, RENK, and Standard Lithium? Investors can still get in early with NEO Battery Materials. The Company is benefiting from the drone boom and the raw materials conflict between the US and China. NEO Battery Materials has developed advanced battery technology. The first manufacturer of drone batteries has already placed an order. In the future, the Company also plans to offer complete batteries itself. To save time in commercialization, a factory has been leased. This will allow for rapidly increasing sales and profits. The tariff and raw materials conflict between the US and China is likely to give NEO an additional boost. When will the stock take off?

ReadCommented by Nico Popp on October 13th, 2025 | 07:25 CEST

Drone stocks: Opportunities with Volatus Aerospace, DroneShield, and Rheinmetall

When drones appeared over several European airports in September and brought flight operations to a standstill, it came as a shock. The incidents revealed that Germany and many other Western countries are largely powerless against drones, as there are no defense mechanisms in place. Instead, representatives of the German Armed Forces and police are arguing over who is responsible for countering such threats – in Germany, there are even regulations governing who may defend against enemy threats and where. Meanwhile, the war in Ukraine continues – and with it, the drone war is evolving. It has long been clear that drones are essential as a deterrent and have become a core element of every modern army. We explain why Volatus Aerospace is well-positioned to benefit from the ongoing drone hype.

ReadCommented by Armin Schulz on October 13th, 2025 | 07:20 CEST

The beneficiaries of the raw materials crisis: How BYD is circumventing the problem, and how Power Metallic Mines and Albemarle are profiting

The global energy transition is fueling an unprecedented hunger for strategic metals. However, China's recent tightening of export controls on critical raw materials has triggered a global supply alert and sent markets into turmoil. This geopolitical turning point is forcing the West to radically rethink its approach and is fueling a fierce race for secure supply chains. In this volatile environment, smart players are repositioning themselves along the entire value chain. Who are the winners in this new reality? The strategies of BYD, Power Metallic Mines, and Albemarle provide decisive answers.

ReadCommented by André Will-Laudien on October 13th, 2025 | 07:15 CEST

Trump tariffs 3.0 for China and the Bitcoin crash: Major movements at Strategy, Metaplanet, Coinbase, Nakiki, and D-Wave

With Donald Trump's announcement of a new 100% tariff measure against China on Friday afternoon, previously strong performers in the crypto sector came under significant pressure. The protagonists, Strategy, Coinbase, and Metaplanet, were hit with daily losses of between 3 and 10%. D-Wave, which had gained over 50% in the last 6 weeks, is also starting to feel the squeeze. Nakiki shares, on the other hand, reacted with price gains. The German Bitcoin stock can be pleased that its coin purchase program doesn't start until November - this could offer attractive buying opportunities, with the timing looking ideal. However, it remains to be seen whether this move will trigger a broader correction accompanied by rising volatility. Meanwhile, precious metals have recently been moving in only one direction: up! Could the rally now make an abrupt return?

ReadCommented by Armin Schulz on October 13th, 2025 | 07:10 CEST

Why smart investors should be looking at Gerresheimer, Desert Gold, and Puma NOW!

The true potential of a portfolio is revealed not in calm markets, but in turbulent ones. While the masses are driven by price fluctuations, savvy investors recognize opportunities in companies that have recently underperformed. The key lies in a targeted analysis of resilient niche players, commodity experts with unique access, and global consumer brands that are on the verge of a turnaround. This strategic positioning often makes the difference between average and exceptional returns. Three promising candidates that currently embody this profile are Gerresheimer, Desert Gold, and Puma.

ReadCommented by Fabian Lorenz on October 13th, 2025 | 07:05 CEST

Winners in the tariff war: Almonty Industries, MP Materials, Bayer

Stock market turmoil on Friday: Donald Trump once again threatens to wield the tariff club. This came in response to China's announcement to tighten export controls on rare earths. Yet, there are also winners in the raw materials battle between the two superpowers. In recent months, the US government has invested in companies such as MP Materials, focusing so far on rare earths and lithium. Will tungsten be next? This critical metal has not been mined in the US for a long time, and Almonty would be the logical partner to change that. Notably, while US stocks lost ground, in some cases heavily, on Friday, Almonty shares recovered significantly from their intraday lows.

Read