November 13th, 2025 | 07:20 CET

Record stock market! And the momentum continues with Palantir, D-Wave, Gerresheimer, and NetraMark

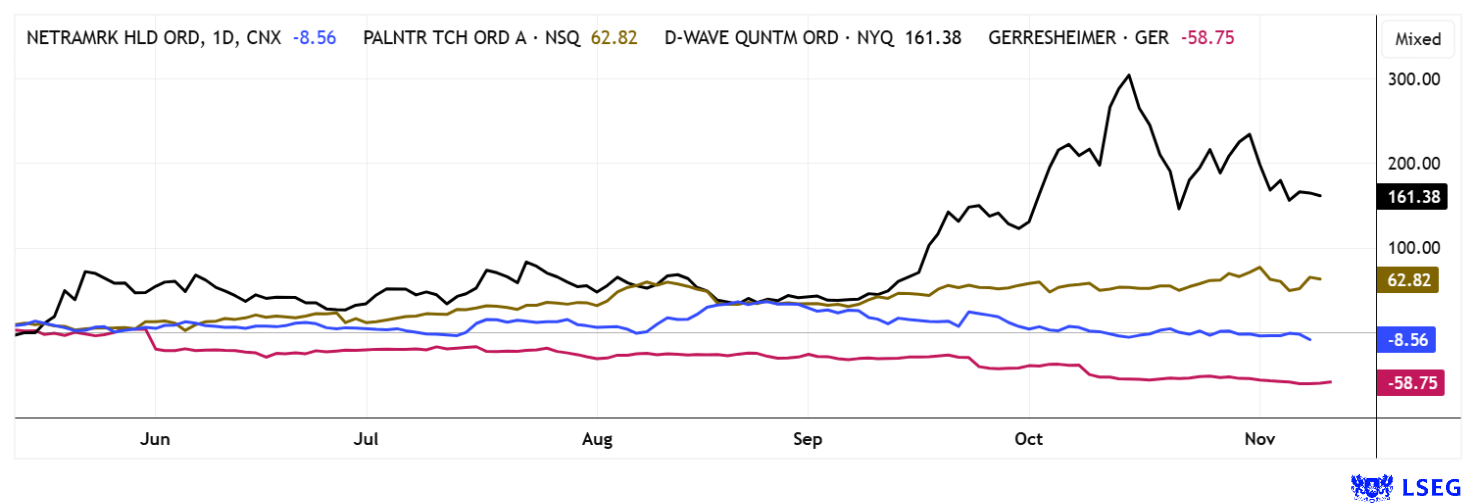

Artificial intelligence (AI) is fundamentally changing drug development by analyzing vast amounts of data in record time and controlling clinical trials more precisely. Advanced systems identify promising drug candidates and predict therapeutic success with impressive accuracy. Companies such as NetraMark are already successfully using these technologies to accelerate development processes. At the same time, the well-known AI stars Palantir and D-Wave are driving the next wave of innovation as pacemakers in data analysis and quantum computing, recording extraordinary share price gains. The German Gerresheimer Group is also increasingly integrating AI-supported solutions into the manufacture of pharmaceutical packaging and medical technology. For investors, this represents a pool of opportunities, but the choice remains difficult!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

PALANTIR TECHNOLOGIES INC | US69608A1088 , D-WAVE QUANTUM INC | US26740W1099 , GERRESHEIMER AG | DE000A0LD6E6 , NETRAMARK HOLDINGS INC | CA64119M1059

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

NetraMark – NetraAI sets new standards in precision medicine

Canadian medical technology company NetraMark Holdings is increasingly becoming a key player in the use of explainable artificial intelligence in the global pharmaceutical and biotech industry. With its innovative NetraAI platform, the Company is able to break down even the smallest and most complex patient data sets into understandable subgroups, thereby gaining new insights into disease mechanisms. In the current year, NetraMark has significantly expanded its project portfolio and entered into several important partnerships. The AI platform is now being used in a Phase 3 study of a novel psychotropic drug, with NetraAI analyzing multidimensional clinical data sets. Patient responses, placebo effects, and side effects are evaluated in detail to optimize market approval and marketing strategy based on data. This development strengthens NetraMark's position as the preferred technology partner for pharmaceutical companies that want to accelerate their clinical processes while drastically reducing costs.

With a clear focus on explainable AI and precision-oriented drug development, NetraMark is setting new standards in data-driven research. CEO George Achilleos emphasizes that the greatest added value of NetraAI lies in the comprehensibility of the results, as scientists, clinics, and authorities can immediately understand the basis for decisions. The latest contract with a leading biopharmaceutical company illustrates how much acceptance of the technology has grown. With its proven impact in areas such as neuroscience, oncology, and pain research, NetraMark is establishing itself as a pioneer of a new era of clinical intelligence. The goal is to gain more precise insights into efficacy and side effects, thereby supporting future regulatory strategies. CEO George Achilleos explained that this collaboration demonstrates the growing recognition of NetraMark's explainable AI as a tool for improving study success. The Company is thus expanding its portfolio with another flagship project in the field of neuroscience and strengthening its position as a pioneer of data-driven precision medicine. With a market capitalization of approximately CAD 110 million and growing interest from international partners, the Company remains an exciting growth stock at the intersection of AI, medicine, and precision research. Given the rising demand for such solutions, the stock is increasingly seen as a takeover candidate, as the efficiency gains promised by NetraAI could save the industry billions. Highly interesting!

D-Wave Quantum – From the lab to explosive sales in the quantum sector?

D-Wave Quantum's stock is currently raising the most questions. With a 2,000% performance in 18 months, the quantum computing specialist is the clear winner on the NASDAQ, but also a mystery. The Company has a revenue of just USD 10 million, but is valued at nearly USD 10 billion on the stock market. At the heart of the investment story is a strong technological lead in the field of hybrid quantum/HPC solutions. The Company already provides practical applications for industry in this area. In Q3, D-Wave doubled its revenue to USD 3.7 million, with an impressive gross margin of over 71%, and its order backlog continues to grow, including a million-dollar order from the Italian government and collaborations with companies in Europe, the US, and Japan. Analysts are largely optimistic in view of rapid progress and the record liquidity of USD 836 million achieved after capital increases, and see further potential. If the current irrational valuation recedes somewhat at some point, D-Wave Quantum remains a very exciting growth story in the tech sector due to its market leadership and real progress in the quantum field. However, it is questionable whether the market will give us a 50% setback. The stock fell another 7% yesterday, and the high of USD 46.70 is already quite a long way off. Watch this space!

Palantir Technologies – The price is unstoppable

Even after the Q3 figures, Palantir's share price continues to rise. For a short time, it looked as if the air above USD 200 was slowly getting thinner, but after a 48-hour sell-off to USD 177, the share price was back at USD 195 at the beginning of the week. However, yesterday saw another dip to USD 182, so the battle between the bulls and bears does not seem to be over just yet. The recent dispute between CEO Alex Karp and big-short investor Burry is interesting. Burry's Scion Asset Management revealed in a quarterly 13F portfolio disclosure last Monday that he held put options on 5 million Palantir shares with a notional value of USD 912 million at the end of September. CEO Karp called the recent bets "completely crazy" in a television interview, saying that Palantir is growing at 40% per annum and is having a "dream year" for business. Karp also said it was "super triggering" when short sellers "pick on" Palantir. The head of the AI-powered data analysis and integration company suggested that Burry may have lost a lot of money betting against Palantir. An open media battle – wonderful! Palantir's revenue rose 63% to approximately USD 1.2 billion in Q3, while net income improved by over 300% to USD 447 million. This values the Denver-based company at a 2026 P/E ratio of 250 and a P/S ratio of 100. Anyone investing here must be convinced!

Gerresheimer – Technical indicators point to a rebound

A quick note: Gerresheimer, one of the world's market leaders for medical glass and packaging, has had a challenging 12 months. The share price has been receiving strong technical support at EUR 22 to 25 for several days. The valuation has now fallen so sharply, by 70%, that the remaining "Buy" recommendations on the LSEG platform, with a range of EUR 23 to EUR 40, yield a 12-month average of EUR 37.98. According to Adam Riese, this provides 50% price potential for a gem of the German SME sector! Countercyclical investors are collecting in the EUR 22 to 25 corridor and will not look again for 3 years!

**The stock market is going through wild swings. As a participant in daily trading, one gets the feeling that the direction of algorithmic AI trading changes completely every 10 minutes. This is the new world of the stock market since high-speed trading became established. AI-focused stocks such as Palantir, D-Wave, and NetraMark remain in the spotlight, while a sharply corrected gem like Gerresheimer receives little attention. Those who act countercyclically are called upon here!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.