Comments

Commented by Carsten Mainitz on September 17th, 2021 | 12:42 CEST

Desert Gold, Barrick Gold, flatexDEGIRO - What is next after the correction?

Not always does an equation work out when investing in the short term. Patience and a longer-term investment horizon are not often emphasized for nothing. Investments in tangible assets such as stocks, commodities and real estate have been proven to protect against a loss of purchasing power. Precious metals are also suitable as crisis currencies over more extended periods. Setbacks offer opportunities! Who has the best cards?

ReadCommented by Stefan Feulner on September 17th, 2021 | 12:16 CEST

LVMH, Diamcor, BYD - Consumption without limit

The gap between rich and poor is widening in Germany. The Corona pandemic has further exacerbated the situation. More than 13 million people, around 16% of the population, were below the poverty line and had to live on EUR 781 or less. In contrast, the number of millionaires in the Federal Republic continued to rise from 1.47 million to the current figure of 1.54 million. Due to the sudden rise of the nouveau riche, consumption and the purchase of luxury goods are also rising. After all, expensive cars, watches and diamonds are essential for prestige, to be able to show one's "wealth".

ReadCommented by Armin Schulz on September 17th, 2021 | 11:59 CEST

First Majestic Silver, Silver Viper, Millennial Lithium - Rally Ahead?

A rally in silver was already predicted at the end of last year. The reason was the corona-related 5.9% drop in production. It is the most significant decline in over 10 years, and thus there was a shortfall in supply. In addition, there is strong physical demand, which you can see well on Reddit if you search for "Silverbugs". There, people proudly present their hoarded silver stocks. Since the panic selling at the beginning of August, the price has already risen by 11%. High inflation could give the silver price a further boost. For lithium, on the other hand, the rally is already in full swing. The lithium carbonate price has more than doubled since the beginning of the year. We analyze three companies from these sectors today.

ReadCommented by André Will-Laudien on September 17th, 2021 | 11:23 CEST

NEL, Royal Helium, Linde, BASF - This is where it gets highly explosive!

How will the energy transition play out in Europe? With hydrogen is one way. It is costly to produce if you look at the issue sustainably. The raw material itself is seen as an alternative building block of a green future and, according to experts, could become one of the most important energy sources in the coming decades. The water element is available in abundance, but what is lacking is a truly environmentally friendly way to convert it back into hydrogen and oxygen. Even under the best conditions, green hydrogen costs about 10 times as much to produce as Russian natural gas, which also burns fairly cleanly overall. What is next for this sector?

ReadCommented by Stefan Feulner on September 17th, 2021 | 10:41 CEST

Steinhoff, Tembo Gold, Nikola - Strong rebound potential

Which investor does not dream of investing in a stock anticyclically during strong price setbacks to earn disproportionately from the rebound? But the anticyclical investment strategy, in which one bets against the broad mass, is associated with considerable risks. Because of this, one should analyze the object of one's desire carefully to see the reasons for the rapid sell-off. Are they self-inflicted problems, as was best observed in the Wirecard example, or is the impulse coming from outside.

ReadCommented by Stefan Feulner on September 16th, 2021 | 13:17 CEST

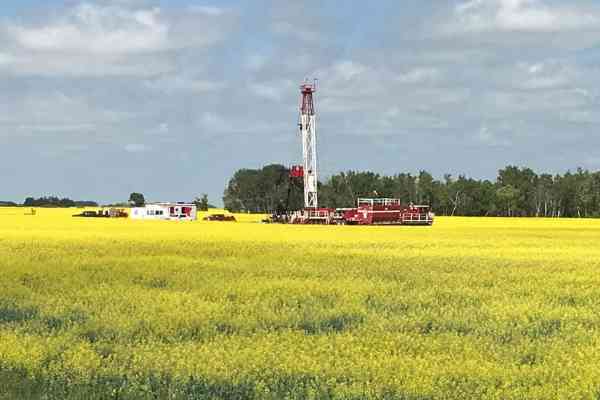

FuelCell Energy, Saturn Oil + Gas, Gazprom - The Renaissance of fossil fuels

There is no question that Germany has already achieved a great deal in terms of climate protection. In 2020, about 45% of its electricity came from renewable sources. However, the goal of becoming greenhouse gas neutral by 2045 is still a long way off. For this plan to become a reality, wind power still needs to be expanded significantly. The first half of the current year shows that it will not be possible to do without fossil fuels in the coming years. According to calculations by the Federal Statistical Office, over 56% of the total 258.9 billion kWh of electricity generated in Germany came from conventional sources such as coal, natural gas and nuclear energy.

ReadCommented by Carsten Mainitz on September 16th, 2021 | 12:45 CEST

Triumph Gold, First Majestic, Varta - Inflation is getting worse than we think - How to safeguard your assets!

Inflation in the US eased slightly in August from July's 5.4% to 5.3%. Nevertheless, this is a high value. It would be premature to derive a trend reversal from this. Far more dramatic are the rates of inflation in wholesale prices in Germany. As the Federal Statistical Office recently reported, these rose by 12.3% year-on-year in August. It was the most substantial increase since October 1974, during the first oil crisis. Investors should invest in tangible assets such as shares, real estate, commodities, or precious metals to protect their assets. Who offers the best risk-reward ratio?

ReadCommented by André Will-Laudien on September 16th, 2021 | 11:58 CEST

Siemens Healthineers, PuriflOH, Fresenius, Novavax - Focusing on health!

The pandemic outbreak in 2020 ushered in a new era. People's health is once again moving to the center of attention. Politicians worldwide see themselves obligated to make public life safe, but whether this will be 100% successful remains questionable. Ultimately, it will depend on the commitment of private companies to what extent the existing health issues can be solved and by what means. On the capital markets, the healthcare sector has been sailing on the highest wave for months because the dangers for billions of people need to be reduced, and framework conditions for public life need to be created. Who benefits the most?

ReadCommented by Fabian Lorenz on September 16th, 2021 | 11:34 CEST

Valneva, Barrick Gold, Central African Gold: Inflation fears and liberation strike

High inflation keeps investors on their toes. In August, the inflation rate in the US remained at a high level of 5.3% compared to the same month last year, as announced by the Labor Department of the world's largest economy. Therefore, the increase in consumer prices was only slightly below market expectations and the increase in July of 5.4%. Compared with the previous month, prices were 0.3% higher. Inflation data usually brings momentum to commodity stocks - positive as well as negative. This is as true for Barrick Gold as for Central African Gold, with one on a good path to higher prices. Valneva shareholders would like to see higher prices after the crash. However, analysts remain cautious.

ReadCommented by Nico Popp on September 16th, 2021 | 10:46 CEST

BYD, Kainantu Resources, JinkoSolar: Investing in green technology

Electromobility is on the rise and unstoppable. In July, a survey by E.ON showed that 66% of Germans could imagine buying an e-car. For around 70% of e-car sympathizers, climate protection is the most important argument in favor of an e-car. We highlight three stocks that can benefit from the trend toward more e-mobility.

Read