Comments

Commented by Armin Schulz on September 10th, 2021 | 12:11 CEST

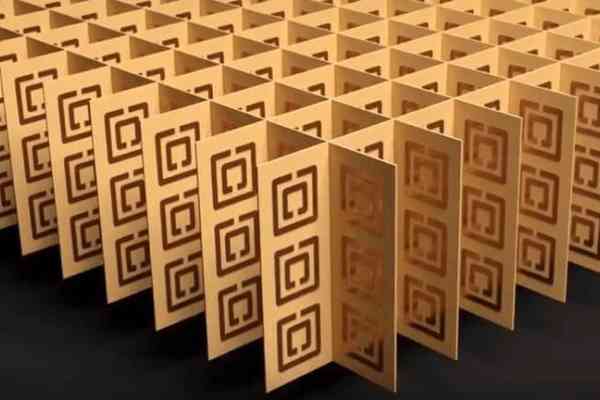

Deutsche Telekom, Meta Materials, Apple: 5G - The coming hype

5G will not only make our mobile internet faster, but it is also indispensable for bringing the Internet of Things, industrial automation and autonomous driving to market maturity. Private users can look forward to virtual realities and augmented realities in the future. Augmented realities can present the user with useful information about objects or even activities via glasses. There are already initial applications in this area, but the technology will develop rapidly in the coming years. The market will grow enormously once the 5G network is installed nationwide. In today's analysis, we show which companies could benefit from tomorrow's hype.

ReadCommented by Stefan Feulner on September 10th, 2021 | 11:16 CEST

GameStop, wallstreet:online, Nikola - It goes on blithely

The ECB is following the lead of the FED. Although some council members warned not to ignore the risk of too high inflation, an end to the ultra-loose monetary policy is not in sight. Only the purchase of government and corporate securities under the Corona emergency purchase program should be "moderately" lower in the fourth quarter. The pro-growth decision is a balm for the stock markets. New highs should follow after the last mini-corrections.

ReadCommented by Nico Popp on September 10th, 2021 | 10:14 CEST

Daimler, Aztec Minerals, Varta: How growth investments succeed

New technologies are currently transforming the economy. The triumphant advance of electric cars is a done deal, and even buildings will soon be largely climate-neutral. First and foremost, carmakers, manufacturers of photovoltaic systems and energy storage systems are driving this development. But other beneficiaries are currently receiving little attention from the market. We present three stocks.

ReadCommented by Stefan Feulner on September 9th, 2021 | 13:33 CEST

NIO, Kodiak Copper, Siemens Energy - Will green policies end in disaster?

Climate change is supposed to move forward quickly. The parties, above all, the Greens around chancellor candidate Annalena Baerbock, are wooing voters with ever shorter targets for CO2 neutrality. However, the construction of wind turbines, electric cars and solar plants requires an enormous amount of metals. There are already signs of a shortage in 2021, which will be even more drastic in the next few years and will seriously undermine the politicians' plans.

ReadCommented by André Will-Laudien on September 9th, 2021 | 12:49 CEST

Royal Dutch Shell, Saturn Oil + Gas, Steinhoff: From 17 to 51 - Triples sought!

Investing in shares consists of striving for a return on the capital invested. In recent months, there have been many stocks that have increased tenfold in price. However, only few investors had persevered. If one lowers one's targets somewhat and still maintains a reasonable profit expectation, even a threefold increase could bring great joy. We take a look at three stocks that stand at just under 17 today and calmly consider whether a 51 could be possible. Impossible, you say - Possible, we say!

ReadCommented by Nico Popp on September 9th, 2021 | 12:08 CEST

SMA Solar, Memiontec, CureVac: Doing good and earning money

When young founders develop business models, it is often a question of "purpose," i.e. the best possible (good) purpose of a company. For the new generation, money is no longer the only thing that counts. Instead, earning money and doing good are the watchwords. On the stock market, too, some companies make the world a little better. We look at three stocks and find out whether there is money to be made in them.

ReadCommented by Nico Popp on September 9th, 2021 | 11:42 CEST

Nordex, Water Ways Technologies, MorphoSys: How investors invest in the future

The future is traded on the stock exchange. But what does it look like? It is not easy to make concrete predictions. That is one of the reasons why there are both positive and negative surprises on the stock market. But as an investor, you can help the odds, for example, by focusing on megatrends. Demographics, health, and sustainability are trends that will still be in place in ten years. We present three possible investments.

ReadCommented by Fabian Lorenz on September 9th, 2021 | 10:42 CEST

SMA Solar, Standard Lithium, Almonty Industries: Between profit warning and supercycle!

It is not only semiconductors that are in short supply, but also numerous industrial raw materials. The situation is only getting worse. In the case of lithium, demand is expected to increase fivefold in a few years. Tungsten is also in demand, and China is an unreliable quasi-monopolist. As a result, raw materials are in short supply, and prices are rising. More and more companies are suffering as a result, like Germany's SMA Solar. The inverter manufacturer had to cut its forecast and analysts promptly reduced their price targets. On the other hand, some companies are benefiting from the situation. Highflyer Standard Lithium is one of them. Due to positive industry and company news, the share is accelerating again. Almonty Industries is also facing exciting months.

ReadCommented by Stefan Feulner on September 8th, 2021 | 13:18 CEST

BYD, Aspermont, Salzgitter AG - Extreme surge in demand

The improved mood in the economy and the reviving business cycle brought companies record results in the second quarter. Above all, electric car manufacturers shone with significantly rising sales figures. In June alone, the number of new registrations in Germany climbed 311% year-on-year. The switch from combustion engines to electric cars is only just beginning. The percentage of battery-powered vehicles on German roads is just 12%.

ReadCommented by André Will-Laudien on September 8th, 2021 | 12:59 CEST

TeamViewer, TalkPool AG, Deutsche Telekom - This is the way to the top!

When the dot-com boom took off at the turn of the millennium, many immature and unpromising business models came onto the market. Every idea was made ready for the stock market - then the techno-crash followed, and many companies disappeared from the radar. The COVID-19 pandemic triggered a worldwide digitalization push - many new achievements now determine the working world of every individual and change society as a whole. The focus is now on: Distant Working, Internet of Things and Communication. We take a look at the cards of three protagonists.

Read