Comments

Commented by Fabian Lorenz on December 17th, 2025 | 07:20 CET

BUY RECOMMENDATIONS and INSIDER SALES: D-Wave, Siemens Energy, Graphano Energy

Insider alert at D-Wave Quantum. The CFO and directors have cashed in nicely, putting a temporary damper on the stock's rally. A new "Buy" recommendation has so far failed to give the stock any new momentum. Graphite is often overshadowed by lithium and other critical metals in the public perception. However, demand is expected to increase significantly in the coming years due to the growing market for batteries for electric vehicles and energy storage. Graphano Energy is benefiting from production in Canada, and investors can get in early. Those who got in early with Siemens Energy are enjoying a tenfold increase. And if analysts are to be believed, the rally is not over yet. According to them, the stock is still cheap.

ReadCommented by Nico Popp on December 17th, 2025 | 07:15 CET

Gold rush: After producers Barrick Mining and Equinox Gold, it is now the turn of explorers – why Desert Gold is a takeover candidate

Forecasts for the gold market in 2026 are clear and point to a continuing supercycle. However, while producers such as Barrick Mining and Equinox Gold have already benefited massively from higher gold prices in recent months and expanded their margins, the valuation of exploration companies is still lagging behind. This historical divergence is likely to close in the coming year. Experience shows that capital flows cyclically: first, investors buy the security of cash flows, then they seek the leverage of resource development. In this environment, Desert Gold Ventures is coming into focus. The Company controls one of the largest non-producing land packages in West Africa, and is active precisely where industry giants are urgently searching for new supply.

ReadCommented by Armin Schulz on December 17th, 2025 | 07:05 CET

How Bayer, WashTec, and Volkswagen will earn more money in the future with digitalization and AI

Artificial intelligence is already generating measurable profits in industry today. In the pharmaceutical and chemical industries, it is revolutionizing research and accelerating the market launch of vital products. Mechanical and plant engineering is tapping into recurring sources of revenue with AI-based services and strengthening customer loyalty. And in the automotive industry, autonomous driving is highly popular and will shape the future. These advances prove that the productive phase of AI has begun. Three companies show how technology translates into competitive advantages and robust margins: Bayer, WashTec, and Volkswagen.

ReadCommented by Armin Schulz on December 17th, 2025 | 07:05 CET

Electric mobility is booming, lithium prices are rising again – An assessment of BYD, Power Metallic Mines, and Volkswagen

The era of the combustion engine is coming to an end. A new ecosystem of technology, raw materials, and manufacturing power is emerging, presenting extraordinary opportunities for early investors. The race toward electrification is in full swing, driven by exploding registration numbers and a rapidly expanding charging infrastructure. But the real leverage lies deeper. Access to critical metals, which are the lifeblood of every battery, is indispensable. As supply chains reorganize, three very different companies are positioning themselves: the emerging giant BYD, the raw materials explorer Power Metallic Mines, and the traditional heavyweight Volkswagen.

ReadCommented by André Will-Laudien on December 17th, 2025 | 07:00 CET

Year-end rally ahead! Selected positioning for 2026 in Almonty, DroneShield, thyssenkrupp, and TKMS

Incredible volatility at year-end. No surprise - the past stock market year will go down in history as one of the best for the DAX and NASDAQ. And this despite shrinking economic growth and rising inflation. But seasoned investors already know that inflation boosts stock prices, and what drives them even more is defense spending. War is terrible, but it fills the coffers of financiers - led, as always, by the US. Donald Trump likes to sell himself as a peacemaker to the outside world, yet the US remains the world's largest producer of offensive and defensive technology. Business is booming, NATO is among the biggest customers, and demand runs into the trillions. Whether 2026 will continue in the same vein is doubtful, but conflicts at least continue to enable hyperinflationary money printing. As a result, the gigantic debt flywheel spins ever faster – this is how FIAT money systems have functioned for millennia! Where do opportunities lie for risk-aware investors?

ReadCommented by Nico Popp on December 16th, 2025 | 07:35 CET

AI and energy hunger: Why Microsoft, Cameco, and American Atomics are part of a megatrend

Artificial intelligence is not only changing the way we work, but also posing enormous challenges for the physical infrastructure of the global economy. Data centers for AI applications require round-the-clock power, a so-called base load that renewable energy such as solar and wind cannot consistently provide due to their volatility. And the response of the major tech companies to this problem - nuclear power! This is currently leading to a historic reassessment of the entire nuclear value chain. We present three companies positioned to benefit from this energy megatrend: Microsoft, Cameco, and American Atomics.

ReadCommented by Carsten Mainitz on December 16th, 2025 | 07:30 CET

Gold and silver on the rise: AJN Resources and Pan American Silver attractive, Puma on the verge of a major turnaround?

Gold and silver prices have recently reached new all-time highs once again, and there is no end to the rally in sight. Silver in particular has developed spectacularly after breaking through key technical resistance levels and has doubled over the past 12 months. Shares of major companies such as Barrick, Newmont, and Pan American Silver have also at least doubled over this period. Characteristically, the prices of exploration companies have lagged behind the performance of precious metal prices and blue chips. As the bull market progresses, there is much to suggest that explorers will outperform the broader market. One particularly exciting name in this segment is AJN Resources. Beyond the precious metals sector, there are also opportunities for investors to strike gold next year – in the case of Puma, a major turnaround appears to be taking shape.

ReadCommented by Fabian Lorenz on December 16th, 2025 | 07:25 CET

Big news at Barrick Mining! First Majestic Silver shares hit record high! Gold gem Kobo Resources on the rise!

Precious metals are shining particularly brightly this year. The two industry heavyweights, Barrick Mining and First Majestic Silver, are benefiting from this. Barrick recently caused a stir with its announcement that it was considering an IPO of its US assets. Is this to prevent a hostile takeover? First Majestic Silver has taken advantage of the mood and raised several million USD to repay more expensive debt and possibly make a takeover. One takeover candidate in the gold sector is Kobo Resources. The Company plans to publish its resource estimate in early 2026. The stock has finally taken off, still has a lot of potential according to analysts, and is now also actively traded on the Frankfurt Stock Exchange.

ReadCommented by André Will-Laudien on December 16th, 2025 | 07:20 CET

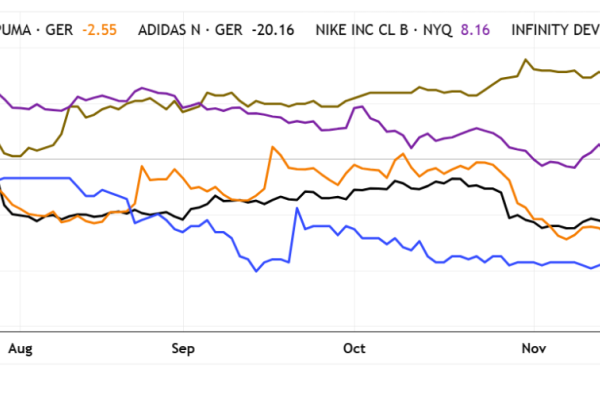

Impact investing, with super dividends into 2026 – Nike, RE Royalties, Adidas, Puma, and Infinity Development

Impact investing has become increasingly important in recent times as investors increasingly recognize that capital flows generate not only returns but also social and environmental impacts. In light of climate change, resource scarcity, and social imbalances, many market participants are no longer satisfied with using financial metrics alone as a benchmark. Regulatory authorities are promoting this development through stricter ESG requirements and greater transparency requirements for companies and financial products. At the same time, younger generations are demanding that their assets be consistent with their values and have a measurable positive impact. If you are looking for something, you will find suitable investments!

ReadCommented by Fabian Lorenz on December 16th, 2025 | 07:15 CET

Novo Nordisk makes a statement! TUI shares jump! Globex shares strong!

Novo Nordisk can end the horror year of 2025 on a positive note. The EMA has issued a positive opinion on a higher Wegovy dosage. Sales could start as early as January. Globex Mining shares have gained over 35% in the current year. There is much to suggest that the share price will continue to rise. With Globex Mining, investors benefit from the commodities boom in a legally secure region with diversified risk. The tourism boom could soon be over, given the economic development in Europe. These prospects dragged down the shares of TUI. However, the stock has reacted strongly in recent days.

Read