Comments

Commented by André Will-Laudien on January 28th, 2022 | 12:07 CET

Daimler, Altech Advanced Materials, Nel ASA, Varta - Battery bull market even without Tesla!

In 2021, many investor topics made hearts beat faster, whether e-mobility, hydrogen or lithium. Every megatrend had its green wave, and after the buying frenzy, there were also corrections. According to the latest statistics from the Deutsches Aktieninstitut, 12.1 million Germans were invested in shares, funds or ETFs. That corresponds to a shareholder quota of over 14% and delivers the third-highest result since records began in 1997. The new stock market players have to cope with fluctuations and uncertainties because the start of 2022 is incomparably bumpier than last year. We highlight current opportunities!

ReadCommented by Stefan Feulner on January 28th, 2022 | 11:55 CET

Deutsche Bank, Memiontec, Texas Instruments - Worrying development

The highly anticipated interest rate decision of the FED came as expected, and nothing will change in the interest rate level for the time being. It was only Jerome Powell's statements due to the urgency of the planned interest rate steps, intended to catch the runaway inflation, that brought the markets down. From a monetary policy perspective, society is facing a turning point. However, beyond money and the capital market, far more pressing problems need to be solved soon. Water scarcity, which denies some 2.2 billion people safe and sustainable access to clean drinking water, is taking on increasingly dire forms. Smart water management is one piece of the puzzle that could be a game-changer in this area.

ReadCommented by Carsten Mainitz on January 28th, 2022 | 11:15 CET

Infineon, BrainChip, Advanced Micro Devices - Winners of the chip boom!

Climate change, mobility change, health technology - none of these megatrends can do without semiconductors. These marvels created from the desert sand are indispensable for every kind of modern technology. If they become scarce, everyone will feel the effects. Car drivers, video gamers and Bitcoin miners have been united in their suffering in recent months: waiting times of several months because chip producers could no longer keep up with production. But one man's sorrow is another man's joy: these stocks will benefit massively from the chip boom.

ReadCommented by Armin Schulz on January 28th, 2022 | 09:55 CET

Nvidia, Diamcor, BP - Buy where demand is huge

Despite a softening Bitcoin price, the situation on the graphics card market remains tense. Getting a card at the MSRP is almost impossible. Prices are falling slightly, but a rise in cryptocurrencies is enough to make prices rise again. Diamond prices have also been climbing since March 2020 and are well above pre-Corona levels. Diamonds are a girl's best friend is just as true today as it was in the 1950s. The oil price also presents itself strongly. The barrel of Brent is quoted for the first time again above USD 90. Many experts have proclaimed USD 100 as a goal. How can investors profit from this demand? We present three companies today.

ReadCommented by André Will-Laudien on January 27th, 2022 | 13:10 CET

Varta, JinkoSolar, Barsele Minerals - Green tech: After the sell-off is before the rally!

Green tech stocks were the clear favorites of investors in 2021. Many stocks from the energy, climate or metals sectors reached multi-year highs. First, the hydrogen hype ran, then the stock market focused on battery makers and e-mobility, and toward the end of the year, uranium and lithium suppliers were bullish. A healthy rotation of green themes, further spurred by the Glasgow climate conference in November. Now some prudence has returned, prices fell slowly at first and then violently in the last few days. Where are the opportunities now?

ReadCommented by Stefan Feulner on January 27th, 2022 | 12:12 CET

RWE, Tembo Gold, Barrick Gold - The course is set

For many shares, the market correction offers the opportunity to add quality to the portfolio at a more favorable level in the long term. Even if the low has probably not yet been reached, long-term anti-cyclical entry opportunities are currently available. The gold price entered a correction after reaching new highs in August 2020, when prices of over USD 2,060 per ounce were paid. Although the chart-technical picture for the gold price is not yet compelling, the current prices should at least be used to build initial positions. Fundamentally, the prospects for the precious yellow metal are already better than ever.

ReadCommented by Carsten Mainitz on January 27th, 2022 | 11:41 CET

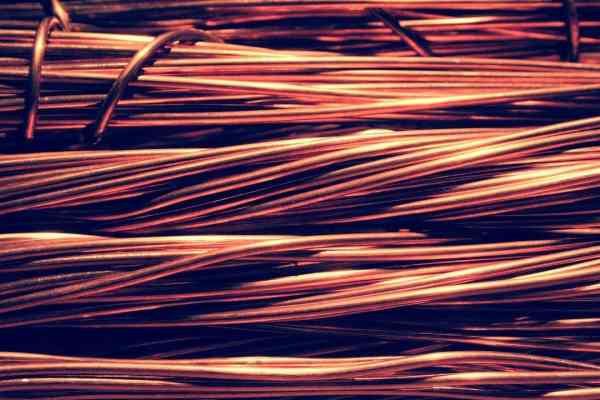

Aurubis, Nevada Copper, Daimler - Copper: Fueling the mobility and climate shift

No metal represents the step into our electrical century more than copper. The reddish shimmering metal with excellent conductivity is in demand wherever electricity is concerned. Experts estimate that about three to four times as much copper needs to be installed in e-cars than in a conventional combustion engine for mid-range cars, which currently comes to about 25kg of copper. Due to the high demand, copper consumption could increase more than tenfold in the next ten years.

ReadCommented by Stefan Feulner on January 27th, 2022 | 11:06 CET

BYD, Defense Metals, Tesla - The long-term beneficiaries of climate change

The post-pandemic global economic recovery and rising investment in more climate-friendly energy infrastructure are driving higher commodity prices amid supply chain disruptions. Shortages of industrial metals, which are urgently needed for climate change, are likely to materialize further in the coming years. This will be significantly exacerbated by the swelling trade conflict between the USA and China. There is a threat of massive bottlenecks in production and sharply rising prices for the respective materials.

ReadCommented by Nico Popp on January 27th, 2022 | 10:13 CET

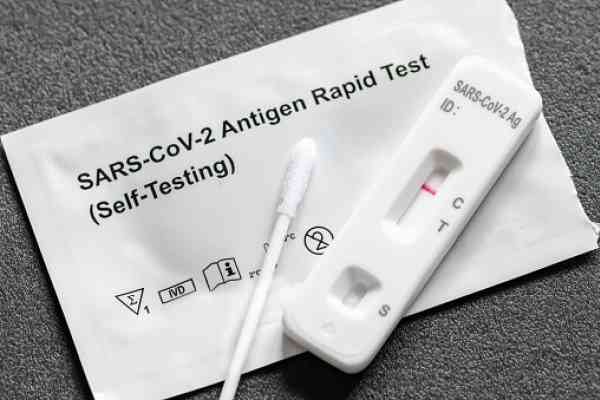

Valneva, XPhyto, Peloton Interactive: What is next for pandemic stocks?

The pandemic is entering a new phase. Although incidences are rising towards the 1,000 mark, the population is largely relaxing. In the meantime, almost everyone knows someone who has fallen ill; as a rule, the scare is over quickly for those who have been vaccinated. In this article, we look at what this means for the stock market.

ReadCommented by Carsten Mainitz on January 26th, 2022 | 13:34 CET

Valneva, Perimeter Medical Imaging AI, MorphoSys - This is where it gets exciting!

The Corona pandemic still has the world firmly in its grip. The number of new infections is skyrocketing. Nevertheless, the chances are good that the pandemic can be brought under control by means of numerous vaccines. But Corona is not the only scourge. Numerous research efforts are focused on diagnosing, treating and curing cancer. Here, innovative AI-based technologies are increasingly being used to help save lives and significantly reduce costs for the healthcare system.

Read