Comments

Commented by Armin Schulz on January 24th, 2022 | 12:27 CET

Deutsche Bank, CoinAnalyst, Block - Market crash, which stocks turn first?

The major indices fell sharply at the end of last week, causing significantly increased volatility. The VIX, which measures volatility, exited Friday's trading at 28.85 points. A week earlier, the value was still below 20. The DAX fell 2.9%, the S&P 2.1% and the Nasdaq 2.9%. Fears of rising interest rates and ever-higher inflation rates are causing uncertainty. In addition, there are poor figures from large companies such as Netflix. But the crypto market is also sending bearish signals. Bitcoin is on its way to test the area at USD 30,000 even though it is also considered a protection against inflation. The question becomes whether it is just the long overdue consolidation or whether the market is really crashing.

ReadCommented by Carsten Mainitz on January 24th, 2022 | 12:20 CET

Barrick Gold, Prospect Ridge Resources, Glencore - The starting signal has been given!

With the publication of quarterly results last week and the achievement of full-year targets, the share of the second-largest gold producer Barrick Gold was able to gain. As a result, this also boosted the entire sector. In addition, the price of gold, which has maintained the USD 1,800 mark at a level of USD 1,830, provides support. The prospects for investments in gold shares remain good.

ReadCommented by Stefan Feulner on January 24th, 2022 | 11:09 CET

BioNTech, Cardiol Therapeutics, Netflix - The return to normality

The outbreak of the Corona pandemic triggered gold-rush sentiment among many companies. In addition to vaccine manufacturers such as BioNTech and Moderna, stocks whose technology supported the mandated measures also multiplied. Whether shopping, school, work or even sports, one could suddenly do everything simply in front of a screen. However, after the restrictions and limitations, society longs for normal life to return. These developments can be seen clearly in the share charts and the most recently presented figures.

ReadCommented by Nico Popp on January 24th, 2022 | 10:13 CET

Mini P/E, dynamic growth and ESG profile: Varta, Saturn Oil + Gas, Gazprom

We have associated modern energy sources, such as batteries or even hydrogen, with future investments for years. Indeed, it is extremely appealing to use renewable energies to feed both the power grids and the engines of ships and trucks. But this transformation is a Herculean task. We look at why investors have great opportunities in this regard and which shares are particularly suitable.

ReadCommented by Nico Popp on January 21st, 2022 | 14:10 CET

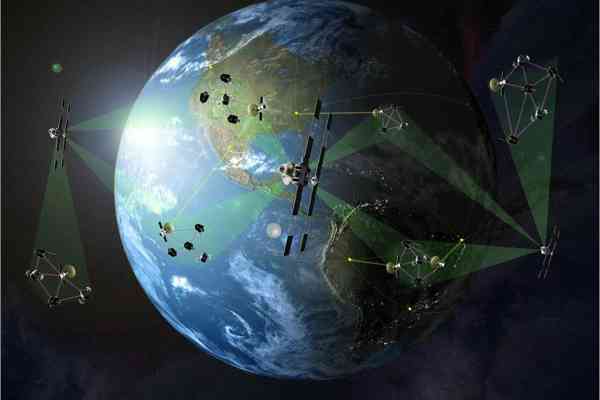

Airbus, Kleos Space, BP: Experience this space visionary live!

Space. Infinite expanses. And almost endless potential for investors. Ever since the super-rich of this earth, such as Elon Musk and Jeff Bezos, have been striving for orbit, space has also been considered a lucrative investment target by investors. To feel weightless as an investor, there are various options between standard and emerging hot stocks. We highlight three titles.

ReadCommented by André Will-Laudien on January 21st, 2022 | 13:15 CET

Barrick Gold, Troilus Gold, Gazprom - Ready for takeoff: Gold ignites now!

Increased geopolitical risks and inflation fears have created an initial reaction in gold. For weeks it stood motionless at USD 1,790 - 1,820. However, the intensification of the Russia-Ukraine conflict has now caused interest in precious metals to rise noticeably. The amount of gold held by the world's largest gold ETF also went up for the first time in two weeks. Since the beginning of the year, it has increased by around 3.7% to currently 981 tons. The highly regarded ARCA NYSE GOLD BUGS Index also moved significantly upwards with +7.8%. Where are the biggest opportunities in the gold market?

ReadCommented by Armin Schulz on January 21st, 2022 | 12:43 CET

Standard Lithium, Noram Lithium, American Lithium - Mega Demand, Mega Opportunity

The US added lithium to its list of critical minerals back in 2017. Due to the ever-increasing emergence of electric vehicles, which is tantamount to a revolution in the automotive industry, the price of lithium increased massively in 2021. Current production capacities are not sufficient to satisfy the growing lithium hunger. In addition, China dominates the global supply chain. If independence is desired, the rest of the world will have to build capacity itself. According to experts, North America could become a competitor. So today, we look at three lithium companies from the region.

ReadCommented by Carsten Mainitz on January 21st, 2022 | 11:02 CET

Samsung SDI, Altech Advanced Materials, Manz - Power stocks!

How is the energy turnaround to be achieved exclusively with renewable energy generation? The sun does not shine at night, and the wind does not blow every day. The answer is energy storage. Batteries and accumulators will play an increasingly important role in the future. Whether for electric vehicles of all kinds (pedelecs, automobiles, buses) or as intermediate storage for renewable energies (at home on a small scale or in wind and solar parks on a large scale). Without new and increasingly efficient storage technologies, the world will not achieve climate neutrality. These three "power stocks" should benefit massively from this development.

ReadCommented by Carsten Mainitz on January 21st, 2022 | 10:45 CET

Yamana Gold, MAS Gold, Newmont - Entry opportunities!

In recent months, gold stocks consolidated. The shares of the second-largest producer, Barrick Gold, were recently boosted by good quarterly data. From a historical perspective, the current price level of the precious metal can be considered high. The general conditions for rising prices are also good in the medium term. Now the sentiment for precious metal stocks could turn more positive again. These companies will certainly benefit from the next gold price rally.

ReadCommented by Carsten Mainitz on January 21st, 2022 | 09:25 CET

Shell, Saturn Oil + Gas, Plug Power - Energy stocks in focus

Oil prices remain in bullish mode, reaching a new seven-year high. The latest increase was due to an explosion of a critical oil pipeline between Iraq and Turkey, through which up to 450,000 barrels of crude oil are transported daily. In general, the supply situation remains tight. OPEC expects a further increase in global oil demand. The primary beneficiaries of this supply shortage are oil producers; they were already able to post record results last year.

Read