Comments

Commented by Stefan Feulner on May 27th, 2022 | 10:30 CEST

Nel ASA, Erin Ventures, NIO - Using setbacks as long-term opportunities

Since Russia invaded Ukraine, stock markets have corrected sharply, and volatilities have increased significantly. The S&P 500 Volatility Index VIX, for example, rose from under 20 to a high of over 35 points. Individual stocks are also still subject to high fluctuations, with market leaders in promising future-oriented sectors such as hydrogen fuel cell technology, photovoltaics and wind energy losing more than 50%. In such market phases, an anticyclical entry can represent a particularly worthwhile investment. A historic opportunity could also present itself in a critical commodity.

ReadCommented by Armin Schulz on May 26th, 2022 | 11:22 CEST

BioNTech, Meta Materials, Plug Power - Future stocks for tomorrow's profits

Shares that focus on future trends harbor both risks and opportunities. If a breakthrough succeeds in a new area, high returns beckon. The business areas can be very different, but they have one thing in common: they will revolutionize people's lives in the future. Examples from the past include computers and cell phones, which ultimately permeated society. Today, we look at three companies that could significantly impact the future.

ReadCommented by Fabian Lorenz on May 26th, 2022 | 11:07 CEST

Nel ASA and Siemens Energy - buy or underweight? dynaCERT with sales partner

It is undisputed that the future belongs to renewable energies. New subsidy programs are passed almost weekly - especially in Europe. However, it is unclear whether now is the time to enter the market. Buy, or wait and see? Among other things, analysts do not agree on Nel ASA. After weak figures, JPMorgan has reduced the price target for the shares of the hydrogen specialist. And at Siemens Energy, too, opinions are divided. High inventory levels are a cause for concern. At the hydrogen company dynaCert, following personnel changes, there are again positive headlines due to a sales partnership and the hope for a share price recovery. Last week, the dynaCert CEO expressed confidence at an investor conference.

ReadCommented by Stefan Feulner on May 25th, 2022 | 13:06 CEST

Asia on the rise - Good rebound opportunities for JinkoSolar, Hong Lai Huat and BYD

Asia has become the engine of global growth in recent years. Demographics and digitalization have driven economic and business expansion. Compared to the Western world, for example, the COVID-19 crisis was better managed, and the economy showed greater resilience. After the pandemic, the region is expected to return to a steep growth path. The real estate market is also experiencing strong growth. Alongside China, Hong Kong and Singapore, the Kingdom of Cambodia, in particular, is growing into a new region of prosperity.

ReadCommented by Carsten Mainitz on May 25th, 2022 | 12:49 CEST

First Hydrogen, Plug Power, SFC Energy - Green hydrogen is booming!

Reducing energy dependence on Russia is currently the top priority for Europe. To this end, the expansion of renewable energy sources is being massively accelerated. However, a massive expansion of the energy grids is also necessary for a sensible distribution. In addition, storage options are needed. That is where hydrogen comes into play. Suppose it is produced from regeneratively generated electricity with the help of electrolyzers. In that case, we have a CO2-neutral energy carrier which can then be transported with little logistical effort - so-called "green hydrogen". The following companies are looking to take advantage of this.

ReadCommented by André Will-Laudien on May 25th, 2022 | 11:46 CEST

Infineon, BrainChip, Daimler, Volkswagen - High-tech stocks at their best!

The global automotive business is operating according to new laws. That is because e-mobility is a done deal, and if politicians' pronouncements are anything to go by, combustion engines will be history from 2030. As a result, the prerequisites for the industry are also changing because intelligent and powerful chips remain the basis for the further development of future mobility. Supply chains and Chinese reliability are still a problem, and high raw material prices will not make the new vehicles any cheaper. Innovations could be an effective means of combating the erosion of margins. Who is ahead in the market of high-tech players?

ReadCommented by Nico Popp on May 25th, 2022 | 10:44 CEST

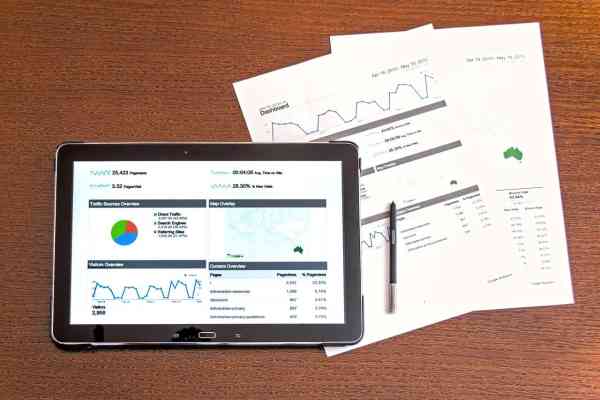

All eyes on Deutsche Bank and Commerzbank - but Aspermont has the greatest leverage

The two best-known German banks are currently in demand on the market. Why? The interest rate turnaround means that the typical bread-and-butter business with loans is profitable again. Business picks up when banks have room to manoeuvre with interest rates in positive territory. Also, the increasingly weaker environment for corporate financing at the upper end of the risk scale ensures that banks take on a more critical role as traditional intermediaries. We take a closer look at Commerzbank and Deutsche Bank, but we also have an exciting second-tier stock on our list that could become an insider tip thanks to its unique selling propositions and growth potential.

ReadCommented by Fabian Lorenz on May 24th, 2022 | 13:26 CEST

Plug Power and BYD shares are strong: when will Almonty Industries take off?

In weak stock market phases, the top performers of the future often emerge. The Plug Power share, among others, is currently shining due to its relative strength. The weak quarterly figures of the hydrogen specialist Plug Power seem to have been ticked off. Instead, the focus is on political support and a large order. The BYD share is also holding up excellently against the backdrop of the ongoing lockdown in China. There is a tailwind from Credit Suisse, and the new premium model is well received. At Almonty Industries, the CEO expressed confidence about the outlook at an investor conference. The Company is fully financed and will soon dominate the tungsten market outside China and Russia.

ReadCommented by Carsten Mainitz on May 24th, 2022 | 12:21 CEST

Altech Advanced Materials, Varta, Mercedes - This way!

The latest data from the Federal Statistical Office speak a clear language. E-cars are increasingly in demand. Around 90% of German e-car production is exported. "Made in Germany" therefore still scores points. The performance of the batteries, adequate infrastructure and the availability of essential raw materials such as lithium are important parameters for rapid market penetration. Innovations always remain the trump card. Germany certainly doesn't have to hide in this respect.

ReadCommented by Stefan Feulner on May 24th, 2022 | 11:23 CEST

Lufthansa, wallstreet:online, Rheinmetall - The mood brightens

At this year's World Economic Forum in Davos, Switzerland, Robert Habeck, Germany's Minister for the Economy and Climate Protection warned of a global recession. Specifically, he said, there were four sources of danger in the form of high inflation, an energy crisis, food shortages and the climate crisis. In contrast, the mood of the German economy brightened considerably in May, despite the Ukraine conflict. "The German economy is proving robust despite inflation concerns, material shortages and the war in Ukraine," Ifo President Clemens Fuest said. "Signs of a recession are not visible at present." Ideal conditions for further rising quotations. Thus, several indices are again on the verge of striking buy signals.

Read