Comments

Commented by André Will-Laudien on July 5th, 2022 | 11:25 CEST

Climate shares: BASF, Erin Ventures, Nordex, BYD - The stuff dreams are made of!

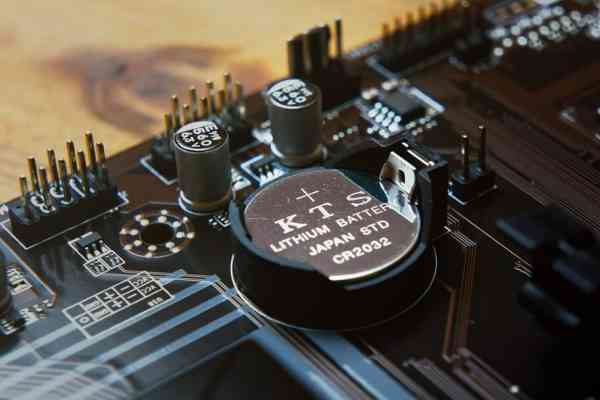

Germany and Europe will have to dress warmly for the coming winter because a stable energy supply seems to be more than endangered from today's perspective. Private households are probably largely at the mercy of this scenario, while the major industrial locations have been working on alternative backup concepts for several months. Battery technology should also be further promoted for local energy storage. An important material for the accumulators is boron, similarly necessary as lithium, but apparently, only few know this. We highlight some interesting aspects for investors.

ReadCommented by Stefan Feulner on July 5th, 2022 | 11:14 CEST

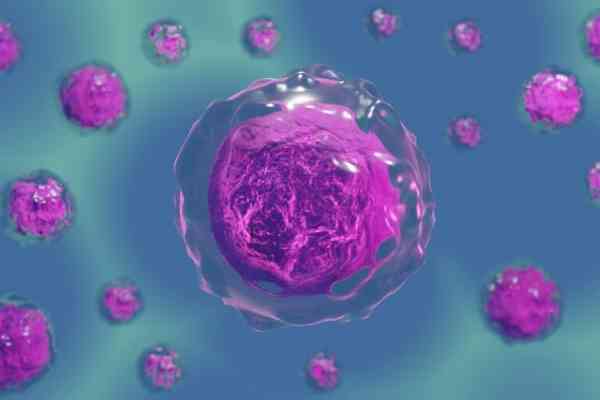

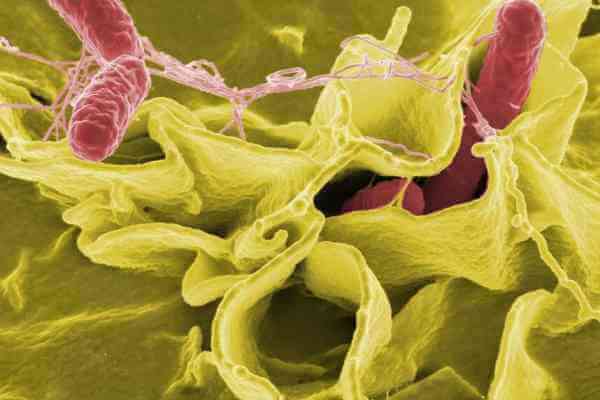

Strong signs at BioNTech and Defence Therapeutics, and Valneva closes the gap!

****Without question, the future belongs to biotechnology. The record-breaking development of vaccines, tests and drugs in the wake of the Corona pandemic, which broke out more than two years ago, showed how important this sector is for humanity. Biotechnology stocks are consolidating strongly despite being established as a critical future technology. The NASDAQ Biotech Index has lost about 40% since last summer, creating attractive entry opportunities for investors at a significantly reduced level.

ReadCommented by André Will-Laudien on July 4th, 2022 | 12:25 CEST

Attention, turnaround! Lufthansa, TUI, Desert Gold, Deutsche Bank: These stocks are taking off again!

From several perspectives, the ongoing crisis is a mammoth task for asset managers and private investors. First, after the long uptrend and the absolute boom valuation of growth stocks from 2015 to 2022, no one knows when a sufficiently high discount has been reached to re-enter. Some stocks, such as Plug Power, are very forward-looking and dependent on government contracts. Here there have already been sales valuations of a factor of 200. So is a P/S ratio of currently 12 after an almost 80% share price loss cheap or still hopelessly overpriced? We do not know because the ongoing war sets new market parameters daily. The major indices will therefore continue to search for a valuation basis in a very volatile manner. We pick out a few selected opportunities.

ReadCommented by Nico Popp on July 4th, 2022 | 12:20 CEST

Cars have a future - Here is how investors can invest: Mercedes-Benz, Altech Advanced Materials, Varta

Mobility is a valuable commodity - despite high fuel prices. Studies show that Germans have continued to drive their cars since the end of February. For some, there is no other choice; for others, independence is too important. If demand for a product or service is so little dependent on price, this is known as low price elasticity of demand. For investors, this insight can be an important orientation that is worth hard cash.

ReadCommented by Armin Schulz on July 4th, 2022 | 12:12 CEST

Defense Metals, Nordex, Rheinmetall - The world does not work without rare earths

Even if many people do not know much about the term rare earths, every one of us uses them. Without rare earths, there would be no smartphones, no wind turbines, no solar energy, cars and other high-tech devices. China has a virtual monopoly on rare earths. We first saw what would happen if China stopped supplying rare earths in 2010 when Japan stopped receiving supplies for a month. Prices for products containing rare earths shot up by a factor of 10. For this reason, the raw material also appears on the list of strategic metals in the USA and Europe. The EU plans to present the Raw Materials Act this fall to reduce dependence on China for critical raw materials.

ReadCommented by Stefan Feulner on July 4th, 2022 | 12:11 CEST

Extreme growth in demand for Ganfeng and Edison Lithium, XPeng and NIO with solid sales figures

The auto industry faces a massive supply problem in the coming years. The reason for this lies in the exploding demand for lithium, an elementary raw material for electromobility. While the lithium market was 33,000t per year globally in 2015, it rose to 85,000t by 2022. By 2030, when the German government plans to have 15 million electric cars on German roads, experts predict an annual demand of up to 400,000t. There is already a clear shortage of supply. The profiteers here are the lithium producers. After a sharp correction in the lithium sector, new opportunities are opening up in the long term.

ReadCommented by André Will-Laudien on June 30th, 2022 | 13:49 CEST

Biotech blockbusters: BioNTech, XPhyto Therapeutics, Valneva, CureVac - What to expect from these stocks?

Now that we have arrived in summer, the pandemic is weakening, and the media presence of the flu disease is also declining. That means less attention for pure-play vaccine makers, and now investors are asking how perhaps alternative money can be made. Is the pipeline of the protagonists strong enough to attract further investor capital, or will the whole industry go underground for the time being? We try our hand at being a truffle pig and dig beneath the surface. Which biotech stock has something up its sleeve?

ReadCommented by Fabian Lorenz on June 30th, 2022 | 12:44 CEST

BYD on board with Apple? Rebound at Nordex and Defense Metals?

The end of the combustion engine is the next driver of electromobility and thus also of renewable energies. After all, the electricity for e-cars has to come from somewhere. The EU has agreed to ban the sale of diesel and gasoline-powered cars from 2035. That should give further impetus to carmakers like BYD. This is just one of the many good news stories from the Chinese group. In the future, it is reportedly known that it will supply Apple. But from a chart perspective, investors need to pay attention. Nordex also has to be careful not to miss the boat with the competition. To this end, the wind turbine manufacturer has raised fresh capital. Both electromobility and wind and solar technology need selenium earths. And Defense Metals is benefiting from this.

ReadCommented by Juliane Zielonka on June 30th, 2022 | 11:39 CEST

Almonty Industries, Plug Power, BASF - Energy becomes the most valuable asset

Europe is at a crossroads: The energy supply crisis is hitting Germany particularly hard due to its dependence on Russian gas. Alternatives must be found as quickly as possible. In Belgium, a hydrogen plant is being built to make one of the largest industrial ports more CO2-neutral - Plug Power is the development sponsor. BASF is already feeling the gas loss and is changing its strategy. Investors are fleeing the stock despite an 8% dividend. And electric top dog South Korea is also building on economic independence. A metal for nuclear energy is of particular value here - and so is Almonty Industries.

ReadCommented by Stefan Feulner on June 30th, 2022 | 11:03 CEST

Tocvan Ventures and BYD with outstanding news - TeamViewer plunges into a bottomless pit

The current correction has hit interest-sensitive growth stocks particularly hard. The US technology exchange NASDAQ, for example, has lost around 34% of its value since the beginning of the year and its high of 16,670 points. Investors did not even stop at shares in future technologies such as electromobility. But in contrast to top dog Tesla - Musk's shares have halved in value within six months - Chinese competitor BYD is rushing from one high to the next. There is also strong news from a promising gold and silver exploration company. A gold price that experts expect to be positive in the long term could help the company to outperform.

Read