Comments

Commented by Armin Schulz on August 17th, 2022 | 11:58 CEST

Daimler Truck, dynaCERT, Nikola - Which transportation stocks are taking off?

The transportation industry faces many challenges. These were addressed on July 15 at the 15th Truck Symposium, hosted at Nürburgring. Here, 110 experts discussed staff shortages, lack of parking spaces and new drive concepts. The latter is still the subject of controversial debate. Are fully electric transport vehicles the future, or will the hydrogen fuel cell prevail? The fact is that the transport industry must significantly reduce its emissions by 2030. Today, we look at three companies that offer solutions for lower CO2 emissions.

ReadCommented by Stefan Feulner on August 17th, 2022 | 10:41 CEST

Positive signs - Infineon, Defence Therapeutics, MorphoSys

A well-known rule says that stock markets trade the future. At the moment, politicians and monetary watchdogs are fighting to contain rampant inflation on the one hand and to prevent a global recession from occurring on the other. Added to this are geopolitical tensions in Ukraine and Taiwan. But the capital market has been robust for weeks, with the DAX alone gaining around 1,500 points since the beginning of July in this year's summer slump. But things are not turning out as predicted by the crash prophets, who are again in the spotlight. There are increasing signs that the stock market has already seen its lows.

ReadCommented by Nico Popp on August 16th, 2022 | 12:18 CEST

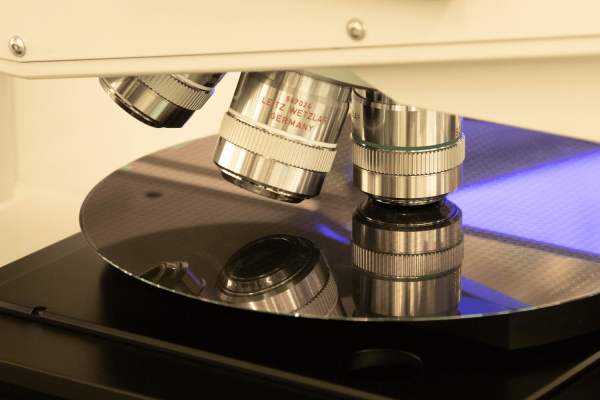

Gamechanger for chip manufacturers: Infineon, BYD, BrainChip, Volkswagen

Computer chips remain in demand. German manufacturer Infineon recently told Handelsblatt that the Company is planning deliveries with a lead time of around two years or more together with customers. As the newspaper estimates, this market situation is favorable for investors and ensures robust margins. We get to the bottom of the chip boom and explain where investors can find opportunities and where risks lie.

ReadCommented by Stefan Feulner on August 16th, 2022 | 10:40 CEST

Analysts enthusiastic about figures - K+S, Meta Materials, Deutsche Telekom

The second quarter results season is slowly drawing to a close. Overall, most companies were again able to surprise on the upside despite recession fears and supply chain problems. In addition, forecasts for the year were largely maintained despite risks relating to energy procurement and costs. Due to the correction in the first half of the year, many companies offer attractive entry opportunities at their current levels. In addition, analysts see price increases of over 50% for various stocks.

ReadCommented by Mario Hose on August 16th, 2022 | 07:08 CEST

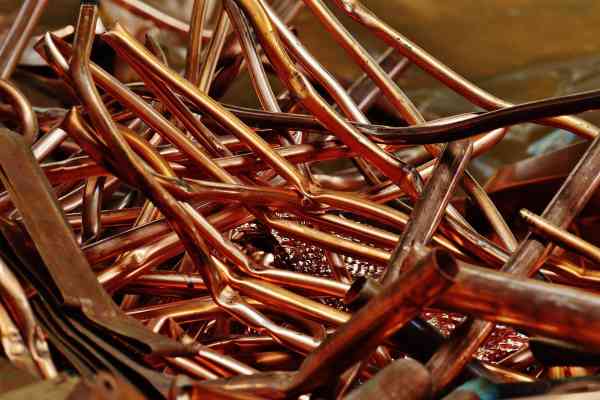

Kodiak Copper CEO Claudia Tornquist: The long-term picture for copper remains extremely strong

Copper is one of the important metals in modern life. When it comes to the energy transition and the change in mobility, the red metal is of great importance. In the global competition between industrial market players, access and price therefore play an important role. Raw material nations such as Canada supply the market with the ingredient of countless technical devices, which are often produced in the Middle Kingdom. For this reason, it is particularly interesting to hear the opinion of an expert. Claudia Tornquist is the CEO of Kodiak Copper Corp. and is exploring for new copper deposits in British Columbia.

ReadCommented by André Will-Laudien on August 15th, 2022 | 13:32 CEST

GreenTech shares: BYD, Alpha Copper, Nordex, JinkoSolar - Top stocks for the climate fight!

According to a study by the International Copper Study Group (ICSG) from 2020, Chile, Peru, China and the US were the largest copper producers in the world. Other significant deposits can be found in Australia, Indonesia, Russia, Canada, Zambia, Poland, Kazakhstan and Mexico. In Europe, the largest copper deposits are concentrated in Russia and Poland. When it comes to calculating the copper market in the next few years, expert opinions differ widely. According to a study by Wood Mackenzie, primary copper demand will increase by over 30% to around 25 million tons by 2030. And ore is already in more than short supply today. Where are the opportunities for investors?

ReadCommented by Stefan Feulner on August 15th, 2022 | 12:26 CEST

Long-term bottom reached? - Barrick Gold, Manuka Resources, Newmont

In 2022, a stock market year characterized by geopolitical uncertainties and major inflation concerns, investors were definitely wrong if they followed the old stock market adage "Sell in May and go away". Although the German stock market barometer DAX only marked a new low for the year of 12,385 points in July, it has since risen steeply by around 1,500 points. The precious metal gold was also able to turn around after a successful test of the critical support zone at USD 1,680 per ounce and set off for new highs after breaking through the USD 1,800 mark.

ReadCommented by Armin Schulz on August 15th, 2022 | 11:48 CEST

Rheinmetall, Kleos Space, Palantir - Is the Ukraine war spreading?

On July 27, the NATO Defense College presented a report warning of an attack by Russia on a NATO ally. According to the report, Russia could establish a military buffer zone. Initially, this would primarily affect countries of the former Soviet Union, first and foremost Moldova. In addition, analysts assume that Russia has not yet demonstrated its full military strength in Ukraine and can also quickly compensate for current losses. If the assumptions are correct, the war will continue for a while. We therefore take a look at three companies that should benefit.

ReadCommented by Nico Popp on August 15th, 2022 | 10:43 CEST

Who benefits from recession and inflation? BASF, Viva Gold, K+S

The market is currently staging a minor bear market rally. The reason: Falling energy prices and the first signs of lower inflation are fuelling hopes that the central banks may pause their interest rate turnaround sooner than expected. The prospect of a soft landing for the global economy has even sent cyclicals rising again in recent days and weeks. But what if inflation stays or the economy shrinks significantly in 2023?

ReadCommented by Juliane Zielonka on August 12th, 2022 | 10:10 CEST

Almonty Industries, K+S, E.ON - These companies benefit from the energy transition

The situation on the energy markets remains tense. The German Minister of Economics received a rejection from Qatar. Alternatives are urgently needed, such as solar and wind power. Almonty Industries is well positioned to source materials for these energies. The world's leading supplier of tungsten can become a decisive player in the market for the hunt for raw materials. Rising prices are benefiting the Company in this regard. The changed prices, in turn, play into the hands of fertilizer producer K+S. Higher average prices in both customer segments compensated for increased costs. In Western Europe, prices fell due to demand, which led to increased sales in Eastern and Northern Europe. Energy network operator E.ON warned of "valuation risks for investments" when publishing last year's results in March and surprised with the current results.

Read