Comments

Commented by Nico Popp on November 28th, 2022 | 12:25 CET

Is this patent causing a rare earths quake? Nordex, Defense Metals, BYD

Wind power is a crucial component of the energy transition. Rare earths are used to increase the efficiency of wind turbines and electric motors. Dysprosium and terbium, in particular, are in demand. But although rare earths are anything but rare, they are only found in a few regions worldwide. Scientists at Darmstadt Technical University have now developed processes to use rare earths more efficiently. We explain the technology and shed light on three stocks related to rare earths.

ReadCommented by Armin Schulz on November 28th, 2022 | 11:44 CET

Almonty Industries, ThyssenKrupp, Varta - Earning from growing tungsten demand

In 2021, 79,000 metric tons of tungsten were mined worldwide from existing mines. In 2015, production was still 89,400 tons. One might think that demand has declined and production has been cut back, but the opposite is true. According to the British Geological Survey report, demand will increase between 3% and 7% per year and will soon exceed available supply. But now, demand could increase significantly in the short term because US Department of Energy DOE researchers have found a way to charge electric cars in 15 minutes. This involves using a molybdenum tungsten niobate alloy as the cathode material instead of graphite. So we take a look at three companies around tungsten.

ReadCommented by Stefan Feulner on November 28th, 2022 | 10:41 CET

SynBiotic SE, Cardiol Therapeutics, Canopy Growth - Like hitting the jackpot

The final draft of the German government's key issues paper on the legalization of cannabis in Germany is ready, and final approval is likely to be a mere formality. For the companies concerned, this is equivalent to winning the lottery. The global cannabis market is expected to grow by 13.9% annually to USD 64.91 billion between 2022 and 2027. However, these profit increases have yet to reach the stock market. Some companies, for example, are trading below cash, while others lost more than 90% of their value in the correction that has been underway since 2019.

ReadCommented by Stefan Feulner on November 25th, 2022 | 23:16 CET

Viromed Medical AG, Encavis AG, K+S - The foundation is laid

For weeks now, the most important stock markets around the globe have been on an upward trend. What was initially only declared as a countermovement in the overriding downward movement could now be the start of a more pronounced year-end rally. While indices such as the DAX and the Dow Jones have already managed to break out of the downtrends they have been following since the start of the Ukraine war, smaller stocks, in particular, still offer considerable catch-up potential.

ReadCommented by Juliane Zielonka on November 25th, 2022 | 10:29 CET

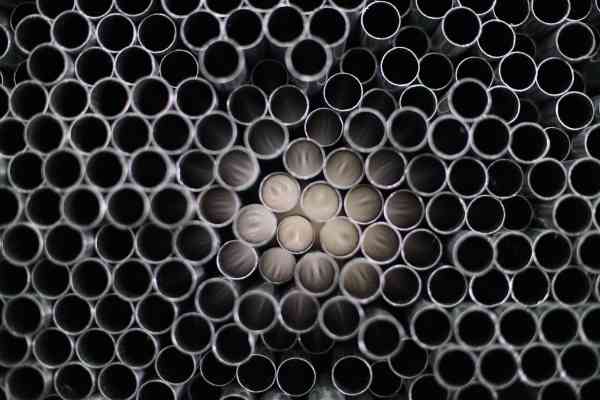

TubeSolar, Nordex, Siemens Energy - Energy drivers for the portfolio

German Engineering is a seal of quality, also abroad. What sometimes takes a little longer in development pays off in the long run. Solar system manufacturer TubeSolar from Augsburg can be pleased about a TÜV certification for its patented products. In Germany, the share of photovoltaics in the power grid rose by 11.2%, and worldwide the CAGR of PV installations increased by 32%. JinkoSolar, a leading Chinese manufacturer of solar modules, has also played a significant role in this growth. However, China shares entail risks. Siemens Energy is not without risk at the moment either. The management heads are changing in the internal takeover game of the Spanish wind energy company Gamesa.

ReadCommented by Juliane Zielonka on November 24th, 2022 | 14:14 CET

Rheinmetall, Saturn Oil + Gas, Amazon - These shares are growing in the face of crises

Tech groups like Amazon are laying off 10,000 employees to get back on track. Shareholders will be happy, and Amazon's Alexa department employees should quickly sign up with Indeed. The department is posting the biggest losses in 2022. Rheinmetall AG is off to a good start through the crisis. Thanks to the "ring swap" deal, the Düsseldorf-based company is now supplying the Greeks with fresh tanks. In turn, the Greeks give their Soviet-designed tanks to Ukraine's soldiers. Rheinmetall's share price has risen by 127.14% since the beginning of the year. Also among the crisis winners is Saturn Oil & Gas. With its numerous active oil drilling projects, investors have a broadly diversified portfolio at their disposal.

ReadCommented by Stefan Feulner on November 24th, 2022 | 14:01 CET

BYD, Globex Mining, Nordex - When does it really start?

Climate change is one of the greatest challenges of our time. With tighter targets for climate neutrality and billions in subsidies, politicians are stepping on the gas. Renewable energies are the only way to achieve a CO2-neutral world. Despite the long-term rosy prospects, companies in the peace energy sector have corrected sharply in recent months, with even market leaders posting losses of over 50% on the stock market. This represents a new opportunity to participate in the energy transition over the long term.

ReadCommented by Stefan Feulner on November 24th, 2022 | 13:01 CET

dynaCERT, Pathfinder Ventures, SFC Energy - Small caps on the upswing

After the sharp corrections of the last months, the time of suffering of many shareholders of growth companies seems to be over. The companies, which have been badly affected by the stricter monetary policy, are sending clear signs of life, both in terms of charts and fundamentals. Volatility is likely to remain in the coming months. From a long-term perspective, however, there are attractive entry levels at a significantly cheaper level with opportunities for a strong rebound.

ReadCommented by Fabian Lorenz on November 24th, 2022 | 12:40 CET

New year, rising prices? BASF, BioNTech and Manuka Resources - Shares in check

As the stock market year 2022 draws to a close, we look ahead to 2023. New year, rising prices? That is what many stock market players are hoping for. The chances are that we will see rising indices again with the end of interest rate hikes in the coming year. Today, we look at three companies likely to attract attention in 2023. At BioNTech, the research pipeline is full to bursting, and there are numerous study results to come. BASF is attractive due to its low valuation and high dividend yield. However, analysts warn of a write-off risk. Manuka Ressources convinces with a profitable core business, and an exciting project in the field of critical raw materials could lead to a revaluation.

ReadCommented by Nico Popp on November 24th, 2022 | 11:12 CET

What the heat turnaround means for copper: Siemens Energy, Kodiak Copper, ThyssenKrupp

Investors looking for the latest trends often focus on metals such as rare earths, vanadium and lithium. But if you want to get the future into your portfolio, you don't have to rely on exotic elements; copper offers the best conditions. As the British Building Services Research and Information Association (BSRIA) has shown on behalf of the International Copper Association, the demand for copper alone for climate-related refurbishment will increase to 160,000t by 2035 from the current 40,000t. That represents an annual growth rate of around 10%. We highlight three companies around the trend.

Read