Comments

Commented by Juliane Zielonka on November 18th, 2022 | 11:25 CET

Pfizer, Cardiol Therapeutics, Morphosys - Heart disease and cancer are on the rise!

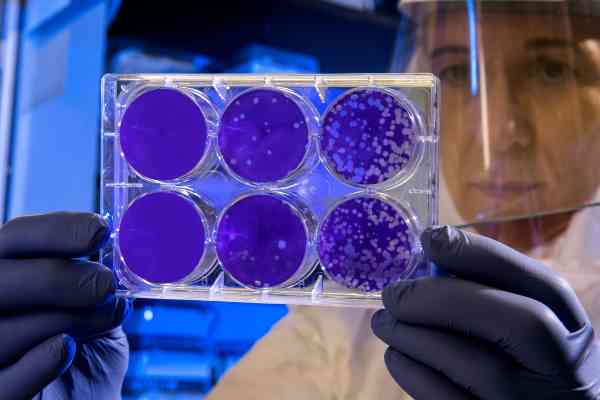

No sooner is the Coronavirus in retreat than the damage caused by the pandemic measures comes to light. Young men, in particular, are affected by heart inflammation after two vaccinations with the Pfizer or Moderna vaccine. Reason enough for both companies to react to the research results of a small Canadian study with a new study that brought exactly that to light. On the other hand, the increase in myocarditis and pericarditis represents a great opportunity for Cardiol Therapeutics to successfully develop its active ingredient against pericarditis. So far, there is only one treatment available in the US that is purely inpatient, and it is in the five-digit USD range. With Cardiol's active ingredient, it may be possible to contain pericarditis more economically and effectively. Another consequence of the pandemic is an increase in cancer cases. Due to late diagnosis and a lack of access to health care, cancer is becoming a global health problem. Morphosys, still reeling this week from disappointing Alzheimer's trial results, however, has promising drugs in the pipeline.

ReadCommented by Fabian Lorenz on November 18th, 2022 | 10:15 CET

Shares of Nordex, BYD, and Almonty Industries: Winners of the energy transition

The energy turnaround is becoming unbearable. But it will take time for the world to switch to renewable energies in private and public life. Today, we take a look at three winning stocks. Among them is BYD. The Chinese carmaker has switched to hybrid and all-electric vehicles and is on track to take Tesla's place as the leading electric carmaker. The first three models for Germany have now been confirmed. At Nordex, sentiment is improving. The share price has jumped, and a large order gives hope. However, wind turbines and batteries cannot be manufactured without raw materials such as tungsten. Now a German research house has taken a closer look at Almonty Industries. The share is on the verge of a revaluation and has a price potential of 100%.

ReadCommented by Juliane Zielonka on November 17th, 2022 | 13:48 CET

BioNxt Solutions, Pfizer, Bayer - Biotech and pharma stocks in focus

Pharma and biotech companies are still booming. However, large corporations like Pfizer and Bayer need help maintaining their market dominance with long-term studies and patent extensions. Pfizer, in particular, experienced the rush of speed in recent years thanks to the emergency approval of the Covid-19 vaccine. In hindsight, however, voices are growing louder about the potential long-term damage of this market cut. Multi-million dollar lawsuits may result. Positioning itself in the mental health niche, whose market size was USD 381.98 billion in 2020, is BioNxt Solutions. Their mission: to tackle depression, anxiety and PTSD with natural substances. A look at the data.

ReadCommented by Stefan Feulner on November 17th, 2022 | 12:10 CET

Rheinmetall, Defense Metals, Nordex - Top opportunities in critical commodities

A quick end to the Ukraine conflict is becoming increasingly remote due to recent events. NATO's military buildup is giving the global defense industry a boom that will likely lift company sales to a new level in the coming years. An important building block for implementing weapons systems is the use of rare earth metals. However, China has a monopoly on the critical raw material value chain, a country that is itself in the midst of an escalating conflict with Taiwan.

ReadCommented by André Will-Laudien on November 17th, 2022 | 11:20 CET

The big catch-up - China Big Tech: Alibaba, Deutsche Bank, TUI and Desert Gold turn up the heat!

Investors increasingly look at the big losers in heavily sold markets because the size of the markdowns identifies potential for the future. Often shares fall because of the general market weakness, but sometimes the operating business also weighs heavy. At the end of the year, there is also "tax-loss selling", especially in North America. We look at some stocks that have suffered significant losses but could now take off again.

ReadCommented by Fabian Lorenz on November 17th, 2022 | 10:40 CET

Breaking news drives Nel ASA share: What are BioNTech and Kleos Space up to?

Growth stocks are currently celebrating a comeback. In particular, when there is also positive news from the company itself, as is the case with Nel ASA. The share of the hydrogen specialist increased by 40% within 4 weeks, and analysts see further potential for their "Top Pick". And then the Norwegians announced a cooperation with General Motors yesterday. BioNTech is also looking good from a chart and operational point of view. The cash box is full, allowing the Mainz-based company to increase production capacities. There is also something happening with space stocks. The valuation of Elon Musk's SpaceX is said to have risen by USD 25 billion in the latest round of financing, which should also improve the environment for Kleos Space. The specialist in space-based high-frequency reconnaissance is facing important weeks.

ReadCommented by Armin Schulz on November 16th, 2022 | 13:30 CET

BioNTech, Meta Materials, and Amazon - Industry leaders belong in the portfolio

In 2021, the stock market world was still in order - it had been going nowhere but up for years. That was the peak of the stock hype, and many top dogs in their industries were very expensive from a fundamental point of view. That has changed significantly this year. Due to the Ukraine conflict, rising interest rates and ever-higher inflation, many industry leaders had to make significant losses. Even a drop of 50% was not uncommon. Yet the long-term outlook is good. Now that the stock market is slowly regaining momentum, it is worth taking a look at three companies that are leaders in their field.

ReadCommented by André Will-Laudien on November 16th, 2022 | 11:27 CET

That hit home! Roche and Morphosys fail with Alzheimer's study, Bayer and Defence Therapeutics continue to rise strongly

It is common for biotech stocks to publish study results as well as figures several times a year. Since there are usually only expenses and few sales to report for these stocks fundamentally, analysts focus on the clinical successes in the way of a trial for the approval of new active substances. This can sometimes lead to erratic price movements. Roche and Morphosys suffered the same fate at the beginning of the week, with their share prices plummeting on the back of bad news. We take a look at a hot sector.

ReadCommented by Nico Popp on November 16th, 2022 | 10:25 CET

Study shows how young people consume - TUI, Pathfinder Ventures, Amazon

Back in the 1980s, sunburn, cheese hedgehogs and bocce ball on the beach were simply part of the package for vacationers. Today, a vacation can be a bit more than that. Individual experiences and new cultures are in demand. As a study by the payment provider Klarna shows, young people, in particular, save significantly more than older generations in relation to their income. The most common savings goals are vacations, housing and pensions. Reason enough to take a closer look at some consumer stocks and their prospects.

ReadCommented by Nico Popp on November 15th, 2022 | 13:30 CET

This hydrogen news moves the share prices today: dynaCERT, Morphosys, Varta

When news moves prices, chart analyses and analysts' assessments are invalidated in one fell swoop. Today, momentum is building for the hydrogen stock dynaCERT. The reason: The Company, together with its new distribution partner, has announced deliveries to renowned mining groups. Among them are Vale, Nexa Resources and Antamina, one of the ten largest mining companies in the world. Is this a breakthrough for HydraGEN™ technology? We shed light on the exciting situation surrounding dynaCERT and also use the examples of MorphoSys and Varta to explain how investors can react when everything suddenly changes.

Read