Comments

Commented by Nico Popp on June 15th, 2023 | 08:55 CEST

Breakthrough for the e-truck? Daimler Truck, Siemens Healthineers, Almonty Industries

For a long time, hydrogen was considered the energy carrier for heavy machinery. Now Daimler Truck has high hopes for a battery-powered model of its Actros. We explain the background, shed light on what lies behind Siemens Healthineers' share buyback program and also introduce a company that could benefit equally from advances in medical technology and the run on modern batteries.

ReadCommented by Stefan Feulner on June 15th, 2023 | 08:35 CEST

Lufthansa, Tocvan Ventures, Aurubis - Optimism is growing

In the run-up to the interest rate decision in the US, investors were in a buying mood and lifted Germany's leading index, the DAX, to a new all-time high. The fact that the monetary guardians are stopping short of further increases in this interest rate cycle offers room for further price gains. The travel industry, which has been badly hit by the Corona pandemic, is also receiving a tailwind. The sharp drop in share prices in the recent past should offer attractive entry opportunities at the current level.

ReadCommented by Armin Schulz on June 15th, 2023 | 08:30 CEST

Deutsche Telekom, Saturn Oil + Gas, TUI - Which share has the most potential?

On June 14, all eyes were on the FED decision. Even though the decision impacts the market as a whole, the analysis of individual stocks is important to make sound investment decisions. The approach can vary, from a fundamental analysis to a technical analysis, a ratio-based decision to a qualitative analysis. In addition, one can take into account the recommendations of financial analysts. In the end, it is important to conduct one's own research and only invest when convinced about a stock. Today we look at three companies and analyze their potential in more detail.

ReadCommented by Fabian Lorenz on June 15th, 2023 | 08:00 CEST

Plug Power share unstoppable! BYD and Globex Mining are on the rise!

Three shares along the energy transition value chain: Plug Power is currently unstoppable. Yesterday, the stock of the hydrogen pureplay again gained around 5%. On a one-month horizon, the gain is now around 50%. And it could go on because Plug Power had fresh orders in its luggage at yesterday's analyst day. The BYD share has also regained momentum in recent weeks. If it manages to jump above USD 33.50, the way is clear for the time being. Globex Mining is also worth a closer look. With this share, investors can add a broad commodity portfolio to their portfolio and thus benefit from the super cycle in a risk-reduced manner.

ReadCommented by André Will-Laudien on June 15th, 2023 | 07:50 CEST

New record prices every day, but where is the perfect battery? Varta, First Phosphate, Volkswagen in focus

Without the next evolutionary step in traction batteries, it will probably be a long time before e-mobility can replace the combustion engine market. Short service life, limited flexibility and high production and disposal costs stand in the way of an economic approach, even if the red-green government likes to downplay these facts. In the end, politics has also failed to provide electricity in an appropriately "sustainable" manner and at an affordable price. Therefore, anyone who wants to promote ecology through politics must ensure that electricity prices are halved, and all currently required fossil components are eliminated from the energy mix. Otherwise, the enlightened consumer may revert to purchasing fuel-efficient internal combustion engine vehicles, even if they eventually have to import them into the EU at some point. Where are the opportunities for dynamic investors?

ReadCommented by Juliane Zielonka on June 15th, 2023 | 07:25 CEST

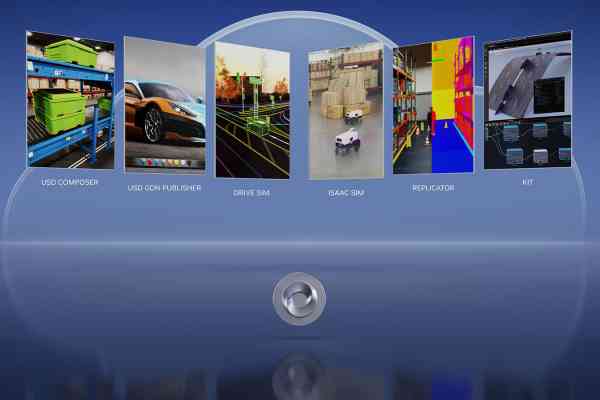

Nvidia, Defense Metals, Uniper - Valuable commodities for trillion-dollar digital market

Digital transformation is critical for industrial companies worldwide to remain competitive and gain strategic advantage. In this context, Nvidia and Hexagon have partnered to provide companies with a comprehensive set of solutions for accelerating industrial digitalization. Defense Metals, on the other hand, secured the supply of essential rare earths for the global energy transition with a successful hydrometallurgical trial and feasibility study. The Wicheeda project in British Columbia strengthens the local energy supply and offers strategic advantages in defence, security and green technology. Uniper, an international energy company, relies on biomass instead of natural gas for energy production. With the construction of a syngas plant in the Netherlands, the Company aims to replace natural gas with sustainable gas in chemical production processes.

ReadCommented by Nico Popp on June 14th, 2023 | 08:10 CEST

Hydrogen picks up - Where profits lurk: ThyssenKrupp, JinkoSolar, Manuka Resources

The hydrogen business is picking up speed worldwide. ThyssenKrupp plans to float its hydrogen subsidiary Nucera on the stock market before the summer break. This announcement is positive for the entire industry, as it indicates that ThyssenKrupp and the banks involved think the market is stable enough to get a reasonable price for shares in Nucera. We look at what is behind the IPO, which Greentech stocks are still interesting and which niche investors can profit disproportionately.

ReadCommented by Stefan Feulner on June 14th, 2023 | 07:55 CEST

Ballard Power, Regenx Tech Corp., FuelCell Energy - Greentech with signs of life

Hope dies last. Despite the rosy outlook with regard to achieving the climate targets, most shares from the renewable energy and electromobility sector have fallen sharply in recent months. Especially companies from the hydrogen sector performed far weaker than the broad market. With an optimistic statement from Plug Power CEO Andy Marsh regarding the achievement of short-term sales targets, several stocks closed in the green by double digits. This momentum may now have heralded at least a short-term rally.

ReadCommented by André Will-Laudien on June 14th, 2023 | 07:20 CEST

Despite the heat pump - uranium is in demand as never before! Rheinmetall, GoviEx Uranium, Palantir, C3.ai

Like a prayer wheel, green political ideas are raining down on the German industrial landscape - no more nuclear energy, but instead coal and gas. Historically high energy prices are to be accepted, even though wholesale prices are already below pre-war levels again and the energy mix is supposedly fed by more than 50% renewable energy. Because no one knows what the future holds for all this, major investment decisions by industry are now going against Germany. VW is investing EUR 10 billion in Spain, and BASF is doing the same in China. Valuable jobs that will no longer exist in Germany in the foreseeable future. What should investors keep an eye on to create at least sunny prospects in their portfolios?

ReadCommented by Fabian Lorenz on June 14th, 2023 | 07:00 CEST

Evotec, Morphosys, Defence Therapeutics: Strong biotech stocks

When thinking of strong biotech stocks in recent years, BioNTech likely came to mind initially. With the successful development of the COVID-19 vaccine, the Mainz-based company advanced to become the new industry high-flyer. But in the meantime, the Company has come back to reality. The coffers are bulging, but vaccine revenues are falling, and the development of the cancer pipeline will still take several years. Therefore, Evotec and Morphosys are currently celebrating a comeback. Analysts are hailing Evotec as the "Tesla of biotech," and price targets are rising. The Morphosys share has increased by more than 100% this year, and analysts believe the value is capable of even more. Due to positive news, investors can speculate on a rebound with Defence Therapeutics.

Read