Comments

Commented by Mario Hose on July 3rd, 2023 | 07:30 CEST

Better than Nvidia and Apple? Up to 150% price potential beckons for aifinyo, sdm and HelloFresh

Those who have bet on Big Tech companies this year are delighted with the high price gains. But haven't Nvidia, Apple, and even some DAX stocks run hot? A repeat performance like in the first half of 2023 is rather unlikely. Taking part of the profits is a good idea. And as a new investment, a whole range of companies are "still" in the shadow of Big Tech and AI hype. It is exactly here where there is also an opportunity. Today, we look at small and mid-caps where analysts say there is over 100% upside. Take aifinyo, for example. The B2B fintech published strong numbers for 2022 and the start of 2023 was also promising. sdm has also had a good start to the current year. Due to two acquisitions, revenue and profit are expected to multiply in the current year.

ReadCommented by André Will-Laudien on June 30th, 2023 | 07:30 CEST

Doublers are possible! Bayer, Defence Therapeutics, BioNTech, Valneva - It is hard to believe!

In 2022, a total of 19.5 million people received the shocking diagnosis of "cancer". Current trends, unfortunately, suggest that this number will continue to rise in the coming years. However, thanks to growing research successes, there is hope that biotechnology will significantly increase the chances of survival for those affected. It is a matter of developing suitable active substances and launching modern therapies. mRNA technology has recently made a name for itself in cancer prevention. Innovative biotech companies are back on the radar of risk-conscious investors. We are on the lookout for doubling potential.

ReadCommented by André Will-Laudien on June 29th, 2023 | 08:50 CEST

100% with Clean Energy! BYD, Regenx Technologies, BASF, Siemens Energy - Recycling is becoming a challenge!

As Western governments finally take climate protection seriously, the media has focused on the areas of energy, mobility, and health. It is clear to all participants that the changes in the world's climate will lead to undesirable developments. Glaciers are melting, the Earth's temperature is rising, and our oceans are already too warm for many species. Huge investments are being made in renewable power generation and modern mobility solutions. The high growth requires access to metals. Recycling also plays a major role because it conserves valuable resources and brings raw materials back into the cycle. Some companies are making a name for themselves, and shareholders can benefit from this.

ReadCommented by Fabian Lorenz on June 29th, 2023 | 08:10 CEST

Change of favorites in hydrogen shares! ThyssenKrupp instead of Nel ASA? Can Grid Metals take off?

Is there a shift in favorites among hydrogen stocks? It certainly seems that way. While former favorites Nel ASA and Plug Power are struggling, ThyssenKrupp is making a strong entry with the IPO of Nucera. The subscription period for the hydrogen subsidiary has been running since Friday, and demand already exceeds supply. In contrast, Nel ASA and Plug Power are being left behind. The Danes, in particular, are facing technical chart challenges and are struggling to maintain the EUR 1 mark. But perhaps the hype around Nucera is an entry opportunity for the established hydrogen specialists. And what about lithium? Stocks such as Standard Lithium and Alkem have been trending nicely in recent weeks. Grid Metals has yet to gain momentum, despite plans to process lithium as early as 2024.

ReadCommented by Nico Popp on June 29th, 2023 | 07:50 CEST

Hydrogen abc - Everything about opportunities and risks: ThyssenKrupp, Daimler Truck, First Hydrogen

Hydrogen is experiencing a boom. The upcoming IPO of ThyssenKrupp subsidiary Nucera has a signal effect. At the beginning of the subscription period, the demand for the shares of the hydrogen specialist exceeded the supply. The shares are to be traded for the first time on July 5. Here we will discuss what Nucera's IPO means for the industry and where risks and opportunities lurk.

ReadCommented by Stefan Feulner on June 29th, 2023 | 07:30 CEST

The profiteers of the new super cycles - SAP, Defense Metals, Hut 8 Mining

Every new innovation takes time and is also not protected from delays. This can be clearly seen in the example of listed renewable energy companies. At the beginning of the new decade, these companies were praised with great anticipation, but disillusionment quickly set in due to the lack of sales and profits. On the other hand, the fact that this sector will prevail in the long term due to the energy turnaround is a foregone conclusion. The situation is similar for artificial intelligence and blockchain technology.

ReadCommented by Juliane Zielonka on June 28th, 2023 | 08:30 CEST

Manuka Resources, BYD, Rheinmetall - Hot commodity rally on the stock market

Manuka Resources expands mining projects in New South Wales following the acquisition of Trans-Tasman Resources. The strategic plan calls for increased gold production at Mt. Boppy Gold Mine. Carmakers struggle for profitability in China, while BYD posts a net profit of USD 2.5 billion. President Xi Jinping is promoting battery-powered vehicles with incentives for consumers. Warren Buffett reduces his BYD shareholding. Rheinmetall wins the order to supply 14 Leopard 2A4 main battle tanks to Ukraine. The order is financed by the Dutch and Danish governments. Delivery of the first vehicle is scheduled for January 2024. Rheinmetall has already delivered Marder infantry fighting vehicles and received another order.

ReadCommented by Fabian Lorenz on June 28th, 2023 | 08:05 CEST

Hydrogen vs battery shares: From Plug Power to Standard Lithium and Power Nickel?

Who does the future belong to? Hydrogen or battery technology? The truth likely lies somewhere in the middle, and both technologies will find their place. However, it is clear that batteries currently have the upper hand in the context of electromobility. This can also be seen in the stock market. While companies like Nel ASA and Plug Power are struggling, Tesla, BYD & Co. are celebrating record sales. But success is heavily dependent on the supply of raw materials. Lithium and nickel are scarce and in high demand. Standard Lithium and Power Nickel are among the profiteers. Standard Lithium is recommended as a buy by analysts with around 100% price potential. Power Nickel has again published promising drill results, which could multiply the upcoming resource estimate. Plug Power is currently overshadowed by the Nucera IPO, but there is some interesting news.

ReadCommented by Juliane Zielonka on June 28th, 2023 | 07:40 CEST

Cardiol Therapeutics, Bayer, BASF - Sensational breakthroughs in medicine and sustainability

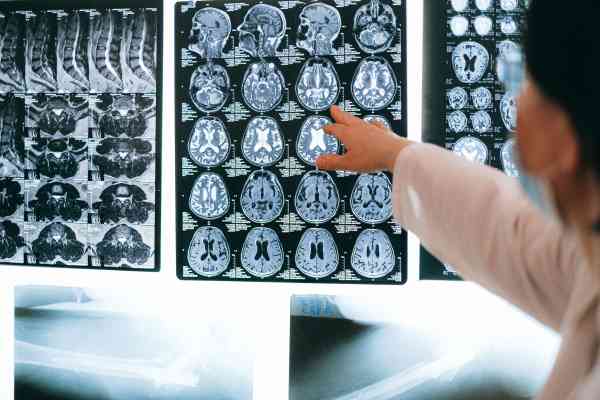

A study in the JACC journal shows that cardiovascular risk factors and diseases will increase sharply in the US. Ischemic heart disease is projected to increase by 31.1%, heart failure by 33.0% and myocardial infarction by 30.1%. Cardiol Therapeutics, a Canadian company specializing in cardiovascular diseases, is thus rapidly gaining in importance. Bayer goes AI and partners for the first time with a Swiss hospital for a digital solution that supports radiologists in diagnosis and treatment. BASF invests with its venture arm in the Swiss startup DePoly, which has developed an innovative chemical recycling technology. Discover the sustainable solution behind this investment here.

ReadCommented by Armin Schulz on June 28th, 2023 | 07:20 CEST

Barrick Gold, Desert Gold, Lanxess - After setbacks, is now a good time to buy?

An old merchant's rule states: The profit lies in the purchase. This wisdom can also be applied to stock market trading. As an investor, waiting for a setback before buying is always advisable. This avoids the danger of entering at a high. After the start of the banking crisis, the gold price soared, and those who bought then are now at a disadvantage. With the recent decline in the gold price, there may be an interesting opportunity to enter the market again. We, therefore, take a look at two gold companies. Finally, we will analyze Lanxess, whose shares recently suffered heavy losses.

Read