Comments

Commented by Fabian Lorenz on January 14th, 2026 | 07:35 CET

Fraunhofer Sounds the Alarm! Will Batteries Soon Be Scarce from China? NEO Battery Materials Offers an Alternative – Launching in 2026!

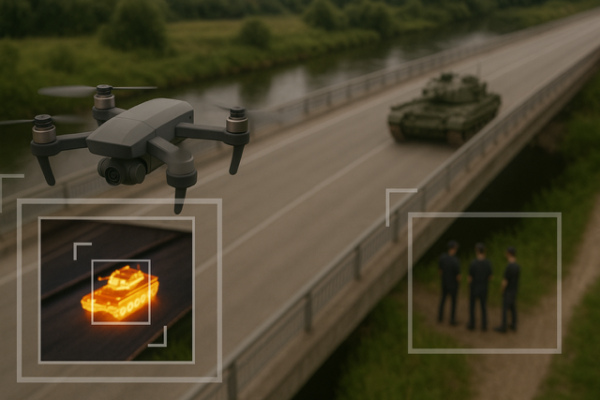

Fraunhofer is sounding the alarm with unusual clarity. Europe's largest research and innovation organization warns that China's new trade policy measures on battery technology pose a strategic risk. In extreme cases, an export ban could become a reality "in a very short time." What is particularly explosive is that Beijing is not only targeting batteries and preliminary products, but also the machines without which no cell factory can start up. This could not only slow down German car manufacturers' race to catch up in electromobility but also create bottlenecks in drones, robotics, and other emerging technologies. Battery suppliers from "Western" production, such as NEO Battery Materials, could benefit from this development. The Company's revolutionary technology is market-ready, with mass production set to begin in South Korea. NEO shares currently appear undervalued.

ReadCommented by Carsten Mainitz on January 14th, 2026 | 07:30 CET

Silver boom with no end in sight! Strong price drivers for Silver Viper, First Majestic Silver, and Pan American Silver!

Silver has been underestimated for a long time, but that changed abruptly last year. The silver boom has been gaining momentum, especially in recent weeks. Currently, a troy ounce costs around USD 85. Like no other commodity, this precious metal combines two worlds – monetary security and a key industrial component. Analysts are increasingly raising their price targets, even beyond the USD 100 mark. The silver market is tight and sensitive to changing conditions. Past price developments reflect rising demand, supply bottlenecks, and a short squeeze. For silver producers and future miners of the precious metal, these are ideal conditions that should cause share prices to rise further.

ReadCommented by Nico Popp on January 14th, 2026 | 07:20 CET

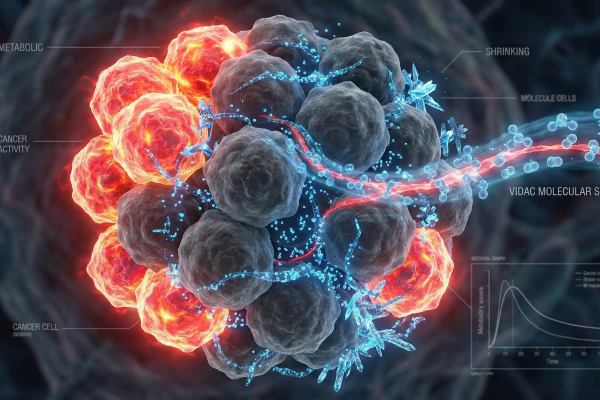

Targeting cancer metabolism: Why Bayer and Pfizer are restructuring - and why Vidac Pharma is filling a scientific gap

The investment year 2026 marks a decisive turning point for the global biotechnology and pharmaceutical sector. After a period of macroeconomic uncertainty, we are witnessing a renaissance in the life sciences, driven by two fundamental forces: the urgent need for big pharma players to replace their expiring patents with innovation, and the scientific breakthrough of novel mechanisms of action in agile biotech small caps. While industry giants such as Pfizer and Bayer are attempting to steer their cumbersome tankers onto a new course through massive restructuring, the as-yet little-noticed biotech company Vidac Pharma is delivering the technological innovation the market is looking for. With an approach that directly addresses cancer metabolism and reverses the "Warburg effect," which has been known for almost a century, Vidac is positioning itself as a disruptive force in oncology and dermatology. For investors, this constellation offers a rare opportunity: to observe the stability of the giants while betting on the explosive potential of a technological innovator that analysts say is massively undervalued.

ReadCommented by Carsten Mainitz on January 14th, 2026 | 07:10 CET

With these data-driven and scalable business models, investors are on the winning side: Aspermont, Palantir, and SAP!

Data is a fundamental part of the economy and our everyday lives. Companies that not only collect data but can also systematically refine, monetize, and scale it are creating business models with enormous leverage. Palantir transforms fragmented information into decision-relevant intelligence for corporations and governments. SAP's software maps corporate data in real time and makes it usable. The often overlooked specialist Aspermont transforms data in the commodities sector into high-margin digital subscription models. All three companies are united by a scalable platform mindset. Where are the biggest opportunities?

ReadCommented by Nico Popp on January 14th, 2026 | 07:05 CET

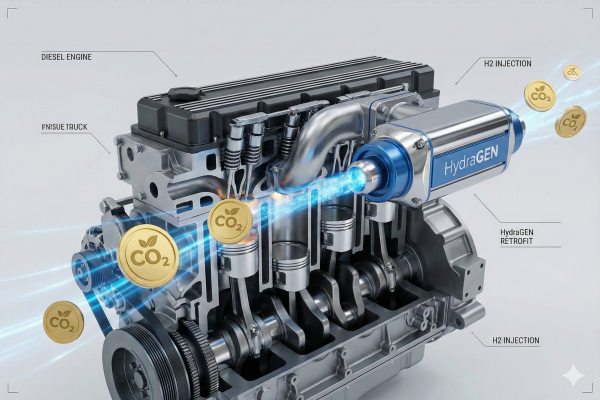

Between euphoria and industrial realism: How Linde, Hapag-Lloyd, and dynaCERT are defining the new reality of the hydrogen economy

We are witnessing a decisive turning point in the global hydrogen economy: The phase of speculative euphoria that characterized the beginning of the decade has given way to a phase of industrial realism and technocratic implementation. In investor circles and industry analyses, the term "mean reversion" has become established – a return to reality, away from unrealistic hyper-growth scenarios and toward physically feasible projects. According to the International Energy Agency's (IEA) Global Hydrogen Review 2025, the hydrogen sector continues to grow steadily and reached demand of nearly 100 million tons in 2024, but the structure of this growth is more complex than previously forecast. In this new environment, where regulatory interventions such as FuelEU Maritime and emissions trading (EU ETS) set the pace, three distinct winner profiles are emerging: infrastructure giant Linde, logistics heavyweight Hapag-Lloyd, and technology bridge builder dynaCERT, which occupies a highly compelling niche.

ReadCommented by Armin Schulz on January 14th, 2026 | 07:00 CET

The resilient winners: How to play it safe with Almonty Industries, Rheinmetall, and Hensoldt

While stock markets are celebrating, a new economic era is quietly dawning. Driven by geopolitical power struggles, a relentless battle for critical raw materials, and the return of strategic state intervention, unexpected winners are emerging. These forces are reshaping tomorrow's investment landscape and elevating select companies into key strategic roles. The rise of Almonty Industries, Rheinmetall, and Hensoldt shows how investors can benefit from this historic shift.

ReadCommented by André Will-Laudien on January 13th, 2026 | 07:40 CET

Silver +200% - Gold doubles! Time for acquisitions? Barrick, B2Gold, Desert Gold, Glencore, and Rio Tinto in focus!

The geopolitical situation brings new uncertainties every day. Most recently, markets reacted strongly to news around the removal of Venezuelan President Maduro, and now massive unrest in Iran has been added to the mix! Commodity prices are galloping against the backdrop of fragile supply chains and the formation of Eastern and Western power blocs with conflicting interests. While the US is formulating its expansionist agenda towards Greenland and Canada, China is responding with further export restrictions. This is exacerbating the situation even further and driving up the prices of silver to USD 85 and gold to over USD 4,600. Both established mines and promising projects are coming into focus, and takeover rumors are circulating once again. How are investors supposed to keep track of all this? We are happy to help.

ReadCommented by Fabian Lorenz on January 13th, 2026 | 07:30 CET

This stock is skyrocketing! Antimony Resources is stealing the show from MP Materials and Standard Lithium!

While investor attention is mainly focused on rare earths and lithium, antimony is quietly gaining momentum. The US government is attempting to free itself from its dependence on China through a billion-dollar deal. In China, antimony smugglers are being sentenced to lengthy prison terms. And Antimony Resources' stock exploded by 18% on Friday. As a result, the Company is increasingly stealing the spotlight from investor favorites in the critical raw materials sector, such as Standard Lithium and MP Materials. This trend could continue over the course of the year, as the exploration project appears to be a real hit, and Antimony Resources' shares still look far from expensive.

ReadCommented by Stefan Feulner on January 13th, 2026 | 07:25 CET

D-Wave Quantum, Silver Viper, Tilray Brands – The year of decisions

2026 could be a year of major decisions for investors. Geopolitical tensions, fragile supply chains, and growing mountains of debt suggest that precious metals will remain at the top of institutional investors' shopping lists. At the same time, technological change is advancing. Quantum computing is evolving from a promise for the future to a key strategic technology, with noticeable momentum in research and investment. The cannabis industry also remains particularly exciting. After years of disappointment, there are increasing signs of a possible turnaround. Tilray Brands made its first mark with strong quarterly figures and improved cash flow.

ReadCommented by Carsten Mainitz on January 13th, 2026 | 07:20 CET

Enormous growth ahead due to hunger for electricity: CHAR Technologies, Siemens Energy, and Nel – Who is in the lead?

Global electricity demand is exploding. What was once considered a stable, moderately growing market has been transformed by two powerful megatrends. AI applications, cloud infrastructures, and energy-intensive data centers are causing electricity demand to rise sharply. At the same time, decarbonization is putting increasing pressure on the economy and society. Many countries have committed to climate neutrality by 2050. This raises a key question for investors: Who can satisfy the growing demand for electricity in a reliable, affordable, and climate-neutral way?

Read