Comments

Commented by Nico Popp on July 17th, 2025 | 07:25 CEST

Investing in graphene – Research unlocks opportunities: Argo Graphene Solutions, BASF, Samsung

Innovation often needs a catalyst - an event that accelerates the adoption of new technologies and pushes companies to explore new directions. The past few years have been full of such catalysts: climate change has driven efforts to reduce CO2 emissions, and the US government's rumbling attacks on Ukrainian President Volodymyr Zelenskyy have prompted a global rethink of defense spending. Graphene, a material of the future, is at the center of many of these developments – reason enough to explore potential investment options.

ReadCommented by André Will-Laudien on July 17th, 2025 | 07:20 CEST

Will Trump seize Greenland's resources? 300% opportunity with MP Materials, European Lithium, CRML, Glencore, and DroneShield

US President Donald Trump has recently reaffirmed his long-standing interest in acquiring Greenland. In April, he did not rule out military options and called control over the island an "absolute necessity" for US security. At the same time, negotiations are underway on the possibility of binding Greenland more closely to the US through a special agreement, a so-called Compact of Free Association (COFA), without formal annexation. However, the Danish government and the Greenlandic administration have signaled their clear rejection: Greenland is not "for sale" and its residents have no interest in becoming part of the US. Rising global tensions and the increasing scarcity of strategic raw materials are putting pressure on industry. The first effects are already being felt, particularly in the high-tech and defense sectors. A rush on strategic metals is underway - and investors are taking notice.

ReadCommented by Nico Popp on July 17th, 2025 | 07:15 CEST

Silver becomes a defense metal: Silver North, Rheinmetall, Siemens Healthineers

US President Donald Trump's ultimatum to Russia is less than four days old, and it is already clear that it will go unanswered. Russia is continuing its attacks on Ukraine and shows no signs of backing down. At the same time, the defense industry is continually striking new deals, expanding capacity, and investing in innovation. Many of these innovations require silver. We explain the surge in demand for this precious and industrial metal and highlight investment opportunities.

ReadCommented by Fabian Lorenz on July 17th, 2025 | 07:10 CEST

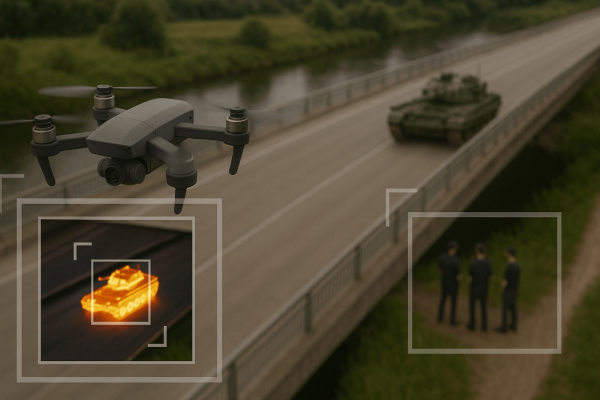

Armament stocks make a splash! RENK, DroneShield, Volatus Aerospace - Drones instead of tanks?

A major shake-up in the defense industry! KNDS is set to go public later this year, and the German federal government may participate in the IPO, which would also result in an indirect stake in RENK. KNDS has a stake in the gearbox specialist, and the two companies are jointly building the Leopard 2, among other things. But are tanks still relevant? The war in Ukraine has at least exposed their vulnerability and ushered in the age of drones. Volatus Aerospace and DroneShield are benefiting from this, with their shares having multiplied in recent months. However, more and more orders are now coming in from NATO. Revenue and profits are likely to explode in the coming years.

ReadCommented by Armin Schulz on July 17th, 2025 | 07:05 CEST

Bayer, NetraMark, Evotec: How AI Research is accelerating returns and could optimize your portfolio

In 2025, the healthcare industry is undergoing a radical transformation driven by AI and advanced technologies. While pharmaceutical giants struggle with cost pressures and regulatory hurdles, algorithms are revolutionizing drug development by decoding clinical data in record time and enabling personalized therapies. In this period of disruption, innovative strength will determine victory or decline. Three companies are at the forefront of this shift: Bayer, with its broad portfolio; NetraMark, leveraging AI-powered data analysis; and Evotec, with its disruptive research collaborations. Find out what is currently driving these stocks.

ReadCommented by Fabian Lorenz on July 17th, 2025 | 07:00 CEST

300% share Almonty Industries: What is next? Strategic partnerships like MP Materials?

Following its NASDAQ listing on Monday, things have quieted down somewhat for high-flyer Almonty Industries - a healthy pause after a year-to-date rally of over 300%. This may even present a buying opportunity or a chance to increase positions. The tungsten gem is likely to generate significant positive news flow in the coming months, including the production start at its tungsten mine in South Korea, new analyst coverage, and possibly even a strategic partnership, similar to what MP Materials achieved. The latter recently made headlines with a US government investment and a partnership with Apple. Although tungsten is not classified as a rare earth element, it can be considered just as critical for defense and high-tech applications.

ReadCommented by Fabian Lorenz on July 16th, 2025 | 07:25 CEST

WINNING STOCKS for the second half of the year!? Rheinmetall, Bayer, and Hotstock PanGenomic Health

Hard to believe: Bayer shares are among the winners in 2025. And even the news flow is positive. Does the Leverkusen-based company even have a new blockbuster in the pipeline? What do analysts say? PanGenomic Health shares could be among the stars of the second half of the year. With a new health app, the Company is entering a billion-dollar market in the US and benefiting from the Trump administration. If it succeeds in securing market share, the stock should have plenty of upside potential. Analysts believe that the air is getting thinner for Rheinmetall shares. However, it is likely only a matter of time before the EUR 2,000 mark is broken.

ReadCommented by André Will-Laudien on July 16th, 2025 | 07:20 CEST

Does Trump love hydrogen after all? The sector is celebrating! Plug Power, Nel, dynaCERT, and MP Materials are in rocket mode

Global pressure to reduce climate-damaging emissions is growing, and the hydrogen sector is increasingly coming into focus. Although US policy under Donald Trump does not prioritize climate protection, Europe and Asia are resolutely pushing ahead with the transformation in mobility, logistics, and mining. Hydrogen technologies offer enormous potential here, especially in the heavy-duty sector. Innovative providers such as dynaCERT are focusing precisely on this area with tried-and-tested solutions for reducing emissions and increasing efficiency. The technologies are mature and ready for use, global demand is rising, and decision-makers are under growing public pressure to support sustainable alternatives. The sector remains relatively quiet, but with a bit of industry rotation, the pendulum could swing quickly in the other direction.

ReadCommented by Armin Schulz on July 16th, 2025 | 07:10 CEST

Novo Nordisk, BioNxt Solutions, BioNTech – How to heal your portfolio with the 2025 healthcare revolution

The global healthcare system is facing a turning point in 2025. Climate change, chronic diseases, and the scars left by pandemics are challenging existing systems, while digitalization and AI are rapidly advancing new therapies. Governments are investing billions in modern healthcare infrastructure, but debates about data protection and scheduling doctor's appointments are escalating. While the WHO warns of stagnation, groundbreaking alliances between research and industry are emerging. This is precisely where Novo Nordisk, BioNxt Solutions, and BioNTech come in with visionary technologies that not only heal but also open up opportunities for investors.

ReadCommented by Nico Popp on July 16th, 2025 | 07:05 CEST

Success through foresight – The secrets of top CEOs: AJN Resources, LVMH, and Amazon

Managers are often portrayed by the public as soulless and interchangeable. But true visionaries still exist. Following in the tradition of Steve Jobs and Elon Musk, they make tough decisions early on, thereby preparing their companies to be future-ready. History shows that it can be well worth swimming against the tide at first in order to ultimately go with the flow. We examine key decisions made by Amazon, LVMH, and AJN Resources and demonstrate how foresight can unlock opportunities for investors.

Read