PLUG POWER INC. DL-_01

Commented by Stefan Feulner on December 1st, 2021 | 14:49 CET

Nel ASA, First Hydrogen, Plug Power - When will the next hydrogen wave come?

It can be frightening to watch the prices on the stock markets flashing red everywhere in the short term. The number of infections continues to rise worldwide, and a mutant called Omicron is spilling over from South Africa. On the other hand, the central banks continue to pour new money into the markets to promote economic growth. Hydrogen stocks are also correcting sharply at the moment, an opportunity for bold investors to position themselves for the long term.

ReadCommented by Fabian Lorenz on November 26th, 2021 | 13:04 CET

Plug Power with a bang - what are Nel and First Hydrogen up to?

Hydrogen shares are in demand again. The basis for the industry is the political will for hydrogen to become a central pillar of the energy transition. It applies to numerous industrialized countries, and Germany's new traffic light coalition will also stick to it. But there is also positive news from the companies in operational terms. Following ThyssenKrupp's plans to float its hydrogen division on the stock market, Plug Power has now reported a major order with charisma. That should also give new impetus to hydrogen shares such as First Hydrogen and Nel.

ReadCommented by André Will-Laudien on November 25th, 2021 | 12:58 CET

Nel ASA, Enapter, Plug Power, ThyssenKrupp - Hydrogen now or never!

It sounds crazy, yet we have arrived at the times when billionaires ask social platforms if they can flog a part of their shares to flush some money into the empty state coffers. In an age of powerful wealth shifts in favor of stock owners, this is perhaps legitimate, or nice, as it is sometimes referred to in the press. But appearances are deceptive. Behind a generally formulated question about whether one should sell shares lies the precise calculation of shifting blame if the announced sale causes a significant price loss. What then happens is a self-fulfilling prophecy with one small difference: the intention to sell was previously legitimized, so to speak, by public vote.

ReadCommented by Nico Popp on November 19th, 2021 | 10:55 CET

NEL, Enapter, Plug Power: Where does the music play for hydrogen?

Hydrogen is an essential pillar of the climate turnaround - after all, hydrogen as an energy carrier releases no CO2 and can be produced using renewable energy. But the technology is only just taking off. Such early phases are characterized by volatility and lean periods on the market. But those who believe in hydrogen for the long term can seize opportunities right now - after all, many shares are trading well below their peak prices. We present three stocks.

ReadCommented by Fabian Lorenz on November 16th, 2021 | 12:56 CET

Climate conference ends: Nel, Plug Power and Defense Metals continue with momentum

After two weeks, the climate conference in Glasgow has come to an end. The results are manageable. Although coal and other fossil fuels were declared to be phased out for the first time, the wording was watered down several times. For example, it was only possible to agree on a call that the use of coal-fired power plants without CO2 capture should be "gradually reduced". But even without concrete resolutions, one thing is sure: the energy turnaround is in full swing, and investor darlings Nel and Plug Power are again stepping on the gas. Defense Metals could be due for a reassessment after the completion of drilling.

ReadCommented by André Will-Laudien on November 12th, 2021 | 13:52 CET

NEL, dynaCERT, FuelCell Energy, Plug Power - How far will the hydrogen wave carry us?

The average temperature on Earth should rise by no more than 1.5 degrees Celsius over the next few decades. 190 countries agreed on this target in Paris in 2015. Since then, there have been four further world climate conferences. The fifth is now underway in Glasgow, Scotland, and is scheduled to end today, Nov. 12. It is not only the EU that is tightening its climate targets - around the globe, more and more countries are decarbonizing their economies. The topic of hydrogen is a rainmaker in this context. Here the question arises, when will it really start? According to the World Energy Council (WEC) analysis, at least 20 countries accounting for almost half of global economic output have already adopted a national hydrogen strategy or are at least close to doing so. We take a look at well-known protagonists.

ReadCommented by André Will-Laudien on November 5th, 2021 | 12:40 CET

First Hydrogen, Nel, Plug Power, Ballard - Glasgow UN Climate Change Conference ups the ante!

In its hydrogen strategy, the EU plans to expand electrolysis capacities to 40 GW for "green hydrogen" by 2030. Germany contributes one-eighth of the EU-wide total capacity within a national share and is a major driver of innovation due to its technological expertise. Green hydrogen refers to the use of electricity for electrolysis from exclusively renewable energies and is, therefore, a completely CO2-free hydrogen production. As a result, hydrogen technology is in the spotlight for climate-neutral energy production and reducing emissions. We get an overview of the listed protagonists.

ReadCommented by Stefan Feulner on November 3rd, 2021 | 13:50 CET

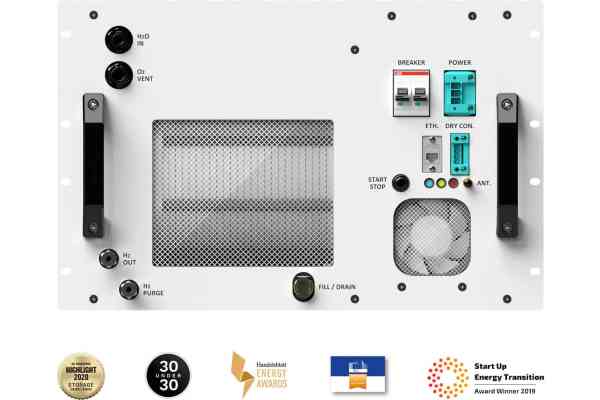

Plug Power, Enapter, SFC Energy - The hydrogen sector is alive

Last year, a strong boom was followed by a harsh correction, which brought even market leaders to their knees with share price losses of over 50%. That hydrogen technology is enormously important for achieving climate goals should be beyond question, even at the current World Climate Conference in Glasgow. The segment has a golden future with regard to the energy transition. Position yourself now and invest in the sector with disproportionately high potential.

ReadCommented by André Will-Laudien on October 29th, 2021 | 10:23 CEST

NEL, Plug Power, Royal Helium - Hydrogen rally, now it's rolling!

Only months ago, the comparatively expensive production of green hydrogen was put side by side with cheap Russian gas. Things can move that fast! The gas price has risen by 500% within 3 months, and the calculations are being recalculated. The explosive development of prices in the last 12 months shows how strongly shortages can affect the raw materials market. On average, known commodities increased by at least 25%, metals by 60-80% and energy doubled just like that. However, gas takes the cake with plus 600% in just 6 months, which gets the hydrogen industry buzzing. We take a closer look.

ReadCommented by Carsten Mainitz on October 27th, 2021 | 14:53 CEST

Enapter, Plug Power, Ballard Power - This is the future!

In 1875, Jules Verne wrote in his book "The Mysterious Island": "Water is the coal of the future. Tomorrow's energy is water that has been broken down by electric current. The elements of water thus decomposed, hydrogen and oxygen, will secure the earth's energy supply for the unforeseeable time." The visionary was right. For a successful energy transition, we need hydrogen solutions. Mass production is increasingly within reach for many companies, but most companies are still in the red. Who will be ahead in the future?

Read