PLUG POWER INC. DL-_01

Commented by Carsten Mainitz on October 22nd, 2021 | 12:18 CEST

Clean Logistics, Plug Power, BYD - Huge upheavals in the transport industry fuel share prices

"Decarbonization" - this term could make it to "word of the year." That is because it describes what urgently needs to be implemented in all sectors to preserve the Earth's habitat: the switch from fossil, carbon-based energy sources to sustainably and climate-neutrally produced energy sources. The transport industry plays a significant role in global warming. In Germany alone, road freight transport is expected to increase by a further 19% by 2030. Innovative ideas and solutions that can be implemented quickly are therefore urgently needed. In doing so, manufacturers are relying on a variety of technologies.

ReadCommented by André Will-Laudien on October 22nd, 2021 | 10:32 CEST

Plug Power, Enapter, SFC Energy - The climate savior is hydrogen!

The strong increase in energy prices is driving the inflation rate in Germany to a high level. With an increase of 4.1% compared to the same month of the previous year, inflation accelerated again in September. Already in July, the ECB thought that a cyclical high might have been reached. It has reached its highest level in almost 28 years, only in December 1993, it was once briefly above the 4% mark. These are historic times into which Western society is now moving; unfortunately, no one knows when the end will be. The efficient production of hydrogen and its industrial utilization would make our energy supply affordable and environmentally compatible in the long term. Unfortunately, the current technologies are still costly and not suitable for mass production. However, hydrogen remains a hot topic on the stock market. We take a look at some of the protagonists in the H2 thriller.

ReadCommented by Stefan Feulner on October 20th, 2021 | 11:26 CEST

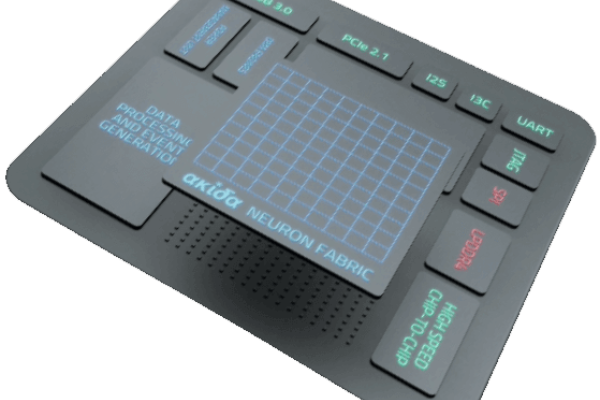

Plug Power, BrainChip, Software AG - Crisis and no end

The global economy is suffering from a chip shortage. One reason for this is blown-up supply chains due to the Corona pandemic, leading to production downtime and short-time working, especially in the automotive industry. In addition, with future technologies such as the Internet of Things, autonomous driving and artificial intelligence, there is a higher demand for semiconductors in addition to more powerful processors. An end to this dilemma is far from imminent, according to industry insiders.

ReadCommented by Nico Popp on October 19th, 2021 | 13:13 CEST

Plug Power, Central African Gold, Newmont: The best of both worlds

The risk appetite is back! Especially in the past week, shares around hydrogen and electromobility have climbed rapidly again. Even hydrogen stocks of the first hour were again kissed awake by the market. We highlight Plug Power, one such share, and list shares that tech-savvy investors can add to their portfolios.

ReadCommented by Stefan Feulner on October 15th, 2021 | 13:23 CEST

Nordex, Tembo Gold, Plug Power - Great rebound potential

"If you don't have the shares when they fall, you don't have them when they rise", this quote comes from the stock market legend André Kostolany. The words of the old master can be applied to the current state of both the stock and precious metals markets. The renewable energy sector currently offers great comeback opportunities. The prices of most wind, hydroelectric and hydrogen stocks have lost more than half their value in recent months, and the bottoming process is underway. Which companies are coming back and continuing their upward trend?

ReadCommented by Stefan Feulner on October 12th, 2021 | 11:55 CEST

NIO, Defense Metals, Plug Power - It is getting critical

Today we are faced with ever-tighter climate targets on the one hand and the availability of critical minerals for a safe and fast energy transition on the other. The disparity between scarce supply and steadily increasing demand is widening. There has been a threat of extreme scarcity and a crashing failure of the widely announced climate change for many years. The few producers of strategic materials are likely to have a bright future.

ReadCommented by Armin Schulz on October 8th, 2021 | 12:19 CEST

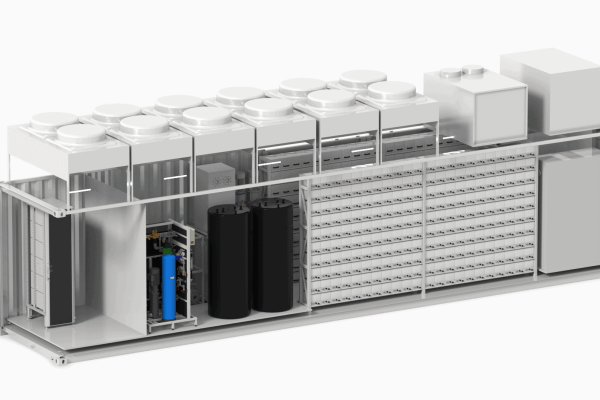

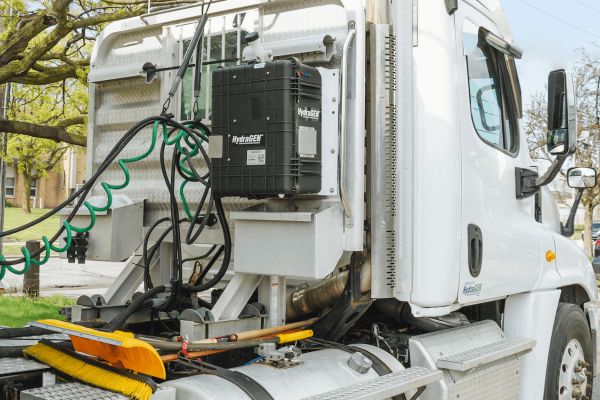

Nel ASA, dynaCERT, Plug Power - Hydrogen is part of the energy turnaround

If the upcoming German government wants to achieve the energy transition and banish all fossil fuels such as coal, oil and gas, part of the solution lies with hydrogen. On particularly sunny or windy days, some of the green electricity generated is simply lost. To avoid overloading the power lines, some of the electricity is given away abroad. Using this energy to produce green hydrogen would make the energy produced both storable and portable. If the price per kg of hydrogen could be reduced significantly, the greatest potential for this technology would automatically arise.

ReadCommented by Fabian Lorenz on September 30th, 2021 | 13:54 CEST

Good News from Evergrande, Plug Power and Triumph Gold

Volatility has increased sharply on the stock markets in recent days. The overall mood is negative. Technology stocks, in particular, are suffering from rising interest rates. In China, energy shortages due to a lack of coal are slowing economic growth, and worries surrounding Evergrande's insolvency continue. The insolvent real estate group has sent a sign of life and gives investors hope. Investors also have renewed hope in hydrogen stocks like Plug Power. For the purchase of gold shares, one needs courage at present. However, this could soon be rewarded in the case of Triumph Gold, for example.

ReadCommented by André Will-Laudien on September 22nd, 2021 | 14:05 CEST

NEL, dynaCERT, Plug Power, FuelCell Energy - Hydrogen, the flagpole is broken!

Today, what a hype, one would say. Those who held their nerve in January and let reality prevail are not the ones who are surprised at the outcome today. Hydrogen was the stuff of dreams for a few weeks, but the barrel foamed over properly. After rises of up to 2500%, almost all H2 stocks went into the cellar. And how dynamic it was! In just 6 months, hydrogen stocks have lost up to 85% again. One wonders: can there be a second wave? The framework parameters are suitable, as both the EU and Joe Biden have agreed on more hydrogen within the climate targets. The only important thing is the exact design of the subsidies because it will probably not be possible without government orders!

ReadCommented by André Will-Laudien on September 15th, 2021 | 14:23 CEST

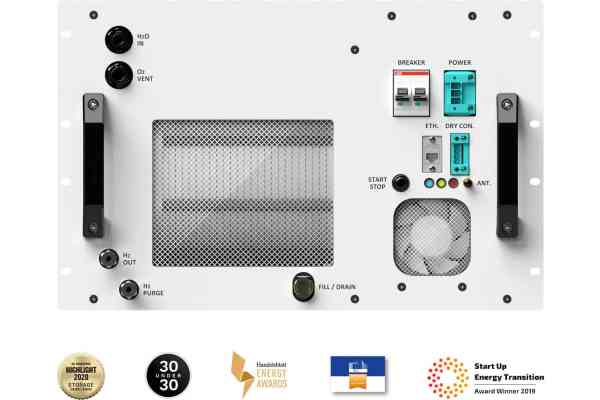

Nel ASA, Enapter, Plug Power, FuelCell Energy - It is time to go all out!

Hydrogen is not only a climate-friendly means of propulsion for automobiles and heavy-duty transport. Large industries such as chemicals and steel can use hydrogen technology to reduce their consumption of natural gas. There are costs involved when converting to hydrogen, most of which are only feasible with political support. The German government's national hydrogen strategy fits in well here. But medium-sized industries, especially energy-intensive sectors, could also become much more environmentally friendly with hydrogen-based technologies. Which stocks are well-positioned here?

Read