PLUG POWER INC. DL-_01

Commented by Nico Popp on September 8th, 2021 | 10:42 CEST

JinkoSolar, Silver Viper, Plug Power: Shares for the energy transition

Clean energy does not work without technology. The energy transition can only succeed if photovoltaic systems or even wind turbines are state-of-the-art. It is therefore essential that there are companies that lead the way technologically. This can be achieved with new products, daring plans, or in a classic way: by promoting suitable raw materials.

ReadCommented by André Will-Laudien on August 30th, 2021 | 12:13 CEST

First Hydrogen, Nel, Plug Power, FuelCell Energy - Is the next Hydrogen rally coming?

Hydrogen is repeatedly put forward as a solution for climate-neutral energy production. A strong distinction must be made for climate protection because only green hydrogen - produced from 100% renewable energy - is truly climate-friendly. Insufficient differentiation between hydrogen types has fatal consequences for the globe. In a recent study, scientists at the University of Standford in California prove that blue hydrogen, produced from natural gas in combination with the injection of the resulting CO2 through carbon capture-and-storage, actually has a significantly worse climate balance than the direct combustion of crude oil and natural gas. Significant methane gas emissions in production mainly cause this. Today we look at interesting values in the hydrogen environment.

ReadCommented by Armin Schulz on August 23rd, 2021 | 13:18 CEST

Plug Power, Enapter, Ballard Power - What is the future of hydrogen?

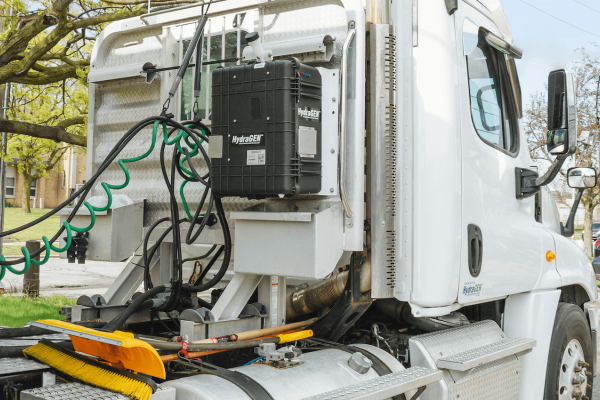

In the passenger car sector, the battle for hydrogen fuel cells seems lost, as the entire automotive industry is focusing on the production of e-cars. In the commercial vehicle sector, there is still hope for the hydrogen industry. The prerequisite for this, however, is inexpensive hydrogen, and this is not yet available. Promises of subsidies due to climate protection for the hydrogen sector should give a boost, but the extreme overvaluation built up in shares from the hydrogen sector up to the end of January has not yet been completely eroded in some cases. After the FED indicated in its latest minutes that it would abandon its loose monetary policy, uncertainty is spreading among many North American hydrogen companies. Today, we take a look at three hydrogen companies.

ReadCommented by André Will-Laudien on August 13th, 2021 | 12:36 CEST

NEL, dynaCERT, FuelCell Energy, Plug Power - Is hydrogen about to explode next?

Not only is the EU tightening its climate targets, but around the globe, more and more countries are decarbonizing their economies. The subject of hydrogen is providing the rainmaking impetus for discussion. Since the closing of ranks on e-mobility, however, it is no longer the focus of attention. However, according to the World Energy Council (WEC) analysis, at least 20 countries that account for almost half of global economic output have adopted a national hydrogen strategy or are at least close to doing so. Leading the way are Japan, France, South Korea, the Netherlands, Australia, Norway, Spain and Portugal. But Russia, China, Morocco and the USA are also working on their strategies. Australia and China are leading the way, while Europe and the Middle East are already doing a lot. We take a look at the premier league of H2 values.

ReadCommented by Armin Schulz on August 11th, 2021 | 10:28 CEST

Nel ASA, First Hydrogen, Plug Power - Hydrogen market awaits impetus

Since sustainability and climate protection have come more and more into focus, the hype around hydrogen stocks has also been in full swing. This rally in almost all stocks continued until the end of January. Some of the company valuations were astronomically high. Since investors have been looking more at key figures, the share prices of hydrogen companies have been falling. The key objective is to lower the cost of hydrogen. That would make it economically viable, and the share prices of companies in the hydrogen market would rise significantly again. Currently, the market is waiting for impetus. A lot of funding is being made available in Europe and the USA for hydrogen development. Today we take a closer look at whether there is already impetus from the companies.

ReadCommented by Stefan Feulner on August 9th, 2021 | 11:24 CEST

Plug Power, Silver Viper, Xiaomi - The pressure is mounting

The Federal Reserve is in a tight spot. Due to positive labor market data, the US economy has created more jobs in July than at any time in a year; the bulk of market participants expect a swing in monetary policy soon. Due to the fear of interest rate hikes, the precious metals gold and silver fell drastically. But are the monetary authorities even in a position to raise interest rates significantly due to the general conditions? Probably not, which should cause both gold and silver prices to soar in the long term.

ReadCommented by Armin Schulz on July 23rd, 2021 | 12:47 CEST

Nel ASA, dynaCERT, Plug Power - Investments in hydrogen increase worldwide

Sustainability is a trend that is gaining more and more momentum. This can be seen well in the investments announced in the hydrogen sector. In February, members of the Hydrogen Council, which is made up of 109 global companies, wanted to put USD 80 billion into developing hydrogen projects. By July, that sum had increased by USD 70 billion to USD 150 billion. Europe is a frontrunner in hydrogen technology thanks to funding from the EU Commission's Important Projects of Common European Interest (IPCEI). According to McKinsey, it is only a matter of time before hydrogen is traded like all other commodities. Today we highlight three companies in the hydrogen segment.

ReadCommented by Stefan Feulner on July 16th, 2021 | 14:45 CEST

Plug Power, Kodiak Copper, NIO - The shortage as an opportunity

Commodity markets are always subject to the forces of supply and demand. The energy transition and the achievement of climate targets pose new challenges for society. With the expansion of electromobility and renewable energies such as wind and hydropower, demand for some mineral raw materials will increase sharply. This is offset by an extremely tight supply and trade conflict with the leading producer China. There is a threat of further rising prices and, to be seen with the current chip shortage, even production losses.

ReadCommented by André Will-Laudien on July 14th, 2021 | 11:39 CEST

Enapter, NEL, Plug Power, FuelCell - Hydrogen under cross-examination!

The sharp rise in prices for heating energy and fuels keeps Germany's inflation rate at a high level. With an increase of 2.3% compared to the same month last year, inflation slowed slightly in June, but it had risen in each of the previous five months, reaching 2.5% in May, the highest level in almost 10 years. The efficient production of hydrogen and its industrial utilization would make our energy supply affordable and environmentally sustainable in the long term. Unfortunately, current technologies are still costly and not suitable for mass production. However, hydrogen remains a hot topic on the stock market. We take a look at the main actors in the H2 thriller.

ReadCommented by André Will-Laudien on July 9th, 2021 | 12:07 CEST

BYD, Plug Power, White Metal Resources - Watch out at the platform edge!

At some point, the market must also consolidate! Almost daily, the S&P 500 had climbed to a new high in recent weeks. Despite individual inflation warnings from the central banks, the shares continued to climb blithely: "The trend is your friend!" - and so it is not a big deal to have to give up 2%. The time had come yesterday - investors took cover for the time being. Now it must be seen whether strong trends can withstand a temporary downturn. We look at three interesting stocks.

Read