PLUG POWER INC. DL-_01

Commented by André Will-Laudien on May 3rd, 2022 | 12:11 CEST

The energy madness: NEL, dynaCERT, Plug Power, FuelCell Energy - Hydrogen shares and the next price explosion?

If not now, when? Never before have there been so many arguments for new technologies that improve energy generation and distribution. After years of globalization, local connections are becoming important again in the current dislocation of international relationships, as the world has truly come apart at the seams. Supply relationships, price relations and availability, are under scrutiny. For the GreenTech movement, the current conditions could not be better, with climate protection and new technologies for decarbonized mobility leading the way. We take a look at the protagonists of hydrogen technologies.

ReadCommented by Stefan Feulner on April 28th, 2022 | 10:58 CEST

Plug Power, Altech Advanced Materials, Nel ASA - Ambitious valuations

There is everything to be said for the transformation from fossil fuels to renewable energy. Now that the Western world has broken away from the Russian aggressor, the expansion of "freedom energies" is to proceed even faster. Baerbock, Habeck and Co. have already announced the withdrawal from dependence on the Eastern European neighbor. It should now be exciting to see how implementation works in the near future. The listed companies in the respective sectors, such as fuel cells, hydrogen and photovoltaics, have already built up horrendous valuations despite a correction that has been ongoing for months. Thus, caution is advised for some shares against a further slide.

ReadCommented by Nico Popp on April 25th, 2022 | 11:51 CEST

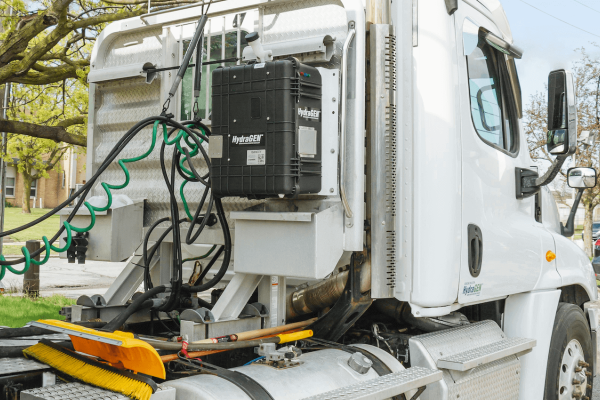

Hydrogen becomes marketable: Plug Power, dynaCERT, NEL

The energy transition is a long-term project. There must be no prohibitions on thinking about it. Only about a year ago, representatives of the automotive industry rejected hydrogen. In the meantime, however, a lot has happened. The sanctions against Russia have made energy more expensive, and hydrogen is now increasingly seen as a substitute for gas. In addition, more and more hydrogen projects around logistics projects and trucks are picking up speed. Reason enough to take a close look at the industry.

ReadCommented by André Will-Laudien on April 25th, 2022 | 10:48 CEST

Plug Power, First Hydrogen, Daimler Truck, Ballard Power - Revolution of transport: Hydrogen versus oil and gas!

It is hard to find more arguments in favor of hydrogen than right now! The element burns cleanly, it can be produced infinitely from nature and is currently even competitive given the high prices for oil and gas. Now the governments must act and direct their one-sided firing of e-mobility in the direction of hydrogen. Given the raw materials crisis, the year 2022 should be defined as an initial departure into the future. The last climate conference in Glasgow in 2021 has set the course - now, we must not stand still but get out with the budgets. What helps the environment is ultimately also good for the economy. Hydrogen drive is an alternative to ecologically questionable battery production! As an investor, these shares should be kept in mind.

ReadCommented by Stefan Feulner on April 21st, 2022 | 11:35 CEST

Plug Power, Barsele Minerals, Nordex - Prepared for the crisis

A ghost is haunting, not only in Europe. It is the ghost of stagflation. Stagflation means stagnating economic growth with rising inflation. Russia's invasion of Ukraine has now added another factor of uncertainty. The central banks are being challenged. While the Fed reacted by raising interest rates for the first time, the European Central Bank has shone by failing to act. The consequences for consumers are drastic, and inflation is likely to weigh on us for a long time to come due to the food and energy crisis.

ReadCommented by Fabian Lorenz on April 15th, 2022 | 12:07 CEST

Exciting hydrogen forecast: Shares of Nel ASA, Plug Power and dynaCERT facing golden times?

For many, hydrogen is a key factor in successfully implementing the energy transition. Accordingly, the technology is being promoted strongly. Since the start of the Russian war of aggression in Ukraine, hydrogen has again gained importance, and experts are overflowing with growth forecasts. First, in mid-March, the investment bank Jefferies published a forecast according to which the demand for hydrogen electrolyzers could rise to more than 400 gigawatts by 2030. By then, however, only 79 gigawatts would be available. So the supply gap is enormous. To fill it, hydrogen specialists like dynaCERT, Nel ASA and Plug Power could be in for golden times. And it gets even better. A new study puts the Jefferies forecast in the shade.

ReadCommented by Nico Popp on April 13th, 2022 | 18:02 CEST

A crisis here, an opportunity there: BASF, Almonty, Plug Power

Quarterly figures and many upcoming annual general meetings will bring to light what has been somewhat abstractly clear for weeks: many industrial companies are in serious danger. Yesterday it became known that the Russian army is said to have sprayed an unknown substance over Mariupol. If it was poison gas, the West would be forced to react. It cannot be ruled out that oil from Russia will be the next to be hit. Just how dependent companies like BASF are on Russian energy recently became clear. We examine three stocks and their opportunities and risks in this market phase.

ReadCommented by Stefan Feulner on April 12th, 2022 | 18:37 CEST

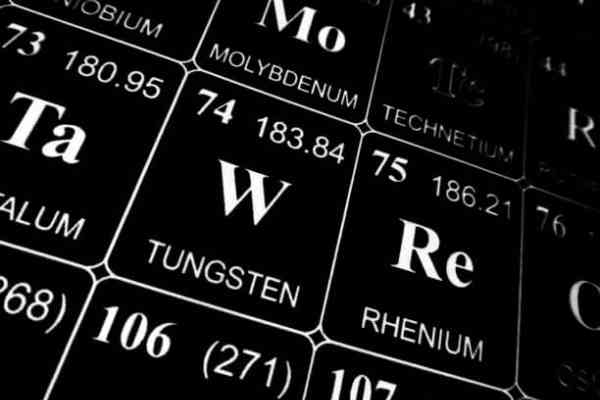

Plug Power, Phoenix Copper, JinkoSolar - Shares for freedom

The conflict between Russia and Ukraine, which has been simmering for weeks, dominates world events. Above all, the implementation of the energy turnaround is at the top of the agenda. Due to the declared sanctions, politics and the economy are facing a stress test on becoming more independent from Russian gas and coal in the future. Longer coal and nuclear lifetimes are on the cards. The traffic light politicians agree that the real path to energy independence is to phase out fossil fuels in the long term. However, scarce raw materials such as copper make this an expensive undertaking.

ReadCommented by Stefan Feulner on April 6th, 2022 | 10:19 CEST

Ballard Power, dynaCERT, Plug Power - Hydrogen more important than ever before

The consequences are already apparent, at the latest when you stand at the gas pump and look at the horrendous increases of the last weeks. Germany is paying the price because of its overdependence on one customer, in this case, Russia. It is also a fact that Germany is moving too slowly concerning the energy transition. Acceleration is now imperative. Hydrogen fuel cell technology has already been identified as the missing piece of the puzzle and is becoming all the more important due to the current geopolitical tensions.

ReadCommented by Armin Schulz on April 1st, 2022 | 12:54 CEST

Plug Power, Perimeter Medical Imaging AI, JinkoSolar - Shares for the future

Since the Ukraine crisis at the latest, it has been clear that the energy policy will have to look different in the future. While the end of fossil fuels has been heralded before, the transition must now happen faster than initially planned. Hydrogen could play a major role in heavy-duty transportation and energy-intensive industries. In electricity, renewables such as wind and solar power are expected to play a key role. But there are promising developments not only in the energy sector but also in medical technology. Cancer is on the rise worldwide, and any development that helps fight it is welcome. Today we look at stocks from the hydrogen, medical technology and solar power sectors.

Read