NEL ASA NK-_20

Commented by Nico Popp on August 23rd, 2021 | 11:03 CEST

Rheinmetall, Defense Metals, NEL: What can work in this market

The current events in Afghanistan show that countries will have to invest in their defense in the future in order to meet geostrategic requirements. Currently, the Bundeswehr is fighting tooth and nail against bureaucracy and time to save as many Germans or local forces and their families as possible from the Taliban. Modern equipment is just as necessary for this as efficient decision-making chains. In this article, we look at two defense-related companies and conclude with the current situation with NEL's hydrogen stock.

ReadCommented by Stefan Feulner on August 20th, 2021 | 11:14 CEST

Geely, GSP Resource, Nel ASA - Taking advantage of the correction

After a ten-year high of over USD 10,500 per ton, copper is correcting and is currently scratching the USD 9,000 mark. In the short term, there is a favorable entry opportunity to participate in the next supercycle. Copper is the base metal of the energy transition. The high demand due to the switch to renewable energy sources is already being offset by an extremely tight supply. The result is rising prices in the long term.

ReadCommented by Stefan Feulner on August 18th, 2021 | 11:37 CEST

Nel ASA, Enapter, Nordex - Highly acclaimed and deeply fallen

The euphoria around renewable energy shares was huge last year. Companies from the hydrogen, wind energy or electromobility sectors were able to multiply and reached valuations that they would never justify in the next few years. This run was fueled by billion-dollar programs to promote the energy turnaround by politicians. A market shakeout has been underway for months. Which stocks are now promising and which have further correction potential?

ReadCommented by Nico Popp on August 16th, 2021 | 10:16 CEST

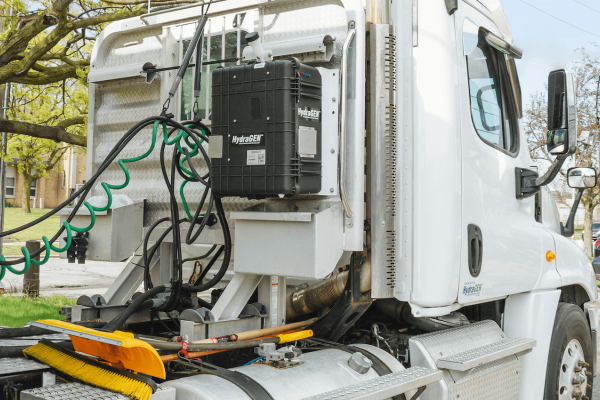

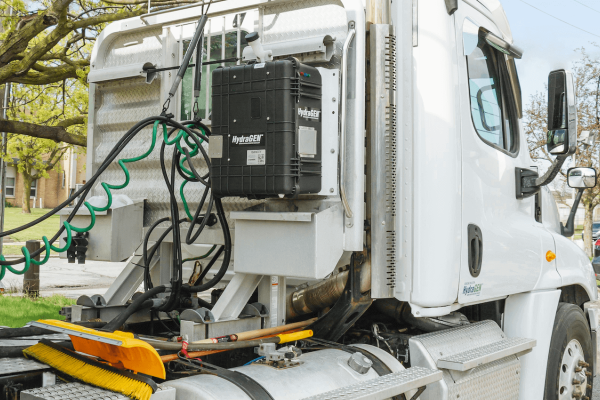

NEL, Pure Extraction, Deutsche Post: Hydrogen becomes practical

The Union's candidate for chancellor and CDU chairman Armin Laschet only received a loud laugh when he asked Tesla boss Elon Musk about the chances for hydrogen as a fuel for cars. The question is entirely justified. Although the trend for cars is clearly towards electric vehicles, hydrogen could be the solution for delivery vans, trucks or ships. Reason enough to take a closer look at participating companies and potential customers.

ReadCommented by André Will-Laudien on August 13th, 2021 | 12:36 CEST

NEL, dynaCERT, FuelCell Energy, Plug Power - Is hydrogen about to explode next?

Not only is the EU tightening its climate targets, but around the globe, more and more countries are decarbonizing their economies. The subject of hydrogen is providing the rainmaking impetus for discussion. Since the closing of ranks on e-mobility, however, it is no longer the focus of attention. However, according to the World Energy Council (WEC) analysis, at least 20 countries that account for almost half of global economic output have adopted a national hydrogen strategy or are at least close to doing so. Leading the way are Japan, France, South Korea, the Netherlands, Australia, Norway, Spain and Portugal. But Russia, China, Morocco and the USA are also working on their strategies. Australia and China are leading the way, while Europe and the Middle East are already doing a lot. We take a look at the premier league of H2 values.

ReadCommented by Carsten Mainitz on August 12th, 2021 | 10:31 CEST

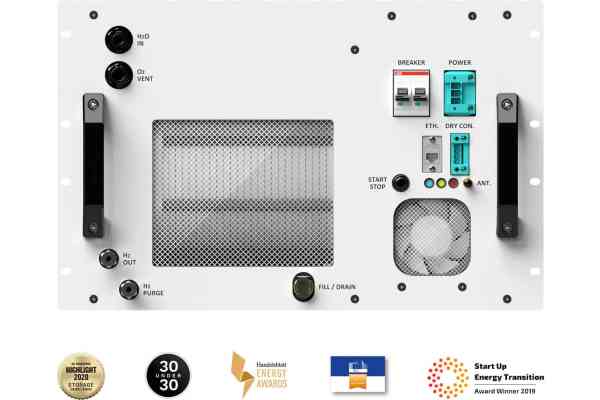

Enapter, Nel, SFC Energy - A new chapter in the hydrogen revolution

The energy revolution needs hydrogen solutions. The road from innovations and first prototypes to mass production and relevant market shares is long. However, the stock market is already rewarding the potential of one or two companies. The companies that can successfully offer solutions will later operate in a market worth billions. Which horse should investors back in this growth industry?

ReadCommented by Armin Schulz on August 11th, 2021 | 10:28 CEST

Nel ASA, First Hydrogen, Plug Power - Hydrogen market awaits impetus

Since sustainability and climate protection have come more and more into focus, the hype around hydrogen stocks has also been in full swing. This rally in almost all stocks continued until the end of January. Some of the company valuations were astronomically high. Since investors have been looking more at key figures, the share prices of hydrogen companies have been falling. The key objective is to lower the cost of hydrogen. That would make it economically viable, and the share prices of companies in the hydrogen market would rise significantly again. Currently, the market is waiting for impetus. A lot of funding is being made available in Europe and the USA for hydrogen development. Today we take a closer look at whether there is already impetus from the companies.

ReadCommented by André Will-Laudien on August 5th, 2021 | 12:45 CEST

TUI, GSP Resource, NEL - The volcano starts to smoke!

Chart analysis is a popular tool among traders and investors to optimize trading in securities or derivatives. The goal is to forecast future price developments based on charting techniques. However, there is a need to remember that under the assumption of efficient market theory, a chart already contains all the available information. Unfortunately, there are as big misunderstandings in chart interpretation as in fundamental analysis. In charts, formations may or may not indicate a breakout, whereas fundamental information has historical and future significance. In all assumptions, we naturally assume that the stock market is always right, meaning that the current price reflects the Company's value at any point in time. But that does not make the decision any easier!

ReadCommented by Nico Popp on July 27th, 2021 | 10:20 CEST

NEL, dynaCERT, Daimler: The winners of the mobility revolution

Whether with hydrogen or with battery technology, mobility is transforming. In this article, we discuss where the journey could lead, why established automakers are gaining ground with ambitious plans, and whether there are still innovative solution providers around the mobility of the future that the market has not yet noticed.

ReadCommented by Nico Popp on July 26th, 2021 | 09:48 CEST

NEL, Pure Extraction, Volkswagen VZ: Where one piece of news can change everything

Sustainability is one of those things - The closer you look, the more complex the situation becomes. Just recently, a study by the non-governmental organization ICCT showed that even hydrogen vehicles fueled with green hydrogen could have sustainability flaws. The reason: the tanks are sometimes made of carbon fibers. Their production can generate about as many greenhouse gases as the production of batteries for e-cars. We look at three stocks related to hydrogen and mobility and explain what opportunities investors can associate with them.

Read