BAYER AG NA O.N.

Commented by Nico Popp on January 23rd, 2026 | 07:15 CET

Revolution in agricultural chemistry: How MustGrow Biologics is benefiting from the plight of Bayer and Corteva

Global agriculture is at a historic turning point, driven less by a belief in technological progress than by regulatory necessity. For decades, global food security has been based on synthetic pesticides and fertilizers, but that era is rapidly coming to an end. Authorities from Brussels to California are tightening the screws and banning established active ingredients one after the other because their ecological collateral damage is no longer tolerated. For the agricultural giants, this poses an existential threat: their full warehouses are in danger of becoming worthless if they do not find effective biological alternatives quickly enough. In the current extremely hectic environment in industry, which is characterized by billion-dollar acquisitions and strategic alliances, new power structures are emerging. While Corteva Agriscience is aggressively buying market share with its chequebook and Bayer is pushing ahead with its portfolio restructuring, the Canadian company MustGrow Biologics has carved out a position that is considered the "sweet spot" in the industry. The Company is the technology partner whose active ingredients have already been validated and licensed by the market leaders.

ReadCommented by André Will-Laudien on January 19th, 2026 | 07:20 CET

Black Monday: Despite Greenland disputes, tariffs, and Mercosur, biotech is on the rise! Bayer, Vidac Pharma, BioNTech, and Novo Nordisk in focus

The stock market has had a very volatile start to 2026. Now, due to the unresolved Greenland issue, punitive tariffs are even being reintroduced for European countries that wish to stick with the Danish administration. Questions of international law did not impact the stock market in any of the conflicts of 2025. What usually receives a lot of attention, however, are shrinking margins caused by artificial tariffs. Just as the EU had been patting itself on the back over the Mercosur agreement, the next Trump-style threat is looming. The biotech sector is advancing steadily and with considerable momentum. Can the life sciences leaders outperform the DAX?

ReadCommented by Fabian Lorenz on January 16th, 2026 | 07:05 CET

First Majestic reports, but the stock fails to benefit! Bayer continues to rise! Silver Viper takes off!

The upward trend in silver remains fully intact, and clear triple-digit price targets are circulating through the market. Yesterday, core holding First Majestic Silver reported on the fourth quarter and full year 2025. However, the stock failed to benefit from the news. Investors may find better opportunities in 2026 with Silver Viper shares. The silver explorer is undergoing a transformation and now holds three projects in Mexico. The most recent capital increase was met with strong demand, and drilling programs and results are expected in the current year. Looking at the share price chart of Bayer, one might think that the Leverkusen-based company had struck silver. The share price rose sharply in the first few days of the new year. However, analysts believe the upside potential has largely been exhausted.

ReadCommented by Nico Popp on January 14th, 2026 | 07:20 CET

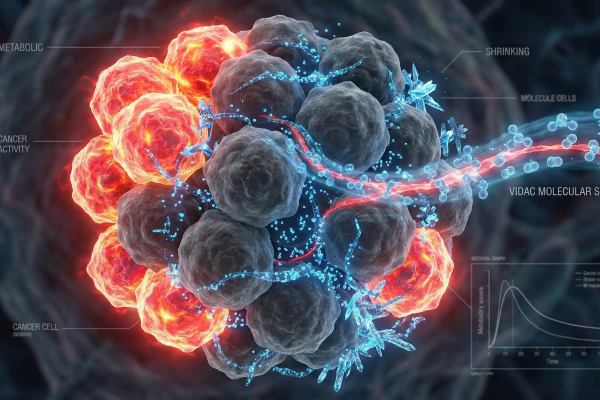

Targeting cancer metabolism: Why Bayer and Pfizer are restructuring - and why Vidac Pharma is filling a scientific gap

The investment year 2026 marks a decisive turning point for the global biotechnology and pharmaceutical sector. After a period of macroeconomic uncertainty, we are witnessing a renaissance in the life sciences, driven by two fundamental forces: the urgent need for big pharma players to replace their expiring patents with innovation, and the scientific breakthrough of novel mechanisms of action in agile biotech small caps. While industry giants such as Pfizer and Bayer are attempting to steer their cumbersome tankers onto a new course through massive restructuring, the as-yet little-noticed biotech company Vidac Pharma is delivering the technological innovation the market is looking for. With an approach that directly addresses cancer metabolism and reverses the "Warburg effect," which has been known for almost a century, Vidac is positioning itself as a disruptive force in oncology and dermatology. For investors, this constellation offers a rare opportunity: to observe the stability of the giants while betting on the explosive potential of a technological innovator that analysts say is massively undervalued.

ReadCommented by André Will-Laudien on January 2nd, 2026 | 07:05 CET

Attention - fasten your seatbelts! 2026 could be a rocket launch for Novo Nordisk, Evotec, Bayer, and Vidac Pharma

The stock market is starting the new year 2026 in a buoyant mood. The mining and commodities sector showed that it is not only possible to make money with tech stocks, with almost every stock doubling in value, and some even increasing tenfold. The coming year, however, could bring yet another shift in perspective. The biotech sector has been quiet for quite some time, but some of the protagonists in our selection are showing, in part, significant technical base formations. For risk-aware investors, it may be time to reshuffle more decisively and realign portfolios. Come in and find out!

ReadCommented by Carsten Mainitz on December 23rd, 2025 | 08:45 CET

USD 600 billion market potential – Pfizer and Bayer are in the race, Vidac Pharma in the fast lane?

The market for cancer drugs is the largest segment within the pharmaceutical industry and currently has a volume of over USD 200 billion. According to experts, the market will already be worth USD 500 to 600 billion by 2032 or 2033. Companies such as Pfizer and Bayer are among the industry leaders. As is often the case, however, there are promising stocks from the second and third tiers beyond the blue chips. One such company is Vidac Pharma. The Company is pursuing a new, promising approach to skin cancer. Analysts attest to the shares' great potential.

ReadCommented by Armin Schulz on December 17th, 2025 | 07:05 CET

How Bayer, WashTec, and Volkswagen will earn more money in the future with digitalization and AI

Artificial intelligence is already generating measurable profits in industry today. In the pharmaceutical and chemical industries, it is revolutionizing research and accelerating the market launch of vital products. Mechanical and plant engineering is tapping into recurring sources of revenue with AI-based services and strengthening customer loyalty. And in the automotive industry, autonomous driving is highly popular and will shape the future. These advances prove that the productive phase of AI has begun. Three companies show how technology translates into competitive advantages and robust margins: Bayer, WashTec, and Volkswagen.

ReadCommented by Stefan Feulner on December 15th, 2025 | 07:00 CET

Alibaba, Power Metallic Mines, Bayer – Spectacular twists

The 2025 stock market year is drawing to a close, and the major indices are likely to finish in positive territory once again. Nevertheless, fears of a correction are growing, especially for hyped AI stocks. In addition, due to sector rotation, there are companies that could stage a year-end rally due to their favorable valuations. Stock picking is likely to be more in demand than ever in the coming months.

ReadCommented by Fabian Lorenz on December 12th, 2025 | 06:55 CET

Buy these stocks now?! Bayer, Gerresheimer, WashTec!

Bayer is undoubtedly one of the positive surprises of 2025 on the German stock market. Operations are running smoothly for the Leverkusen-based company, particularly in the pharmaceutical sector. And next year, the glyphosate disaster could also come to an end. Analysts have now raised their price target. WashTec shares are still at the beginning of an upward trend. Growth, improved margins, a dividend yield of 5%, and a share buyback program continue to argue in favor of buying the stock. Analysts share this opinion. Experts do not yet see the time as right to buy Gerresheimer shares. Although the stock appears to have bottomed out, investors are still advised to wait.

ReadCommented by Carsten Mainitz on December 11th, 2025 | 07:20 CET

On the winning side – now and in 2026: Antimony Resources and Bayer, crash at Evotec!

The year 2025 is drawing to a close. It is time to focus on stocks and investment themes that could offer attractive returns in 2026. Trends such as AI, defense, and robotics are expected to continue. Further involvement in the commodities sector also appears lucrative. Here, investors can find an exciting second-tier investment story in the still largely undiscovered Canadian company Antimony Resources. But opportunities also exist in the blue-chip segment. Bayer has established a solid foundation this year, and analysts have recently raised their price targets significantly. For heavily punished stocks like Evotec, a turnaround could also emerge next year.

Read